Technicals suggest a correction is coming, reports Ricky Wen.

Wednesday was a gap-up and hold type of session as the E-mini S&P 500 (ES) could not muster enough strength after advancing for about +0.4-0.5% over the prior day’s closing print by hovering in the 3310s-3320s.

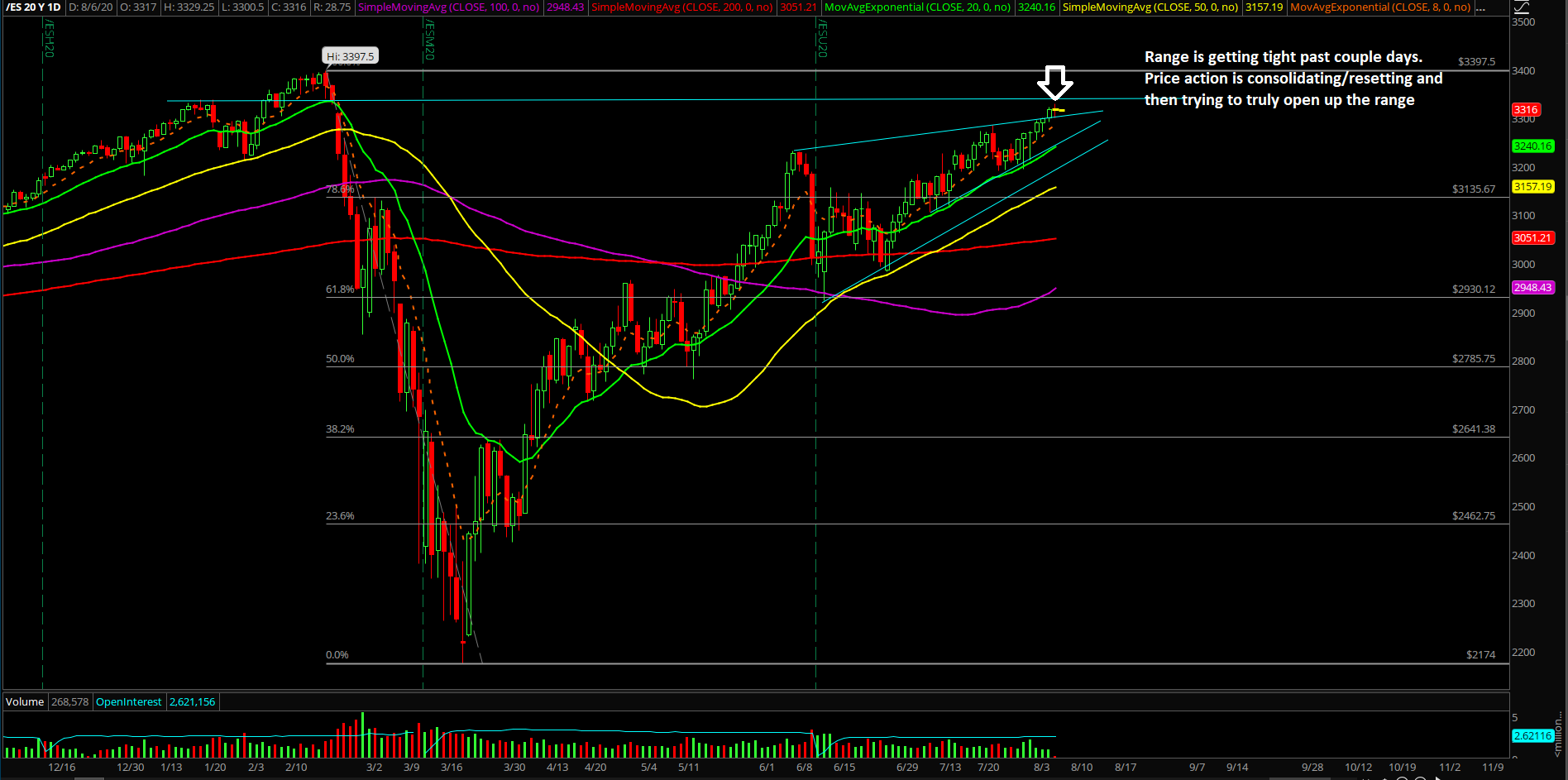

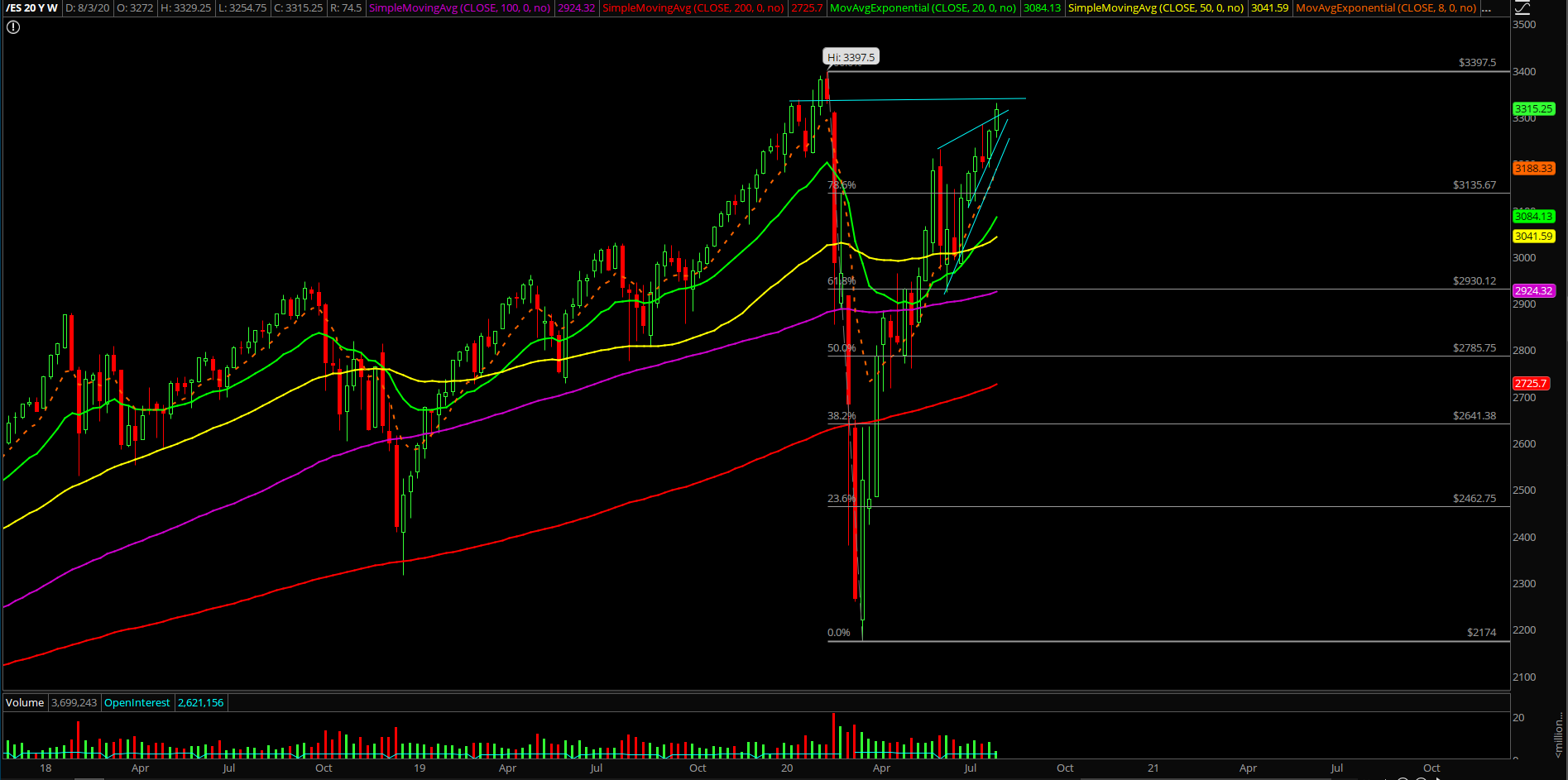

Basically, the price action has been telling us the range remains confined as it needs time to digest, reset and eventually attempt higher due to the ongoing trend.

The main takeaway from Wednesday and the prior day is that is that the upside targets have finally opened up given the current breakout above 3285/3300. However, the biggest concern is that our proprietary signals have been consistently warning us this week on its sustainability issue, so we must utilize the trending support levels and judge momentum in real-time.

Essentially, as long as price action remains above trending supports then it’s the same old grind. However, if trending supports get taken out, things could change quickly into either another breakdown and mean reversion attempt or a prolonged consolidation again.

What’s next?

Wednesday closed at 3317.75 on the ES, so it was just a gap up and holding pattern. Thursday is more of the same thing as price remains confined in an immediate range until further notice given that price action is electing to digest/consolidate/reset.

Game plan summary:

