Covered-call trades can be entered by legging in (two separate trades) or via the buy/write combination form (one net trade), explains Alan Ellman of The Blue Collar Investor.

When available, the latter is an effective, and perhaps cheaper, way to execute our covered-call trades when the bid-ask spreads of our options are narrow. This article will explain how to use the combination form using a real-life example with Corcept Therapeutics Incorporated (CORT), a stock on our premium stock watch list on 9/8/2020.

Initial Trade Structuring

On 9/8/2020, CORT was trading at $19.98 and the 10/16/2020 $21.00 call showed a bid-ask spread of $1.35-$2.20. Leveraging the Show or Fill Rule, we will seek a bid premium of $1.70 for a five-week expiration. Here is the option chain for CORT on 9/8/2020:

CORT: 5-Week Option Chain on 9/8/2020

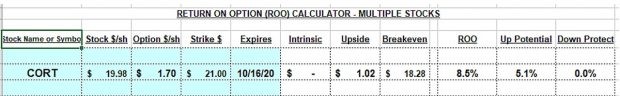

Initial Calculations with the Multiple Tab of the Ellman Calculator

CORT: Initial Calculations with the Ellman Calculator

Legging-in

- Place a market order to buy 100 shares of CORT

- Once executed, place a STO (sell-to-open) limit order for one contract at $1.70

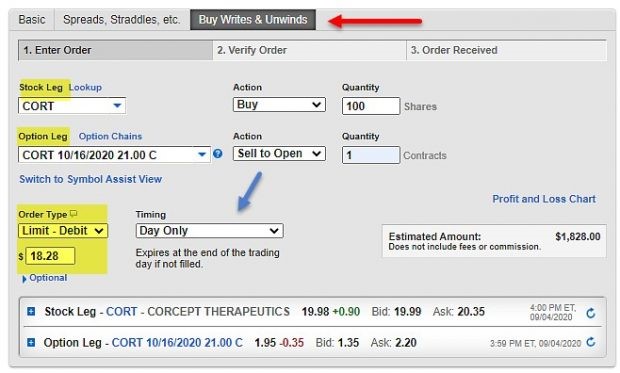

Buy/Write Combination Form

CORT: Buy/Write Combination Form

- Go to buy writes & unwinds (titles may vary slightly from broker-to-broker)

- The net debit limit order is set at $18.28 ($19.98 – $1.70)

- Day only: if not executed, we re-evaluate the next trading day

- Review and confirm order

- Once executed, place a buy-to-close limit order on the option side based on our 20%/10% guidelines ($0.35 or $0.15)

Discussion

Covered-call trades can be executed by legging-in or with a buy/write combination form. Both are acceptable with a possible slight advantage to the latter when the bid-ask spread is small. Legging in may be a better approach when the spread is wider so we can leverage the Show or Fill Rule.

Learn more about Alan Ellman on the Blue Collar Investor Website.