2021 will be a challenging year for bond investors, as we are starting off with low interest rates and rising inflation, explains Marvin Appel of Signalert Asset Management.

These unfavorable conditions will especially impact Treasury and investment-grade bonds. As a result, I believe the most productive strategy for 2021 will be to search for higher yields in the form of credit risk rather than in the form of longer duration. I recommend corporate and municipal high-yield bond funds, and corporate floating rate bond funds. In our experience, we have protected our clients from much of the risks of these types of bonds with our timing models.

In this article I will review the inflation outlook and the historical precedent that suggests our current climate will be unfavorable for investment-grade bonds. I will then review the more favorable climate in below-investment-grade corporate and municipal bonds, and suggest a simple risk management strategy that you can use in managing your own holdings in high-yield municipal bond funds if you wish.

Inflation expectations are rising.

By comparing the yields on Treasury Inflation-Protected Securities (TIPS) and on nominal (fixed-coupon) Treasury notes, you can infer how much inflation the bond market is projecting. For example, the difference between the real yield on 10-year TIPS (-1.03%) and 10-year nominal Treasury note yield (1.04%) shows that if inflation over the next ten years averages 2.07%, the return from either security will be the same. That inflation outlook is the highest since 2018.

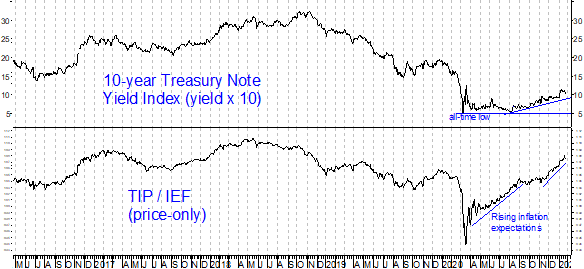

The chart below shows similar information inferred from the performance of ETFs that track TIPS (TIP) and 7-10 year nominal Treasury notes (IEF). The TIP/IEF ratio has been rising steadily since the March 2020 sell-off and, like inflation expectations, is at its highest level since 2018.

Unfortunately for bond investors, the actual level of interest rates is still quite low by historical standards. (See top clip in the chart.) That means that if you buy Treasury notes or bonds of any maturity at current yields, you are likely locking in returns that will lag the rate of inflation. This situation is not limited to Treasury notes; investment-grade bonds more generally are in a similar predicament. The SEC yield on the Vanguard Total Bond Market Index Fund (VBMFX) is just 1%, similar to the yield on 10-year Treasury notes. (VBMFX has an overall shorter maturity and therefore less risk in the face of rising interest rates, but more credit risk compared to 10-year Treasury notes.)

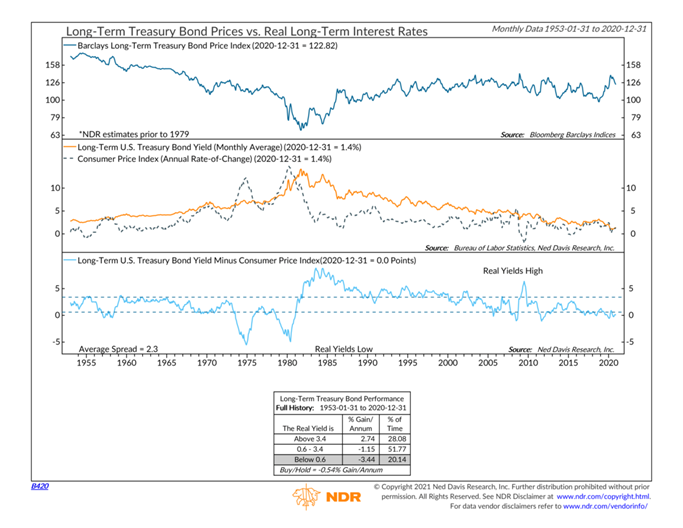

This condition has been historically unfavorable for the performance of bonds. For example, the chart below shows how real long-term (10-30 years maturity) Treasury yields have affected bond prices since 1952. Negative real yields, such as we are suffering now, have been historically rare. The 1970s saw the biggest lag between interest rates and inflation, and there were periods of notably negative real yields surrounding the 2008 financial crisis. During periods when bondholders were not compensated with yields adequately above inflation, bond prices have fallen historically.

The bottom line is that investment-grade bonds do not look attractive for 2021, particularly Treasuries. If your investment objectives require you to hold investment-grade bonds, look for shorter duration (five years or less) and look for the lower end of the investment-grade universe (BBB or Baa), where spreads to Treasuries are still decent. High-yield corporate and floating rate bonds look reasonably attractive.

