Over the past few weeks, the theme in the stock market has been a selloff in the tech sector, says Jay Soloff of Investors Alley.

Several high-fliers from 2020 and early this year have taken a beating. While many buzzworthy tech names seemed to be overvalued, they didn’t look like they would experience a pullback…that is, until they did.

Perhaps the best-known of the trendy tech stocks is the one that invested in several of them. Of course, I’m talking about the ARK Innovation ETF (ARKK). Cathie Wood’s famous exchange-traded fund invests in some of the most popular names of the latest tech euphoria, including big names like Tesla (TSLA), Square (SQ), and Roku (ROKU), along with many smaller names you’ve likely never heard of.

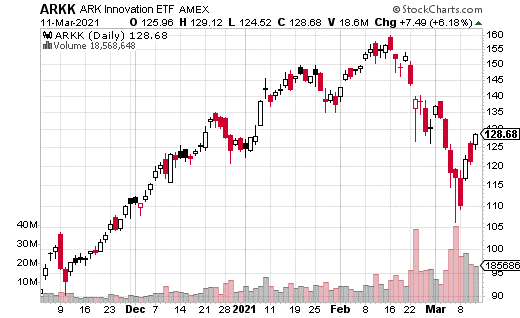

ARKK made waves by significantly outperforming the major stocks indices, and by a considerable margin. In November, right before the election, ARKK was trading for $100 (up from $60 in June). By mid-February of this year, it peaked at around $160.

However, as investors began questioning the valuation of the tech sector, ARKK dropped from $160 to $110 in about three weeks. It’s since rebounded to around $130. Nevertheless, that’s more than a 30% drop in less than a month, and it’s surely spooked some investors who thought ARKK was bulletproof.

To put it in perspective, the S&P 500 is up about 4% for the year as of this writing. ARKK is down 2.5% over the same time frame. But, when you zoom out to the last year, the S&P 500 is up a very respectable 35%. ARKK? Well, it’s up 146% in the last year. I don’t think Cathie is losing any sleep over the recent pullback.

In the options market, the order sentiment has been broadly bearish. Still, some large block orders that hit the tape suggest the price may be stabilizing.

In particular, two blocks of puts were sold expiring on April 1. With ARKK trading at around $128, the 105 puts were sold 3,800 times total for an average price of $1.50. That works out to $570,000 collected in premium. The put seller will keep all of the premium if the stock price is at about $105 at April expiration.

The position starts losing money if the stock is below $103.50 at expiration. The risk extends all the way down to a stock price of zero (which is, of course, highly unlikely). Assuming the stock stabilizes, the $1.50 in premiums collected amount to a yield of 1.2% in just three weeks. Annualized, that’s about 14%.

Essentially, ARKK would have to plunge about 20% in just a few weeks for the trade to lose money. It’s a relatively safe way to generate a yield. Still, ARKK can undoubtedly be volatile, and you may not want to deal with the ups and downs while you wait.

This position could also be from a trader who feels the puts are expensive due to hedging or heavy speculative downside bets. In that case, the put seller is likely hedging directional risk elsewhere. It’s impossible to know for sure, but I don’t expect that these block trades are cash-secured puts.

Learn more about Jay Soloff at Investors Alley.