Monday was “The Ides of March,” an important religious festival in ancient Rome and the last day for paying debts, explains Ian Murphy of MurphyTrading.com.

In 44 BC a few senators marked the date with a hands-on approach to regime change when they stabbed Julius Caesar to death.

Today is the third Friday in March, a date traditionally known as “Quadruple Witching Day” when four classes of options and futures expire. This was likened to the havoc created by witches of old because volatility often increases in financial markets on this day. Considering most market participants are men, Wizarding Day would have been a more appropriate title.

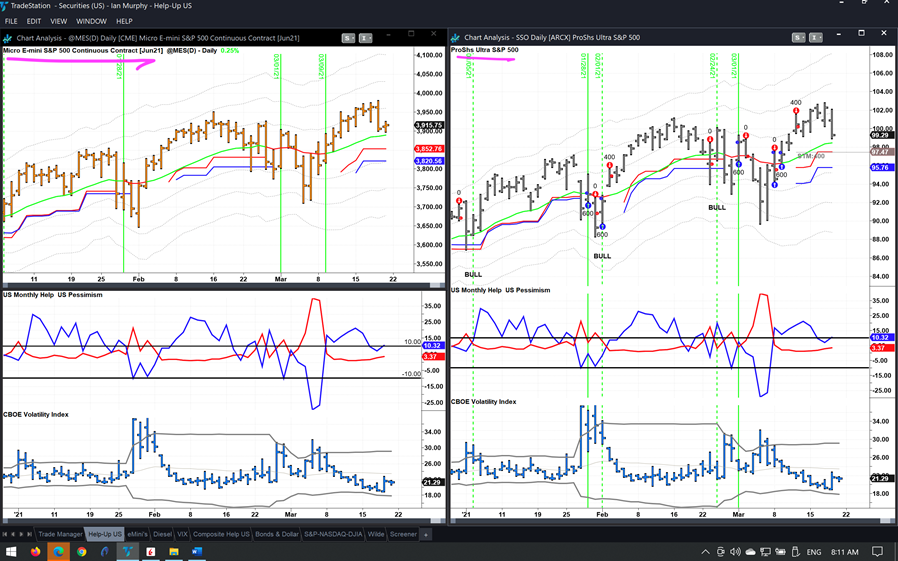

In anticipation, the trade in Micro E-Minis of the S&P500 has been rolled into the June contract using a calendar spread on the Interactive Brokers platform. The trailing stop has flatlined at 3852.75 since the Ides.

The same trade in the ProShares Ultra S&P500 ETF (SSO) is still open and yesterday’s pullback came about 1ATR closer to the trailing stop, which is at $97.47.

With an expected pickup in volatility today trailing stops are our best defense against excessive loss because history has shown us overstaying your welcome rarely ends well.

Learn more about Ian Murphy at MurphyTrading.com.