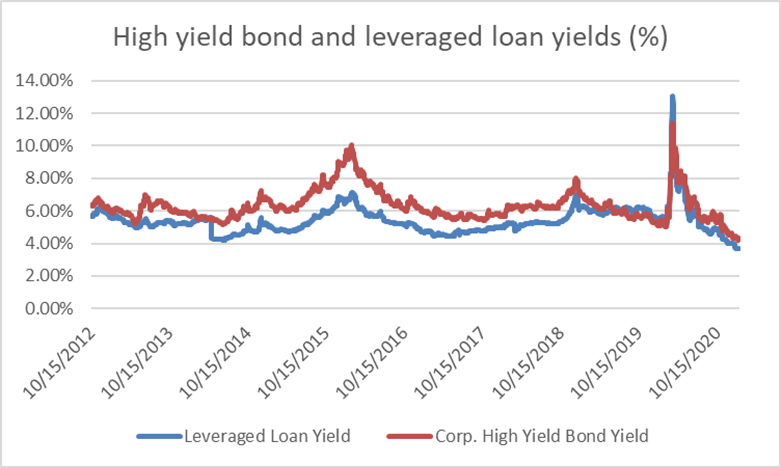

There are no bargains in today’s bond markets, but high-yield and floating rate corporate bonds are likely to be your best bets this year, particularly if you utilize a risk-management strategy such as our timing models. The absolute yields on these funds are at historical lows (see chart below). However, spreads to Treasuries of comparable maturities, although narrower than normal, are well within historical ranges: 3.75% for high-yield corporate bonds and 3.59% for leveraged (below-investment-grade floating rate) loans1.

Are these rates sufficient to compensate for the default risk? Fitch Ratings currently projects default rates of 3.5% for corporate high-yield bonds and 4.5% for leveraged loans in 2021. Recoveries would have to be as little as 10 cents on the dollar for high-yield bonds and as little as 20 cents on the dollar for floating rate loans in order for the returns on these riskier bonds to match that of their investment-grade counterparts of similar maturities. Such meager recoveries are well below historical averages of 40 cents on the dollar for high-yield bonds and 65 cents on the dollar for leveraged loans. The bottom line is that even on a buy-and-hold basis, below-investment-grade credit is likely to outperform investment-grade and Treasury debt2.

If you utilize open-end mutual funds, as we do for our clients, you have to take two things into account when projecting potential returns. First, mutual funds have expense ratios (typically about 1%) that reduce returns available to shareholders. That is the bad news. The good news is that the mix of bonds in corporate high-yield bond mutual funds is usually of higher credit rating than the mix of bonds in the benchmark index, which means that losses to defaults are likely to be less. Based on my experience I believe it reasonable to approximate total returns by the funds’ SEC yields. That implies projected 2021 returns of 3%-4% from corporate high-yield and floating rate bond funds.

High-yield municipal bonds are appealing for tax-sensitive investors.

MoneyShow’s Top 100 Stocks for 2021

The top performing newsletter advisors and analyst are back, and they just released their best stock ideas for 2021. Subscribe to our free daily newsletter, Top Pros' Top Picks, and be among the first wave of investors to see our best stock ideas for the new year.

High-yield municipal bond funds are worth a look if you are in a high-tax bracket. For example, the basket of high-yield muni funds we use for clients recently yielded 2.9% (SEC yield), which is free of federal but not most state income taxes. On an after-tax basis, this compares favorably with the yields from corporate high-yield bond funds.

Another appeal of high-yield municipal bond funds is that under normal market conditions, they diversify corporate high-yield bond funds in terms of interest rate risk. Corporate high-yield borrowers are more likely to default than even below-investment-grade municipal borrowers. As a result, most of the time, high-yield and investment-grade municipal bonds move in similar directions: rising when interest rates fall, and falling with interest rates rise. In contrast, falling interest rates usually accompany fears of a slowing economy, and that has tended to pull corporate high-yield bonds lower. Conversely, rising interest rates have usually accompanied inflation fears, an environment which makes it easier for corporate borrowers to meet their debt obligations and therefore helps support the price of corporate high-yield bonds.

The danger in high-yield municipal bond (and the funds that hold them) is lack of liquidity. That means that during periods such as 2008 or the first quarter of 2020 when everyone was rushing to the exits at the same time, high-yield municipal bond funds fell precipitously.

In 2020, the risk of municipal bankruptcies loomed large as local tax revenues fell and Republicans in the federal government showed little inclination to send aid. Now that tax revenues are rebounding in many places (especially California) and Democrats are stronger in Washington, the outlook for municipal debt has improved.

