I’m not bearish at this moment but it’s hard to argue with the self-evident truth—stocks are struggling, states Joe Duarte of In the Money Options.

Certainly, stock traders tend to focus on stocks, yet equities are part of a much larger complex system composed of the markets (M), the economy (E), and people’s lives (L). In fact, this set of relationships may become increasingly evident in the next few weeks as we seem to be entering a period where the options market (the tail) is wagging the dog (the stock market) just as bond yields reach critical levels. All of which adds up to one word for MEL: V-O-L-A-T-I-L-I-T-Y.

Of course, it’s hard to know whether the volatility that could ensue could be bullish, bearish, or just plainly exasperating to anyone who is trying to trade a trend, make a living, or decide on whether to take that vacation they’ve put off for the past 12 months. Still, no matter what happens, the stock market will need to decide whether easy money from the Fed is still enough of a catalyst to push prices higher in the face of rising bond yields and an economy, which may stagnate under the pressure of supply chain disruptions, depleting inventories, order log buildup, and workforce-related issues and limitations.

Moreover, under the hood, we are seeing an increase in the influence of weekly options expiration as a driver of volatility in stock prices, which means that the periods where the market would rise relatively smoothly over days and weeks may be coming to an end at least in the short term as indecision feeds volatility. And it is that volatility that may bleed from M to E and L with some likely unintended consequences.

