A few clients noted I have not commented on international markets of late, preferring to concentrate on the US, states Ian Murphy of MurphyTrading.com.

Individual queries on overseas markets and stocks have been answered directly with clients but there is so much happening globally, I prefer to avoid broad-based commentary and focus instead on a specific market or strategy.

Most traders have exposure to US markets at some point, so that is a good base for beginners and experienced traders alike. Please drop me an email if you would like me to look at a specific stock or market in your country.

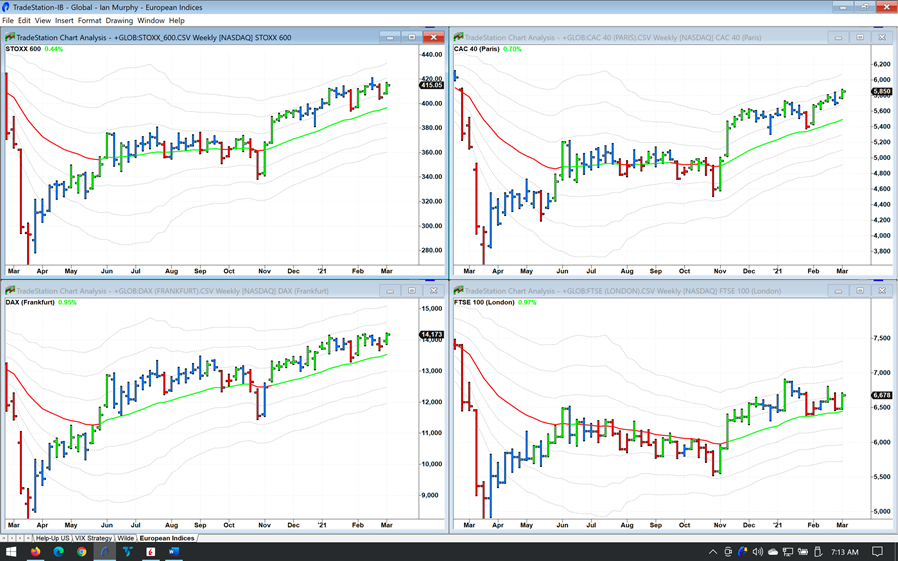

Looking at the three main European equity indices and the pan-Euro STOXX600 they were all trading above their 1ATR channels on a weekly chart at 07:00 ET, so technically bullish. European equities have been attracting a lot of international attention and commentary from value investors since January.

The US Help strategy triggered on Monday (green vertical line on top left chart above) and I’m long four Micro E-Mini contracts of the S&P 500 (CME: MES). This trade was taken on the Interactive Brokers account and the stop is at 3850 (right chart). The stop is tighter than normal because of the elevated volatility of late. I am looking for a 50% retrace of the trigger bars to hold as support (red dashed line on top left chart).

If still open, these contracts will be rolled on Thursday, March 11.

Learn more about Ian Murphy at MurphyTrading.com.