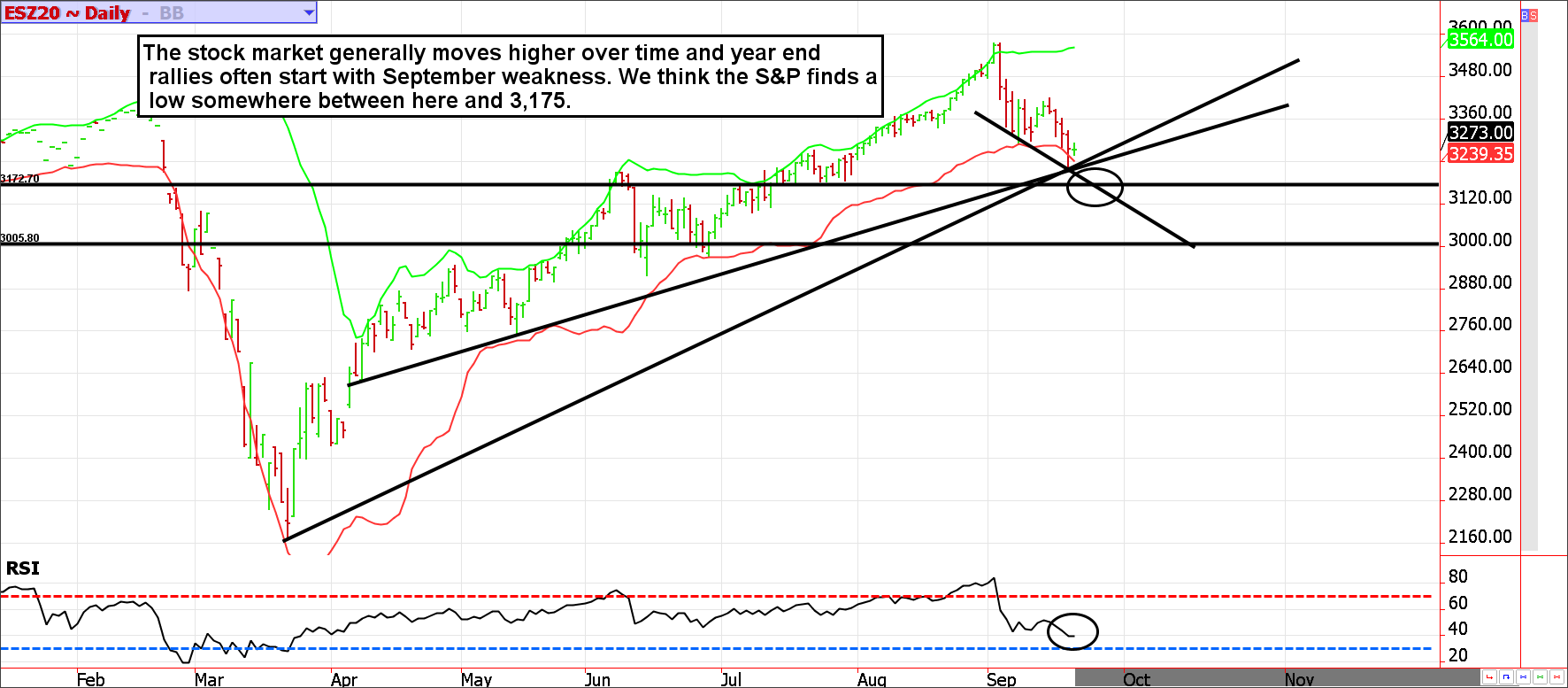

The S&P 500 has corrected roughly 10% from high to low in September; historically, the average market decline is a little over 10%, explains Carley Garner of DeCarleyTrading.com.

This leaves it in line with run-of-the-mill corrections. It is difficult to put what happened in March out of our minds, but the reality is that is the exception to the rule not the norm. Roughly 20% of the time, market declines unfold into a 20% correction. The bears will salivate while they focus on the possibility of another 300 drop in the S&P. However, the real focus should be on the fact that 80% of the time, what we have seen thus far in September is normal market behavior most often followed by a rally.

We can all agree a good and hard correction in stocks was needed.

As the equity market moves higher, the naysayers grow louder but for some reason, corrections are met with surprise; they are either too fast, too deep, or too long. In 2020, we've experienced “too fast” and “too deep” but have been spared the “too long”. We doubt this correction will be any different. In fact, we think it is mostly behind us.

Late September weakness in the equity market is normal. In the last 28 years the Dow has been up the week after the September witching just 25% of the time (7 of 28)...be woke! Sometimes that seasonal weakness extends into October, but more often than not September/October swoons are the best times and places to get bullish. October isn't known for being a bear killer for nothing.