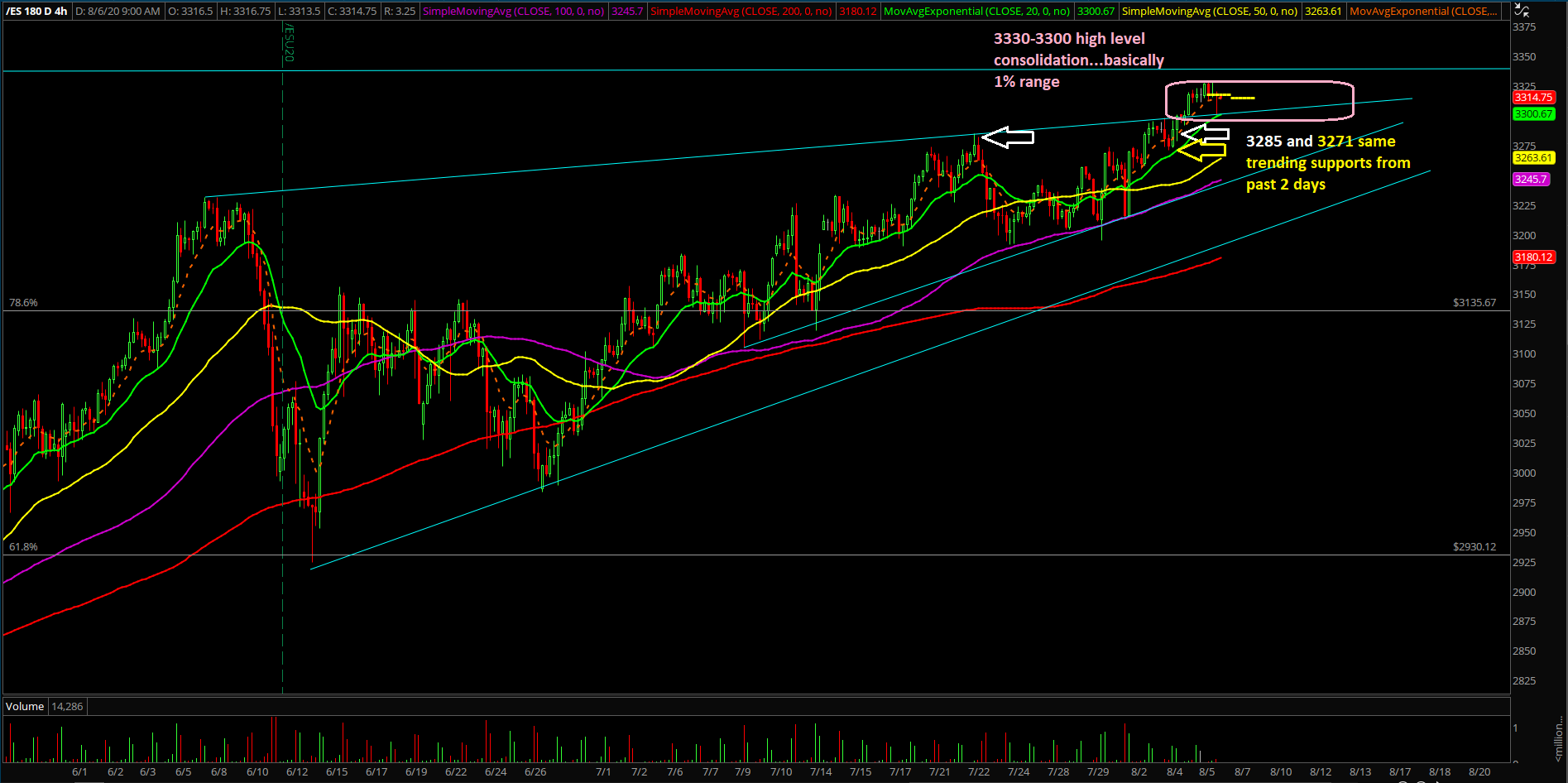

- Overnight has held the 3300 backtest on first try basis, so see if RTH continues to hold this upper region in order to judge the momentum. If you recall, Aug 4th closing price was around 3300 so this level could tell us a lot -- i.e., whether it’s the low of the day already or whether we get an actual gap fill during RTH. (For reference, 4hr 20EMA trending support has grinded up all the way to 3300 so there’s an alignment there.)

- Be aware that Friday is likely another range consolidation with limited upside and downside until price can get out of 3330-3285 or 3330-3271.

- Not much has changed, as immediate trending supports remain at 3285/3271, so additional grind up is favored when price action maintains above it. A break below these levels would open up the more important level, which is 3250 given the last few days’ worth of grind up/breakout structure.

- During Aug 4, the immediate breakout above 3285 has opened up 3312/3350 as continuation targets, and this is only valid when price able to sustain above yesterday’s 3285/3271 for immediate continuation purposes. Focus on the continuous higher low setups if/when applicable because of the high level consolidation structure favors the on-trend setups.

- Otherwise, a short-term reversal/another consolidation may be into play due to the failure of a breakout continuation.

- Our proprietary signals are still flashing warning signs to us on the sustainability of the current rise, so we must be very careful here and utilize the trending supports to judge real-time momentum/odds.

- In addition, we must keep an eye on the relative strength/weakness of big tech being a leader, as this remains a critical juncture with price action keep hovering around the NQ 11050 mark area (see charts below)>

See chart reviews and projections on the Emini S&P 500.

Ricky Wen is an analyst at ElliottWaveTrader.net, where he hosts the ES Trade Alerts premium subscription service.