If you’re wondering why the stock market is suddenly so volatile, look no further than the options market, states Joe Duarte of In the Money Options.

Moreover, the way things ended up in options, the NYAD, and the major stock indexes last week the odds are for a big move in stocks this week; and it could be to the upside. See below for full details.

Meanwhile the bond market is worried about inflation, the Fed continues to pour money into the banking system, and supply chain and geopolitical worries abound.

The result of this uncertainty has been volatile hair trigger trading action where the intraday moves up or down can be sizeable in terms of bonds, stock indexes, stocks and options. Yet, as confusing as it may seem, from an internal standpoint, the action in the options market has been a fairly good predictor of where the weekly expiration will head. And as the expiration goes so does the market.

The Options Expiration Effect

Over the last few weeks, we’ve seen the number of call options at key strike prices for SPY overwhelm puts on weekly and monthly expirations. Generally, the stock market has risen when this has happened due to the hedging techniques used by computer algo traders, day traders, and market makers. However, this pattern of call buying reversed temporarily last week with the number of puts bought outnumbering the number of calls on the 3/24 weekly SPY expiration.

The net effect was that as put buying increased, the dealers (algos) sold puts, while simultaneously selling stocks or stock index futures to hedge the risk of selling the puts to the put buyers. Moreover, as put buying increases dealers have to sell more puts to meet demand. This vicious cycle in turn accelerates the downside action in stocks because falling futures prices trigger algo sell programs, which are required to sell when certain price points are hit.

On the other hand, as we saw on 3/25, the day started with put buyers leading the way only for the trend to be reversed after the lunch hour when the call buyers arrived in force and reversed the downside action for the market in a reversal of the vicious cycle; call buying requires buying of stocks and stock index futures to hedge. And as call buyers overwhelmed the expiration forcing the algos to reverse course the market ended up moving higher for the day.

Of course, now it gets interesting. Last week, the situation was exacerbated as expirations 3/24 (Wednesday) and 3/26 (Friday) were more volatile than average. But guess what? This week, we have SPY expirations on 3/29, 3/31 and on 4/1 (Thursday), right before Easter weekend.

What’s the bottom line? Be prepared for MORE VOL as the news cycle will likely provide fodder for shall we say, enthusiastic algo trading!

Two Waste Stocks That Smell Like Roses

Their business is certainly not glamorous but shares of Waste Management (WM) and Republic Industries (RSG) are certainly not just smelling like roses but showing some upside momentum in a skittish stock market.

I recently recommended shares of Waste Management Inc. and the stock has moved steadily higher since then. As a result, I followed up by adding shares of Republic Services.

Perhaps the best reason, aside from the fact that both stocks, as I will describe below, have excellent technical characteristics, is you guessed it: COVID-19 has changed the dynamics of the waste business. It should not be surprising, of course, but the work from home, increasing reliance on takeout food, and on-line shopping, has increased the amount of paper, Styrofoam, and plastics discarded by households and businesses.

This emerging dynamic has increased the business opportunities for waste-management companies. For instance, WM recently beat its earnings and revenue expectations and put a share-repurchase program in place. Moreover, RSG delivered record free cash flow, EBIDTA, increasing margins, and raised its earnings guidance for its next fiscal year.

Both stocks delivered chart breakouts on 3/24/21, which is even more impressive when you consider the fact that Wall Street analysts are not all that excited about the companies. Thus, this means that investors are disagreeing with mainstream Wall Street, which is usually a positive sign since as the stocks gain in price, the Wall Street analysts are likely to change their tune, which may improve prices further.

Of the two stocks, WM is a bit ahead in its breakout compared to RSG. Nevertheless, both stocks are under accumulation with On-Balance Volume (OBV) and Accumulation Distribution (ADI) confirming. Moreover, the fact that both stocks are moving decidedly higher in a market that is moving sideways is a sign of relative strength.

NYAD and Major Indexes are Setting Up for Big Move

The New York Stock Exchange Advance Decline line (NYAD), while remaining in its long-term uptrend, continued its recent choppy trading pattern over the last week with support at the 20 and 50-day moving averages with no new high on the line. On the upside, NYAD survived a midweek attempt at a Duarte 50-50 Sell Signal.

Again, it’s important to note that as long as NYAD continues to make new highs, remains above its 50- and 200-day moving averages and its corresponding RSI reading remains above 50, the trend is up. This combined set of observations has been extremely reliable since 2016.