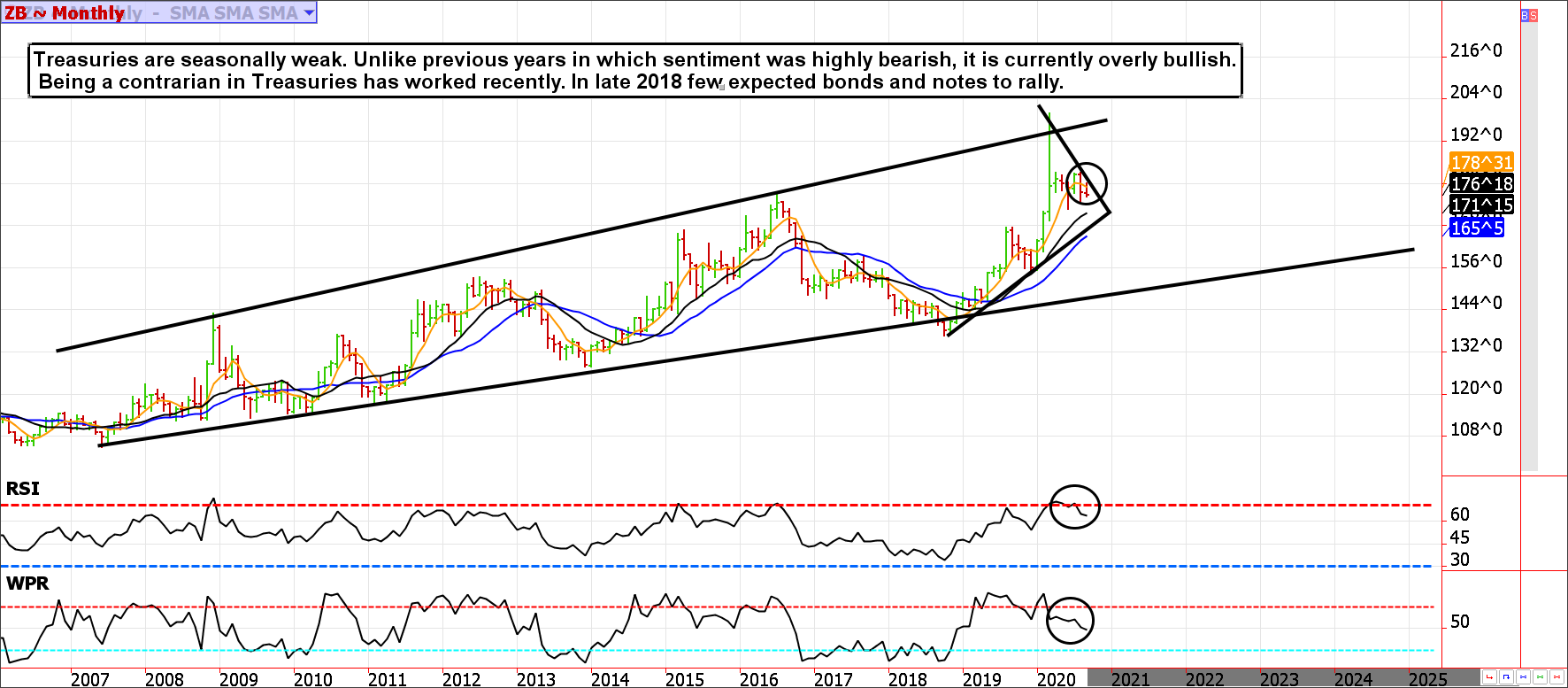

Are Treasuries pegged?

Some believe asset buying by the Fed in short-term Treasuries, corporate bonds, and now the long end of the yield curve has essentially pegged security pricing and, therefore, yields. This is a valid point; much of the ebb and flow interest rate market participants have become accustomed to has all but disappeared in recent months.

The Federal Reserve's actions have taken the risk out of holding corporate bonds (at least that is the perception) and has discouraged Treasury bears. The result is an emotionless market lacking volatility. While it could be argued price stability is a net positive, we should never forget price controls don't work as expected in the long run (ask New Yorkers).

Treasuries are known for making moves when nobody is looking. We suspect there is a good chance the Treasury market makes a break for it sooner rather than later. We are leaning lower in the overall direction, but it would not be uncharacteristic to see some sort of sharp and temporary probe higher before rolling over, so be prepared for some shake and bake.

In short, these aren't "bet-the-farm" levels but it is a good place to start considering nibbling on bullish positions, particularly if support at 3,175 is reached in the S&P 500, and bearish positions in Treasuries.

To learn more about Carley Garner, visit DeCarleyTrading.com.