2021 is getting off to a messy start. The pandemic is raging in the US and Europe, while China is locking down again, states Ian Murphy of MurphyTrading.com.

The US president has been impeached for a second time and the fiscal deficit has just hit a new record. The incoming Biden administration plans to unleash a $1.9 trillion rescue package as 1.15 million new workers claimed benefits last week. Corporate America will no doubt add to the gloom today when the big three banks JPMorgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC) report.

Yet in the face of all this, the equity markets power on. According to Barchart.com not one single liquid US stock made a new yearly low on Wednesday, January 13. This is the first time I’ve seen this since I started correlating NHNL data. To describe the situation as “irrational” would be an understatement.

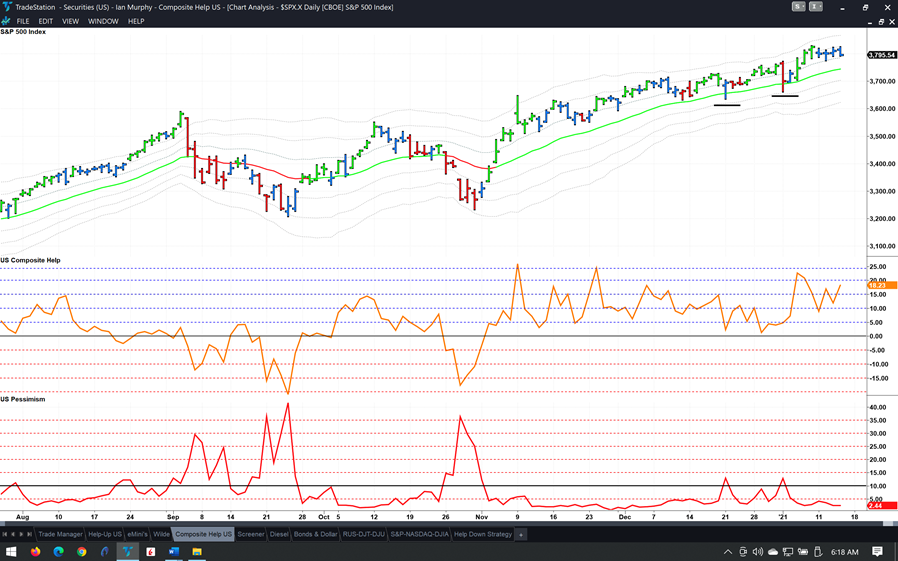

Looking at the benchmark S&P 500 (SPX), the index has paused for breath in the past four sessions as the price bars turned blue with no meaningful upward progress. However, the index still remains in bullish territory above the 1ATR line on a daily chart. The divergence in Composite Help (orange line) has been cancelled and the Pessimism Indicator (red line) is not flashing any warning signals just yet.

I would not be surprised to see a pullback here and the level to watch for support will be the rising 21EMAC (3744.73) where the index found support on two recent occasions as marked. A close below this level and rising pessimism will be a bearish sign, a washout and reversal will likely see the bull run continue.

Learn more about Ian Murphy at MurphyTrading.com.

MoneyShow’s Top 100 Stocks for 2021

The top performing newsletter advisors and analyst are back, and they just released their best stock ideas for 2021. Subscribe to our free daily newsletter, Top Pros' Top Picks, and be among the first wave of investors to see our best stock ideas for the new year.