While the euro broke its two-year bear trend, a bull market may not follow, reports Al Brooks.

The EURUSD currency pair broke to a new 52-week high and it is no longer in a bear trend. It should soon test 1.18, but it then might evolve into a big trading range.

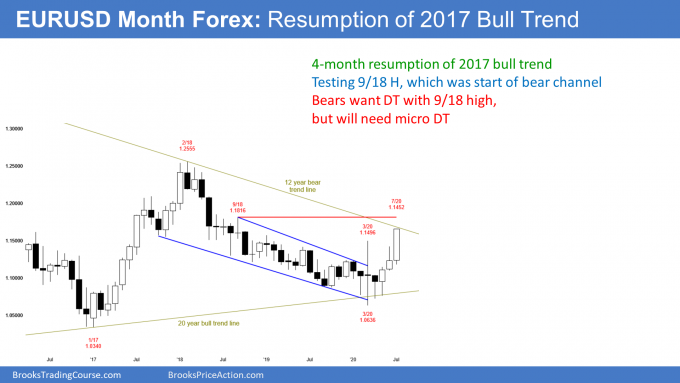

The euro weekly chart has had consecutive big bull bars closing near their highs (see below). In addition, last week it closed far above the March high. That was a 52-week high. More importantly, it was the final major lower high in the two-year bear channel. Traders now believe that the two-year bear trend has ended.

When a bear trend ends, a market is either in a bull trend or a trading range. It often is in both. At the moment, the rally is strong, and traders see it as a bull trend.

The next target is the September 2018 high. That was the first pullback after the strong reversal down (bear spike) from the February 2018 high. It was therefore the start of the two-year bear channel. The selloff from the February 2018 high was a Spike and Channel Bear Trend.

Spike and Channel Bear Trend

The monthly euro chart is reversing up from a higher low major trend reversal (see below). The bulls want the rally to continue far above the February 2018 high.

But when a market reverses up from a bear channel, the first target is the start of the channel. Here, on the monthly chart, that is the September 2018 high of 1.1816. Once the rally reaches the target, the bulls often take profits.

Also, the bears know that a bear channel began at that price two years ago. They expect that traders will sell there again.

So, there are bears selling into shorts as well as bulls selling out of longs. That typically results in at least a minor reversal down. It also generates confusion.

Consequently, what usually happens is that the rally stalls and the chart turns sideways. The rally becomes a leg in a big trading range, and traders look back at the two-year bear channel as a bear leg in the trading range.

If the EURUSD Forex market stalls around 1.18, it will probably be in a trading range for at least another year. The top of the range should be around 1.18, but it might be back at the February 2018 high at around 1.25. The bottom is just about 1.06, but the odds are against a test of that level for at least a year.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed E-mini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a two-day free trial.