Joe Duarte points out the latest Covid-related trade as a move away from public transportation due to Covid-19 is still considered valid.

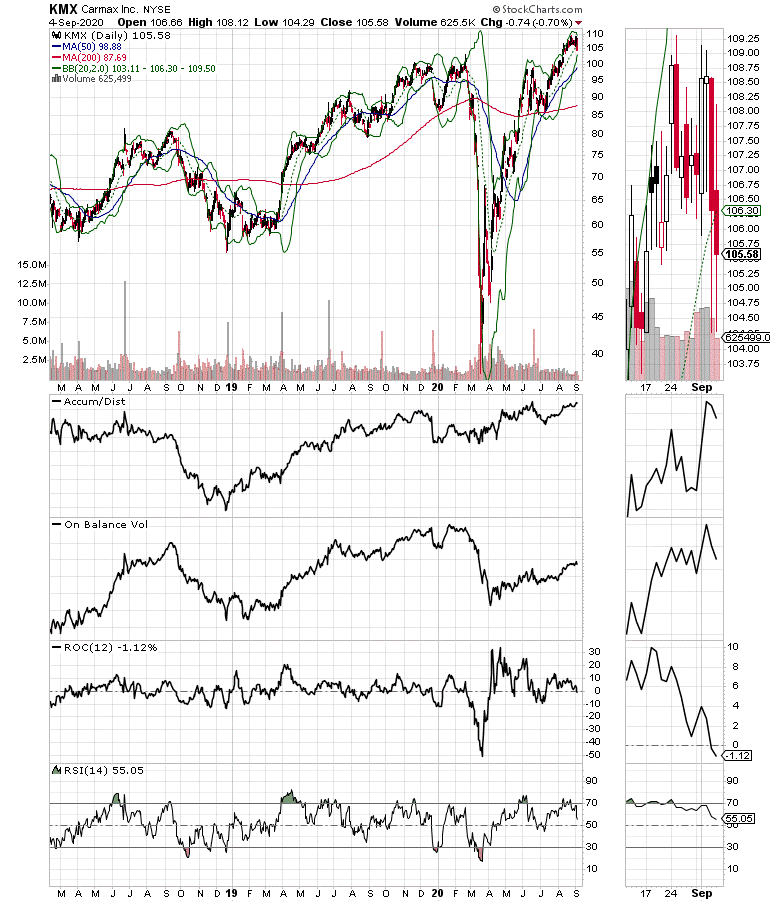

Shares of used car sales giant CarMax (KMX) held up during the recent wave of selling suggesting that, at least, for now, one major on the ground trend, the move away from public transportation due to Covid-19 is still considered valid (see chart below).

Not a day goes by when I’m driving that I don’t see countless temporary plates; with the majority of them on used cars. Of course, KMX doesn’t sell all the used cars in the United States, but it certainly sells its fair share, both at the retail and wholesale level. This business model diversification gives KMX an advantage while the company at least two macro income streams.

Moreover, with earnings due on or about Sept. 24, it will be very interesting to see what the company says about the state of the used car market where price pressures have been increasing of late due to limited supply and increasing demand. In addition, the company’s shift to online car marketing and selling, at least as part of their sales process, by the end of the June quarter, was showing positive signs of a liquidity improvement along with a return to nearly normal sales levels.

Investors should also consider that used car demand is rising and that supplies are lagging, setting up the same type of supply and demand situation being experienced by homebuilders prior to their big run in 2020. Indeed, putting all these factors together suggests that the odds of better than expected earnings are well above decent and likely explains why the stock is holding up at the moment.

Technically, the stock remains under accumulation with both Accumulation/Distribution (ADI) and On Balance Volume (OBV) moving higher during the recent consolidation period.

To make sure you are there when the market gives us all clear take a FREE trial or subscribe to Joe Duarte in the Money Options.com by clicking here. At the February 2020 Money Show in Orlando I correctly predicted that Covid-19 was likely to be a chaotic event and advised investors how to stay on the right side of the markets. Now as the stock market is starting to show signs of stress, I am returning to the Money Show with my latest analysis and predictions. To learn how to manage what lies ahead and how to pick stocks with explosive potential in any market, join me at the Virtual Money Show Expo on Sept. 16, 2020. Go here to register Free of charge