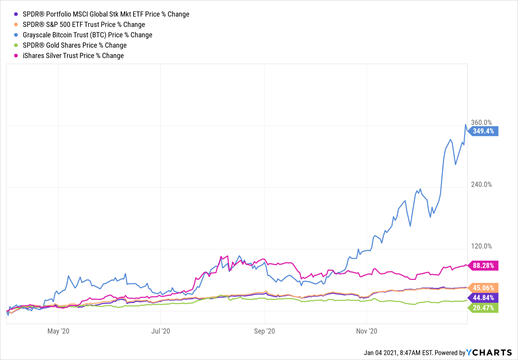

Which markets and which assets “won” 2020? It’s kind of a trick question because the answer is...ALL of them, states Mike Larson of Safe Money Report.

US stocks. Global stocks. Commodities. All of them surged at least 35% from March through year end—only the third time in the last half-century of record-keeping we’ve seen that happen. In the Journal’s words:

“Investors ended one of Wall Street’s wildest years on record by piling into everything from Bitcoin to emerging markets, raising expectations that a powerful economic comeback will fuel even more gains.”

And while stocks failed to follow through in the first couple days of trading in 2021, other investments kept right on going. Gold jumped more than $50 an ounce on Monday, for instance, while silver tacked on big gains and the VanEck Vectors Junior Gold Miners ETF (GDXJ) soared more than 7%. Bitcoin futures are up ANOTHER $3,000 since December 31.

Why? What accounts for so many gains across so many types of investments—particularly alternative ones like precious metals and cryptocurrencies? The ongoing “Money Flood” out of Washington!

Fiscal stimulus in the form of unemployment benefit increases and direct payouts to Americans...

A mega dose of money-printing from the Federal Reserve...

The prospect of even MORE of both once President-Elect Joe Biden takes office...

Wall Street knew this Money Flood was headed its way. So, Wall Street threw a party unlike anything we’ve seen in many, many years. And it did so even as millions of Americans were being thrown out of work and thousands more were dying every week due to the COVID-19 pandemic.

As for metals and cryptos, they offer protection against the enormous side effects of all this stimulus. Those include a collapse in the US dollar and increased worries about the long-term outlook for our nation’s balance sheet.

Naturally, the biggest question NOW is...can this amazing rally continue in 2021? Can everything just keep going up?

Well, the selloff we saw on the first day of stock-market trading showed how euphoric rallies have a way of hitting a brick wall eventually. Sentiment is getting extremely frothy and valuations are getting stretched.

Then there is simple supply and demand. Wall Street banks are dumping scores of low-quality Initial Public Offerings (IPOs) and Special Purpose Acquisition Companies (SPACs) on the public markets. More than 450 companies raised $167 billion via IPOs last year—topping the dot-com bubble record of $108 billion in 1999.

Many of those companies have either been losing money for years or are coming public with no actual business operations, only alleged plans for the future. That kind of action absolutely, positively raises red flags, at least for those of us analysts who have been around the block a few times.

On the other hand, the incoming Biden team clearly wants to push through much more fiscal stimulus in 2021. Plus, there is ZERO reason to expect the Fed to abandon Zero Interest Rate Policy (ZIRP) in 2021—or a couple years (at least) thereafter. Nor is there any reason to expect the Fed to stop flooding markets with cheap money via Quantitative Easing (QE).

What’s that likely to do? Keep pressuring the dollar. Keep supporting gold, silver, and cryptocurrencies. And keep driving investors into something...ANYTHING...that can spin off juicier income and sizable gains in a “ZIRP Forever, QE Forever” world.

My Safe Money Report subscribers are already reaping the benefits of a strategy focused on these kinds of winning investments—with handsome tracked profits piling up.

But they also know to maintain their discipline and keep the dangers of frothy markets in mind. This is no time to abandon the “Safe Money” principles that keep spinning off sizable gains with reasonable amounts of risk.

Safe Money Report focuses on these kinds of stocks, which include names in the consumer staples, food and beverage, retail, and healthcare sectors. Visit Safe Money Report here.