Bubbles, tiny bubbles are everywhere right now. The thing about "tiny bubbles" is they usually get a lot bigger before they pop, states Phillip Streible of Blue Line Futures.

So far in 2021, I have seen three bubbles burst, with the first being hedge fund managers frantically covering their excessively short "high beta - high short interest" stocks, i.e., GameStop (GME), First Majestic Silver Corp. (AG), AMC Entertainment Holdings (AMC), you know the names. The second was the rotation out of momentum (stay-at-home stocks) and into energy, financials, and reopening names. The third bubble that is still unwinding is the "bond bubble," which affects long gold positions. I have recently had many people ask me what narratives they should be watching and how they can hedge themselves.

Let's say I get approached by "XYZ Commodity Fund" and hire me as their asset manager. They will ask me what assets I like, my concerns, and how we can protect the position. The first thing I would do is look at the economic cycle we are in and where interest rates are. Since August, we are in a "reflationary environment" where growth and inflation accelerate, and historically as this occurs, the Fed turns hawkish in time. The part where the Fed "turns hawkish" is when the market will make its transition into the next economic cycle because growth will stall. Now that I have that hard part figured out, I will need to list my assumption of what works and what doesn't, and I can back-check it against performance data since August. Here is what I would write down, and here are the markets I would be watching.

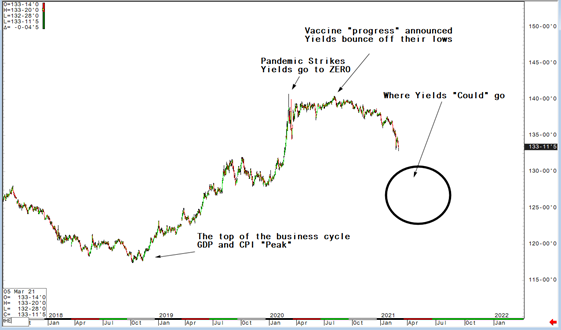

10-Year Note (As yields rise, the price of the 10-Year declines)

6-Month Performance -4.75%

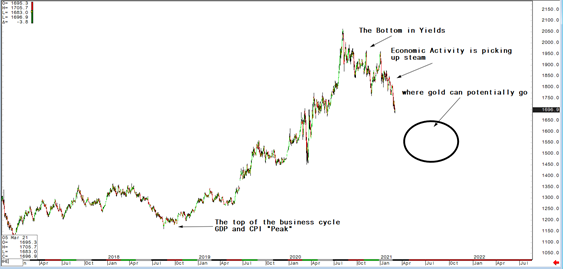

Coincidently, when yields bottom and growth begins, that generally marks the top in gold, and conversely, when yields peak and growth peaks that markets the bottom in gold.

Gold (As yields rise, the price of gold declines)

6-Month Performance -12.15%

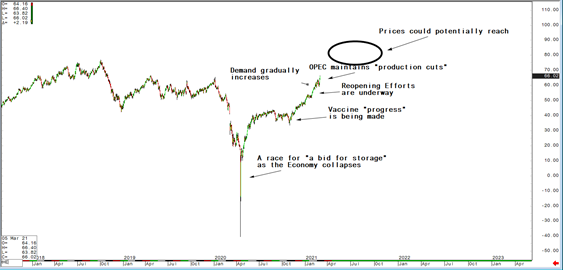

As the economy reopens, people will begin to travel, and demand consumption of energy will increase. Crude oil is often a great proxy for business activity because it is "cracked" into other products that measure demand, such as gasoline and heating oil.

Crude Oil

6-Month Performance +66% Gasoline +75% Heating Oil +68%

What other markets are we watching?

"Inflation" Plays

Prices of Raw Building Materials have been rising such as Lumber, Cotton, Copper

6-Month Performance Lumber +36% Cotton +34% Copper +33%

"Food Inflation"

Food costs have been steadily rising, such as Bean Oil, Corn, Sugar

6-Month Performance Bean Oil +58% Corn +52% Sugar +37%

That should give you plenty of ideas of different ways to look at how changes in economic growth, inflation, and yields affect various commodities.

Learn more about Phillip Streible at Blue Line Futures.