Heads in the Sand No More

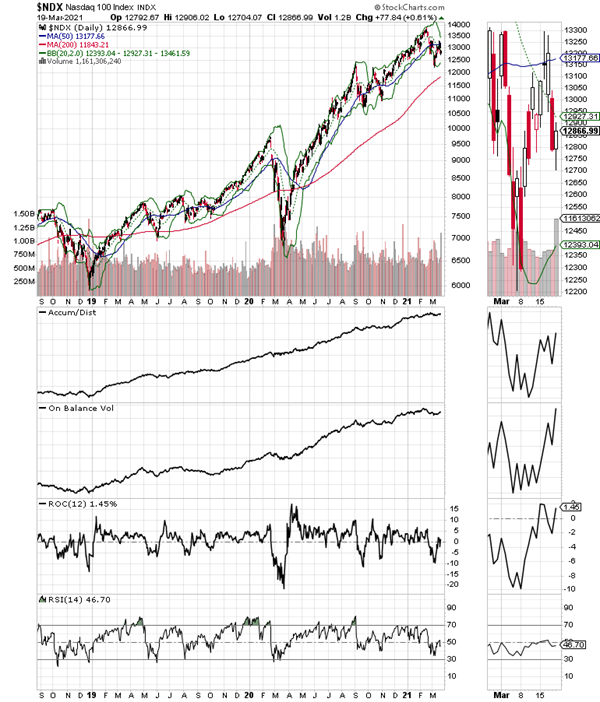

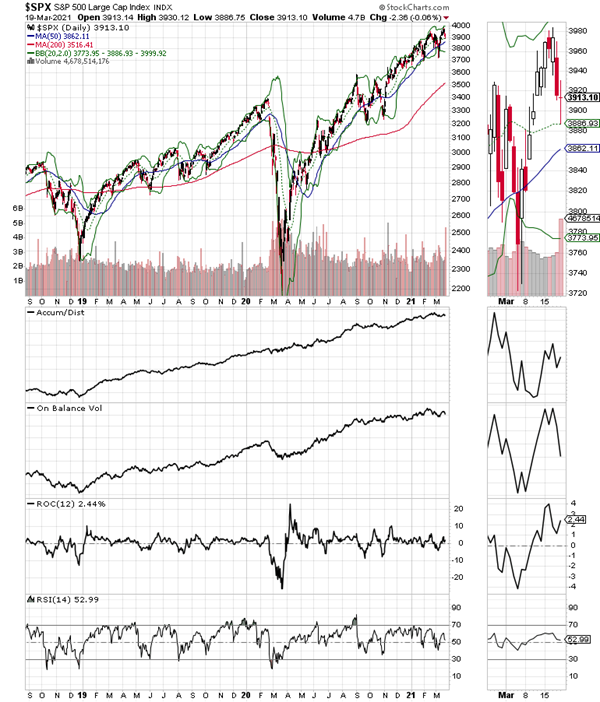

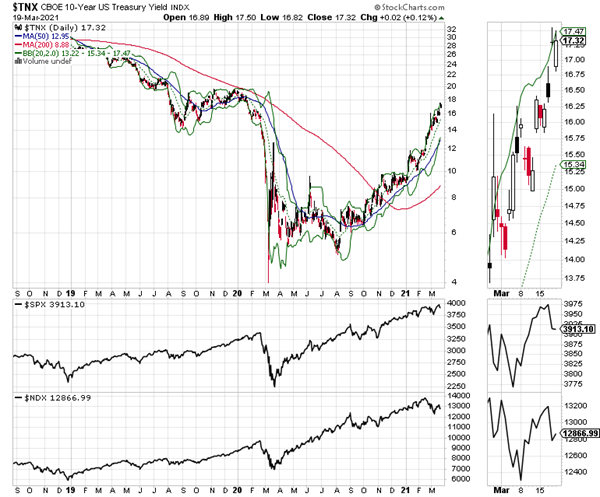

Up until now, stocks have mostly ignored rising bond yields as the Federal Reserve is clearly not going to reverse its QE and zero interest rates policies in the near term regardless of what the bond market does; at least not likely until it’s too late. Accordingly, the net result of this disagreement has been rising bond yields, in turn leading to a nasty selloff in the Nasdaq 100 (NDX), which may be bleeding into the S&P 500 (SPX). See below for details.

Specifically, until the last few days money had been rotating away from high-flying technology stocks and finding its way into the shares of companies that are profiting from the disruptions along key supply chains. So here have been the guidelines for successful stock pickers over the last few months:

- Supply and demand must be in favor of the company’s industry

- Management must be executing its business plan nearly flawlessly

- There should not be any signs of potential relief to the supply chain disruption over the next 12 months

This is what’s worked of late. But it is now possible that bond yields have reached a point where the above group of trends may no longer work. Thus, as I will detail below, bond yields may be reaching a point in which the odds of a broadening of the sectors in the market that could be negatively affected is about to rise.

As Options Activity Increases Trader Indecision Breeds Algo Indecision

Now, let’s add the options market’s contribution to the recipe. It used to be that options expirations made for increased volatility in stock prices once per month, the so called “Triple” and “Quadruple Witching” events, of which we had one on 3/19/21. But now that options volume dwarfs stock volume the tail is wagging the dog (TWD).

So that means that to a certain degree, you have a mini “Triple” or “Quadruple Witching” type event every week, and sometimes more than one due to mid-week expirations in ETFs like SPY. Moreover, due to these more frequent options expirations and the inherent effect that they have on stock prices due to dealer hedging (generally accelerating the underlying trend) it looks as if we’re about to enter a bumpy period.

In other words, as long as there is a trend there is steady money flow into options. During those trending periods, the dealers (algos) essentially hedge by buying or selling a mixture of stocks, options, or index futures to counter the effect of the public’s buying. And that’s why the market tends to trend as the hedge fuels the trend.

For example, under normal circumstances, if the public buys calls, the dealer (algo) is selling calls to the public. Thus, in order to protect itself the algo has to buy stock to hedge against potential losses upon being assigned. That creates a virtuous cycle for rising stock prices as calls bought by the public force the algos to buy stocks to hedge. The problem is that with bond yields rising, the public, the big money, and the algos are starting to freak out as they are not sure as to how to respond to the fist fight between the Fed and the bond market. And this is spawning indecision.

In essence as trader indecision increases it forces the algos to also be indecisive in order to hedge against indecision. And since the market maker algos have to hedge all their positions in order to prevent losses, their indecision, which mirrors and magnifies the actions of non-market maker traders, humans and algos, is increasing volatility.

Bottom line: Buckle up as the war between the bond market and the Fed is bleeding into algo land.

