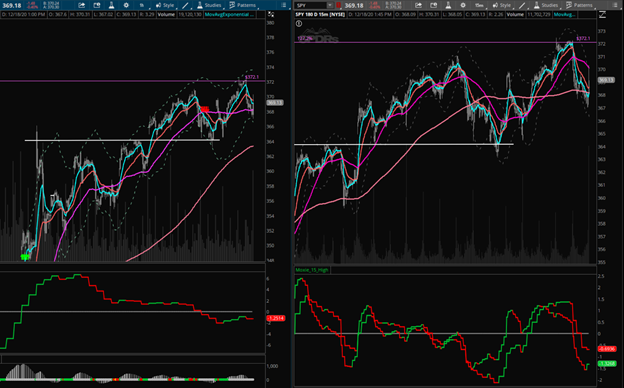

Last week, the Inverse Trampoline setup worked out on the SPY. I wrote about this last week as a heads up that there would most likely be another pullback coming, states TG Watkins of Simpler Trading.

There was a bit of a confluence this time as the 127 Fib was tagged and that's where price got rejected. It was also quad witching day and that adds a lot of weird behavior to the market. Friday was no disappointment in that category as the indexes moved in their own directions most of the day, only to roll over towards the end of the day, and then spike big just minutes before the close.

With the Inverse Trampoline setup from last week, I was expecting price to at least hit the Hourly 50 SMA. This happened exactly as expected, but is it enough? To be perfectly honest, I can’t tell yet because SPY price is still under lower-time-frame MA’s and it hasn’t officially reversed.

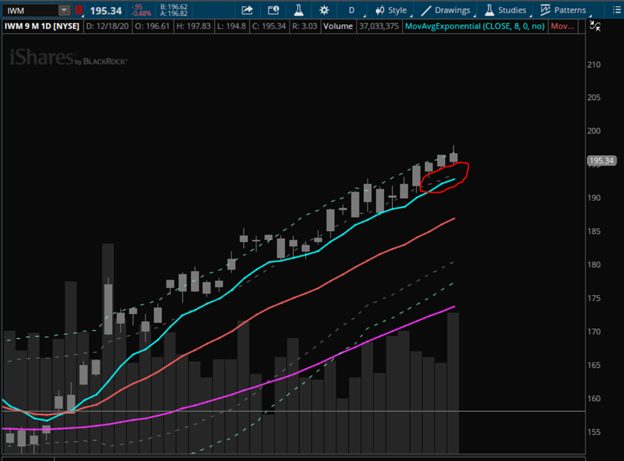

I decided to look around the market and see if I could find any other clues as to the depth of the pullback and I came across two. The IWM is still fairly extended, as seen by the gap between price and the Daily 8 EMA. So I think there is a little more downside until support is found.

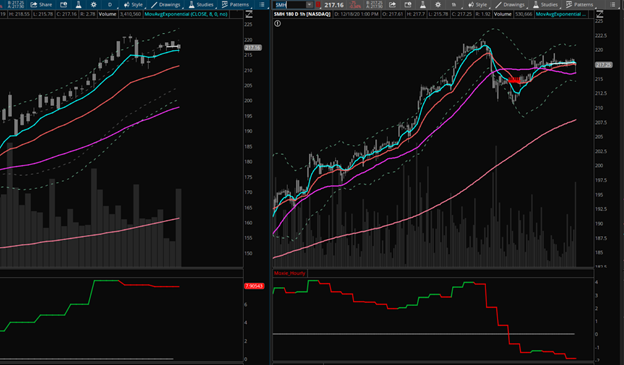

The other clue I have is looking at the Semi’s index; Either SOXX or SMH. What I see there is still a glaring Inverse Trampoline setup that keeps declining.

To sum it up, I think there is likely to be a little more downside on the indexes until they find the support they want. Depending on the index, this could be around the Daily 21 EMA and/or the Hourly 200 SMA. I am not bearish, but I think more of a dip could bring individual names into slightly better buying areas. Let’s keep an eye out.

TG Watkins is the director of stocks at Simpler Trading.