I want to do a follow-up on GameStop (GME), because this stock is just going absolutely bonkers, explains Markus Heitkoetter of Rockwell Trading.

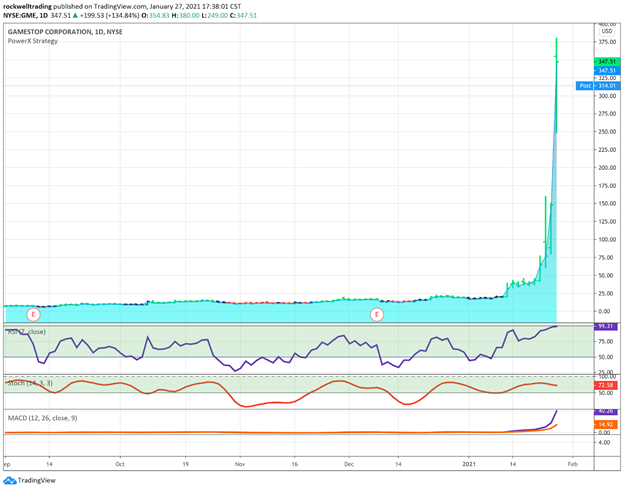

On a previous article, I was explaining exactly what’s happening on GME stock. It looks like the madness for GME stock isn’t stopping just yet. I mean, check out this chart:

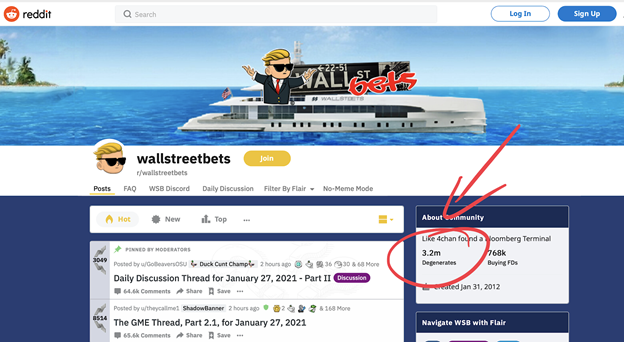

On the 26th everything started, the stock closed up almost 93% at $147.98, and it rose as high as $380! I’ve seen crazy things in this market, but a Reddit crowd squeezing shorts to this extent. It’s just crazy. The WallStreetBets group on Reddit—the one whose purpose is “making money and being amused by it,” their words, not mine—is growing by leaps and bounds. Tuesday, it had 2.3 million users, but Wednesday, there were 3.2 million users!

Even Elon Musk is chiming in:

Musk, who has clashed with Tesla shorts in the past, tweeted a link to the Reddit thread, saying “Gamestonk!”

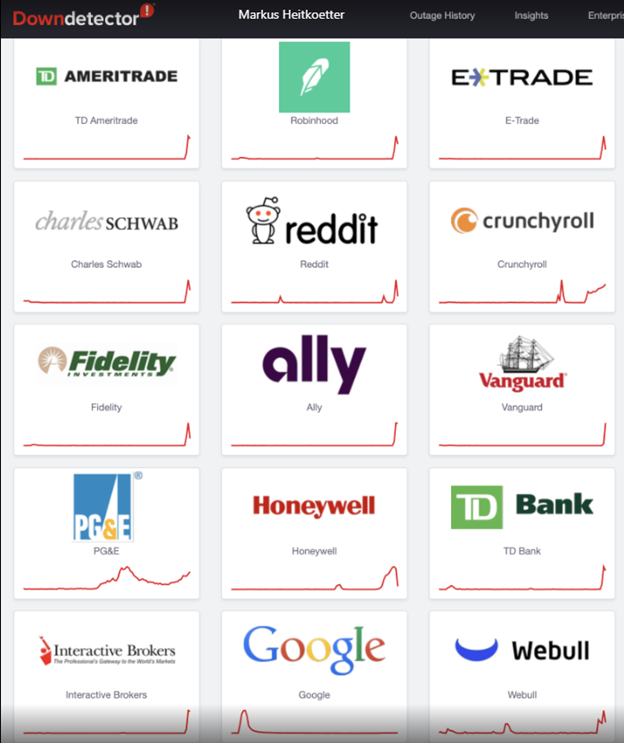

This has caused such crazy trading volume that a bunch of online brokers crashed. Here’s a screenshot from DownDetector.com that I took:

TD Ameritrade is actually restricting trading on GME and AMC stocks because of this insane volume! They said they’re doing this out of an “abundance of caution amid unprecedented market conditions and other factors.” It will be interesting to see if other online brokers do the same.