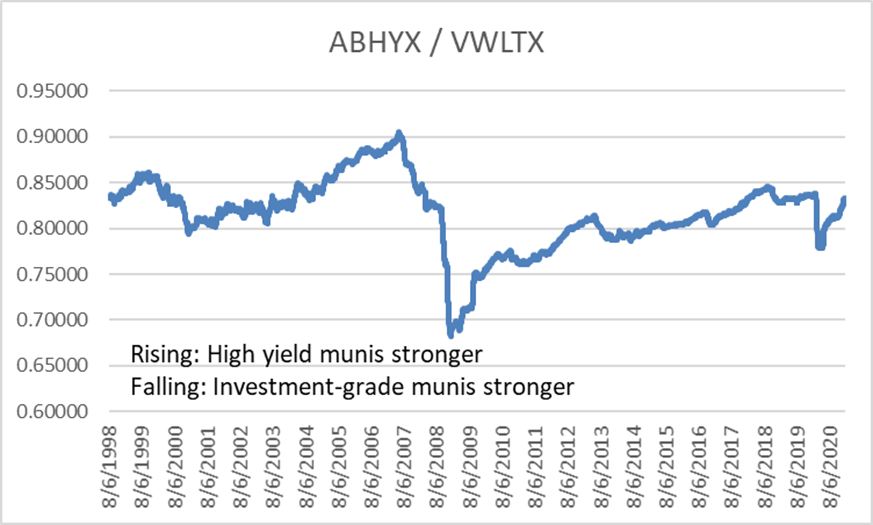

On a buy-and-hold basis, investment-grade and high-yield municipal bond returns have been similar. For example, the chart below shows the ratio of the value of investments starting in 1998 in two municipal bond funds whose portfolios have similar average maturities (17 years) and durations (6 years): Invesco High Yield Muni (ABHYX) and Vanguard Long-Term Tax-Exempt (VBMFX). When this ratio is rising it means that the high-yield muni fund was stronger, and when it was falling it means that the high-yield muni fund was weaker. Over the entire 22-year period, the two funds’ returns were about equal (4.9%/year).

Notice that most of the time, the high-yield municipal bond fund outperformed the investment-grade fund. However, the periods when the high-yield fund lagged were relatively short but very severe, wiping out the long-term advantage. Therefore, in order to capture the advantages of high-yield municipal bond funds during normal conditions without giving them back during corrections in the municipal bond market, we utilize a proprietary timing model for our clients. In my book, Higher Returns from Safer Investments (Pearson Education, 2010), I recommended the simple technique of using a 6% trailing sell and buy stops to reduce your exposure during major corrections such as occurred in 2008 and 2020 and then to time your re-entry. However, if you do not want to time the market, given the risk that interest rates will rise, I recommend the Nuveen Short-Duration High Yield Municipal Bond Fund (NVHIX) for 2021. It has an SEC yield of 2.86% (as of 12/31/2020) and a duration of 3.3 years, which should reduce the interest rate risk.

Conclusions

Bond investors will be hungry for yield in 2021 because yields across the credit spectrum are far below historical norms. As a result, expect below-average returns in 2021. The good news is that default risks for both taxable and municipal bonds appear to be on the wane, so the best opportunities lie with the below-investment-grade parts of the bond market.

We have found it crucial to work to protect our clients from market risks through the use of our timing models. If you are not able to utilize similar techniques, you should look to manage risk by opting for lower volatility fund choices, especially in the high yield municipal bond space where you will be vulnerable to any rise in long-term interest rates. Corporate high-yield and floating rate bond funds should hold up relatively well even if interest rates rise.1 The high yield corporate bond benchmark is the Bank of America High Yield Index and the floating rate benchmark is the S&P/LSTA Leveraged Loan 100 Index.

2 This assumes the Fitch projections to be correct and that interest rates will be stable in 2021. In fact, earlier in 2020 their projected default rates were more pessimistic. If interest rates rise instead of remaining flat, that will likely favor corporate high yield bonds and leveraged loans over investment-grade bonds of similar maturities. I do not expect interest rates to fall in 2021.The high yield corporate bond benchmark is the Bank of America High Yield Index and the floating rate benchmark is the S&P/LSTA Leveraged Loan 100 Index. This assumes the Fitch projections to be correct and that interest rates will be stable in 2021. In fact, earlier in 2020 their projected default rates were more pessimistic. If interest rates rise instead of remaining flat, that will likely favor corporate high yield bonds and leveraged loans over investment-grade bonds of similar maturities. I do not expect interest rates to fall in 2021.

To learn more about Marvin Appel, please visit Signalert Asset Management.