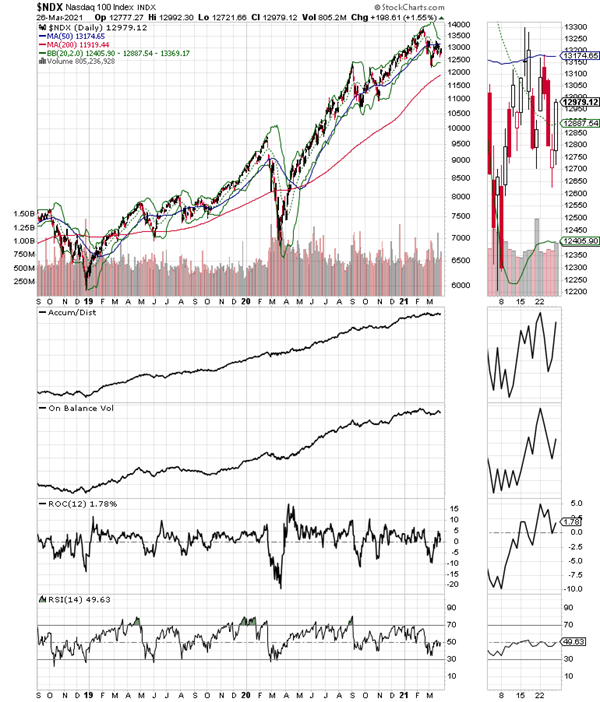

The Nasdaq 100 index (NDX) is likely to have a big move in the next few days as the Bollinger Bands are closing in around prices. The index has struggled with very volatile trading inside a tight trading range between its 20 and 50 day moving averages of late. However, if NDX takes out its 50-day moving average in the current options market set up, the odds of a very explosive move to the old highs are better than even.

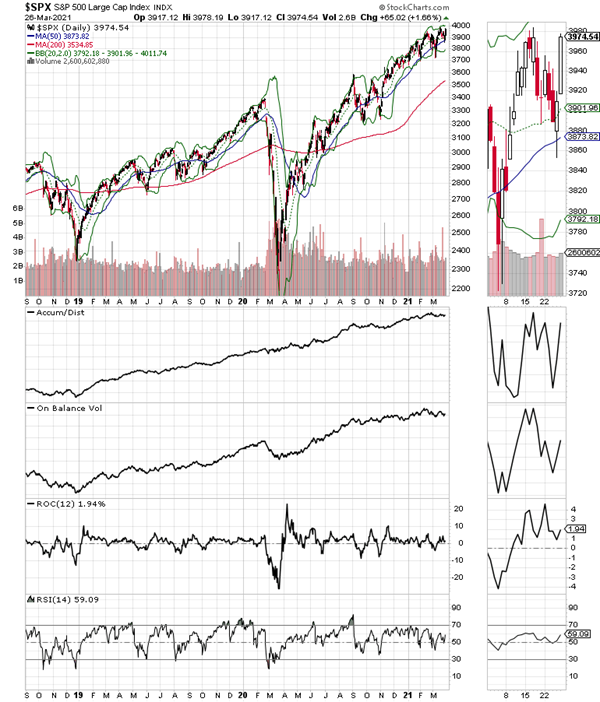

The S&P 500 (SPX) continues to act a bit better than NDX as it has remained above key support areas more reliably. Moreover, SPX is just below its recent high with the Bollinger Bands also closing in, which means that a big move is coming. If it’s to the upside, as I think is quite possible, new highs on SPX are likely in the short term.

Bond Bear Market Persists Despite Yields Rolling Over

Bond yields found support last week suggesting that the bear market in bonds still has legs.

In fact, what we’re seeing is a fairly predictable technical pattern on both the US Ten-Year Note (TNX) and the US 30-year T-Bond yield (TYX) yield, with both pulling back to their 20-day moving averages. This pullback could either continue, consolidate, or use the support area as a launching pad for another stab at a new high.

Indeed, there are still plenty of factors, which support at least a consolidation of yields, such as:

- Supply chain disruptions – now with the ship stuck in the Suez Canal

- Falling inventories

- Rising product demand – as economies recover

- Potential for rising labor costs – as demand increases

Moreover, as the composite chart comparing bond yields to stock indices, above, the stock market remains concerned about the conflict developments outside of the market, as even with yields falling back, the S&P 500 is, and the Nasdaq 100 indices are in their own consolidation patterns.

Therefore, we may be reaching the proverbial tipping point in the Markets-Economy-Life (MEL) system where the central pilar over the last few years, stock prices are not able to rise despite the Fed’s QE and zero interest rate policies as the real world starts to influence the potential for rising profits by companies.

We may not be there yet, but we may be getting closer.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.