Was yesterday’s washout and price reversal a buying opportunity or the beginning of a pullback in US equities, asks Ian Murphy of MurphyTrading.com.

These are the moments when technical analysis comes to the fore because the data will answer the question for us.

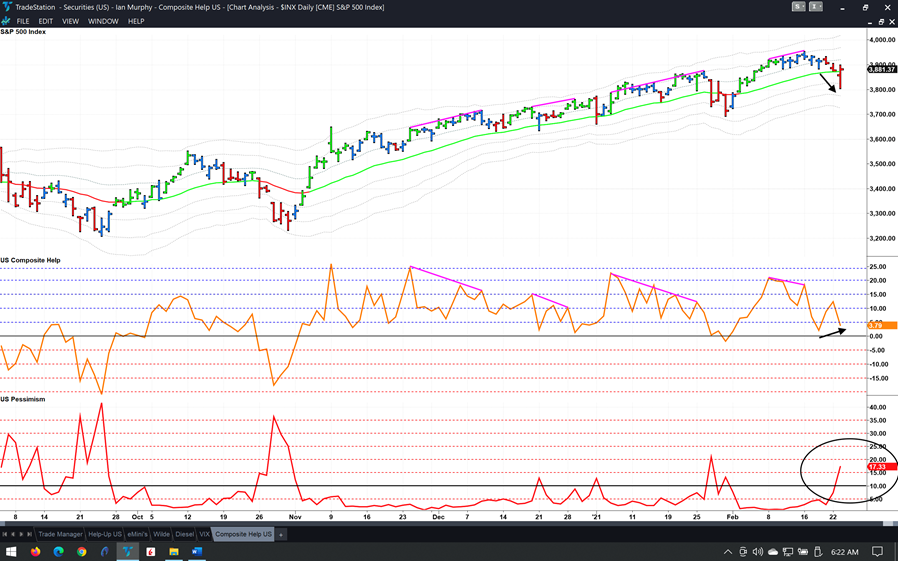

A potential bullish divergence has formed on the Composite Help indicator. This occurs when price makes a lower low (black arrow on top), but the indicator makes a higher low (bottom arrow). As you would expect, Pessimism jumped when new 20-day lows expanded (circle).

A reversal will be confirmed if Composite rises, and Pessimism falls back below 10% today. Both signals must occur for the market to go higher. The S&P 500 (SPX) must also hold the 3880 level.

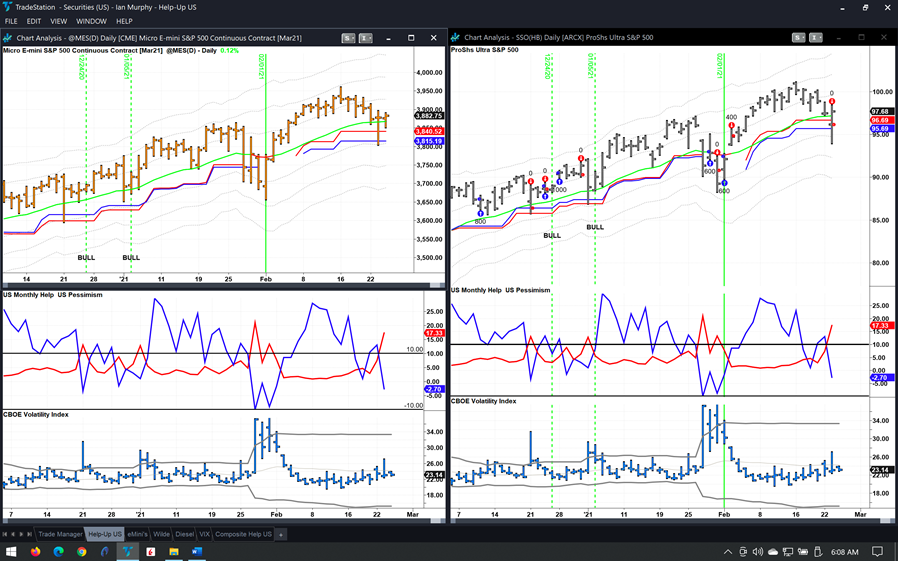

The position in Micro E-Minis was stopped out yesterday for a gain of 1.95% and the geared ETF (SSO) gave a profit of 4.9%. To reenter these positions, I will be looking for the required six signals on the Help strategy. Price and new high-new low data will probably play ball, SPX Volatility Index (VIX) is where I expect the challenge.

The most important thing is not to anticipate the trigger but to wait for the data to confirm, and this will be about 30 minutes before the close of the regular session.

Learn more about Ian Murphy at MurphyTrading.com.