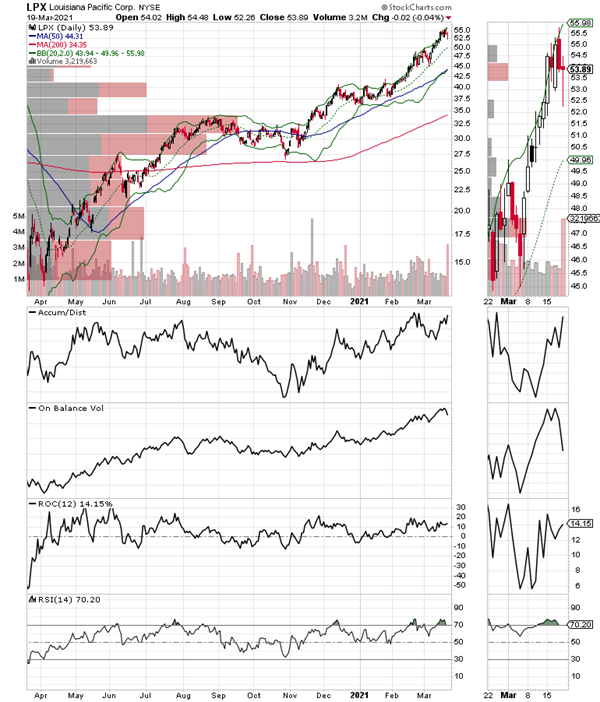

Louisiana Pacific Shifts to Overdrive as Inflation Rises

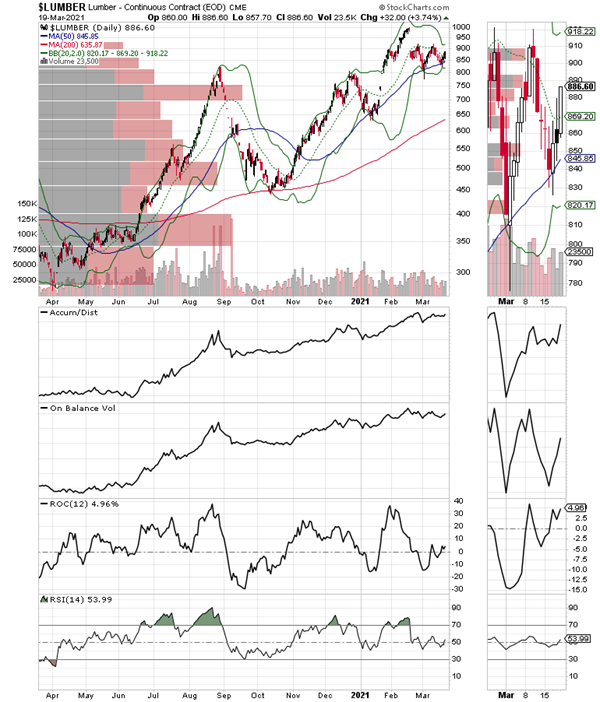

Perhaps the poster child for supply chain stocks at the moment is lumber producer Louisiana Pacific (LPX), which stands at the crossroads of housing and its chief commodity lumber. Certainly, the stock meets the criteria for success in the current tight supply chain world, as many lumber producing plants are still not fully online while housing demand remains steady as the post-COVID migration from large cities and high-tax states remains unabated.

Moreover, the stock has been in a torrid uptrend for the past several months, which was juiced recently after a huge earnings and revenue beat coupled with positive guidance. Certainly, after a huge move up, LPX is due for some consolidation. And of course, that means that there may be opportunities to buy the stock on dips (BTD). But maybe, it’s not a bad time to be patient before making that BTD decision.

For their own account, lumber prices had a good day on Friday, which translated into late-day buying on LPX, which had a volatile day due to options expirations. Moreover, although I own the stock, I am also aware of the fact that even if it’s due for a pullback, the action in the bond market could have a negative effect on it. Specifically, if bond yields continue to rise and the net effect is a major hit to homebuilder orders, it would then likely reverse the price of lumber and hit LPX.

As a result, I’ll be watching to see what happens to homebuilders as well as bond yields. If the stock shows relative strength, it will be a sign that, at least for now the Fed will be the overriding influence on at least some part of the market. If, however, LPX breaks down it will likely be a sign that the bond market’s influence on stocks is spreading beyond the technology sector.

For now, LPX gets the benefit of the doubt as Accumulation Distribution (ADI) and On-Balance Volume (OBV) remain in uptrends. But, in this market things can happen fast that I’m watching this one very carefully.

NYAD Volatility Increases

The New York Stock Exchange Advance Decline line (NYAD) is showing signs of indecision; making brief new highs quickly followed by rapid selloffs, which in turn may be followed by yet another upside reversal. This behavior suggests that options volatility on weekly expirations is starting to become the dominant factor in trading, which is very troubling as it suggests that the overall volatility of the market is about to increase.

At the same time, it’s important to note that as long as NYAD continues to make new highs, remains above its 50- and 200-day moving averages and its corresponding RSI reading remains above 50, the trend is up. This combined set of observations has been extremely reliable since 2016.

The Nasdaq 100 index (NDX) is short-term oversold but also technically weak as it has failed to bounce back above its 50-day moving average while its RSI remains below 50 (Duarte 50-50 Sell Signal). Also, we’ve had a mini-death cross as the 20-day moving average has crossed below the 50-day, which means that tech stocks may not be fully out of the woods yet, although there seems to have been a buying flurry at the end of the day on Friday; so, we’ll see here.

The S&P 500 is still acting better than NDX as it has remained above key support areas more reliably.

Yields Explode as Inflation Creeps In

Bond yields are holding stock prices hostage as the US Ten Year Note yield (TNX) rose above 1.7% and the US 30-year T-Bond yield (TYX) closed just below 2.5% on 3/19/21. This came on the heels of two important developments. One is that the Bank of Japan may start a very slow interest rate increase cycle and the other is that inflation is starting to creep into the Federal Reserve regional services data. Moreover, emerging market central banks in Turkey and Brazil have also raised interest rates recently.

Moreover, there are several major areas of concern now regarding inflation:

- Supply chain disruptions

- Falling inventories

- Rising product demand

- Potential for rising labor costs

As the chart above clearly shows, the S&P 500 is following in the footsteps of the Nasdaq 100 in buckling when bond yields rise. Therefore, we may be reaching the proverbial tipping point in the Markets-Economy-Life (MEL) system where the central pilar over the last few years, stock prices are not able to rise despite the Fed’s QE and zero interest rate policies as the real world starts to influence the potential for rising profits by companies.

We may not be there yet, but we may be getting closer.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.