It seems like the Reddit crowd may have won the battle. I saw lots of headlines today that GameStop’s biggest shorts—Melvin Capital and Citron—said they covered most or all of their positions. And yes, that’s what they said…but did they? It will be interesting to see when short interest data is updated at the end of the month whether this is true or not.

MoneyShow’s Top 100 Stocks for 2021

The top performing newsletter advisors and analyst are back, and they just released their best stock ideas for 2021. Subscribe to our free daily newsletter, Top Pros' Top Picks, and be among the first wave of investors to see our best stock ideas for the new year.

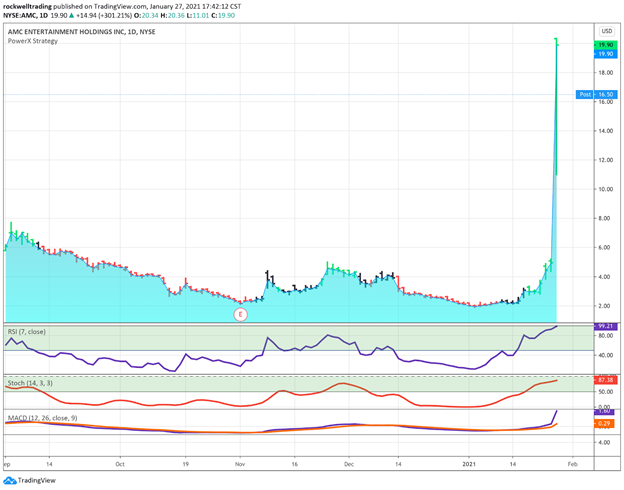

Other Stocks to Look at

This Reddit crowd is targeting some other highly shorted stocks too, so I want to take a quick look at their charts. First up is AMC (AMC). On Tuesday, the 26th, it closed at $4.96, and hit a high of $20.36 earlier. Wednesday it was up 229% at $16.27.

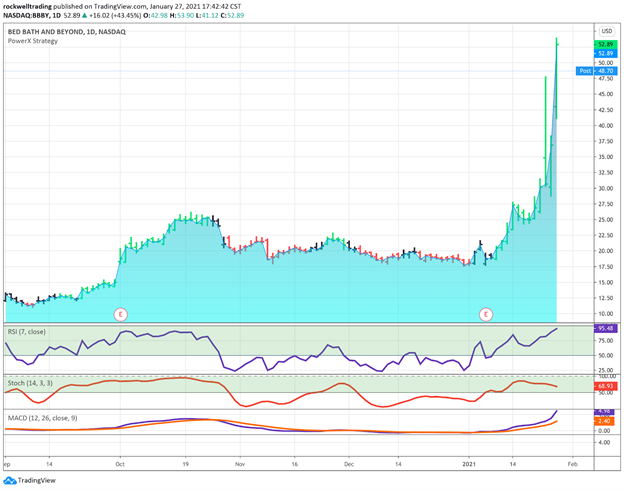

Next is Bed Bath & Beyond (BBBY). It traded as high as $53.90—its highest level since 2015! BBBY closed up 24% at $45.79 shortly after.

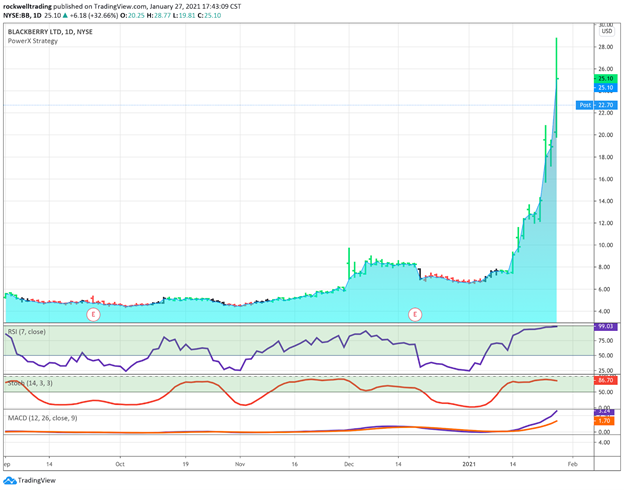

And finally, there’s BlackBerry (BB). BB hit a nine-year high of $23.94 and went up 23.4% at $23.31.

Summary

Now, I’m personally not trading any of these stocks, it’s too risky, but I’m certainly watching! Before we go, I want to make a correction. on GameStop. I mentioned that this was a similar situation to Kodak’s (KODK) volatility last summer. That was not the case. Kodak moved because it was awarded a government contract to make generic drug ingredients. The deal was later halted pending an investigation.

You guys were right, and I was wrong. Thank you for correcting me.

Learn more about Markus Heitkoetter at Rockwell Trading.