Alan Ellman explains how to turn a losing trade into a winner through rolling covered calls.

Exit strategies for covered call writing will frequently allow us to convert losing trades to profitable ones. To corroborate this concept, a real-life example with Nike Inc. (NKE) will be detailed.

Initial trade structuring

- On June 22, 2020, 200 shares of NKE was purchased at $97.72

- On July 17, 2020 $99 calls were sold for $1.60

- Buy-to-close limit orders were set up using the 20% guideline (buy-to-close at 30¢)

- The buy-to-close limit order was changed to 10% (15¢) on July 6

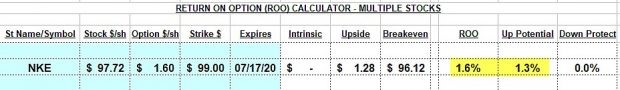

Initial trade calculations using the Multiple Tab of the Ellman Calculator

NKE: Initial Calculations

The yellow cells show an initial one-month time-value return of 1.6% with upside potential of 1.3% creating a maximum 2.9%, one-month return.

Rolling-down exit strategies used during the July contract

- The 20% threshold (30¢) was not reached

- The 10% threshold (15¢) was realized for the first time on July 16

- The $99 call was rolled-down to the $98 strike (48¢) on July 16

- The new 10% threshold for the $98 call (5¢) was reached on July 16

- A sell-to-open order for the $97 call was executed for 13¢

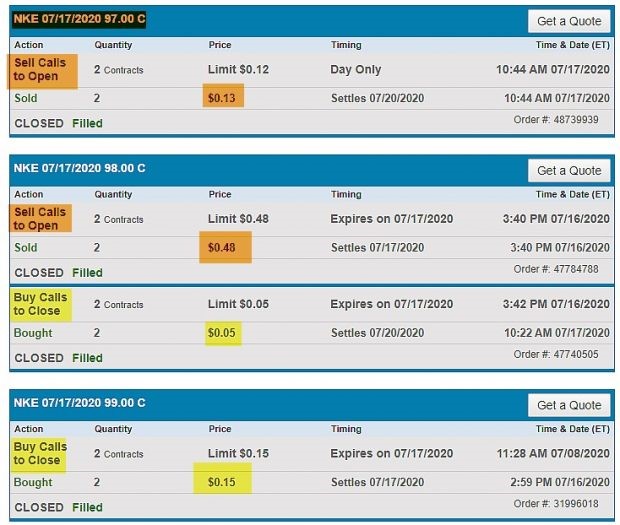

Broker statement showing the 2 rolling-down exit strategy trades

NKE: Rolling-Down Trades

The yellow fields show the buy-to-close orders and the brown fields reflect the sell-to-close orders executed.

Turning a losing trade into a profitable trade

Share price declined from $97.72 to $96.28 resulting in an unrealized loss of $288 for the 200 shares. We received per-share option credits of ($1.60 + 48¢ + 13¢) and option debits of (15¢ + 5¢). This resulted in a net option credit of $402 for the 200 shares. Factoring in unrealized share loss and realized option credit, the trade resulted in a net profit of $114.

Discussion

Option-selling exit strategies will mitigate losses, enhance gains and turn losses into profits. This NKE real-life example demonstrates how multiple rolling -down exit strategies put cash into, rather than out of, our pockets.

Use the multiple tab of the Ellman Calculator to calculate initial option returns (ROO), upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). The breakeven price point is also calculated. For more information on the PCP strategy and put-selling trade management click here and here.