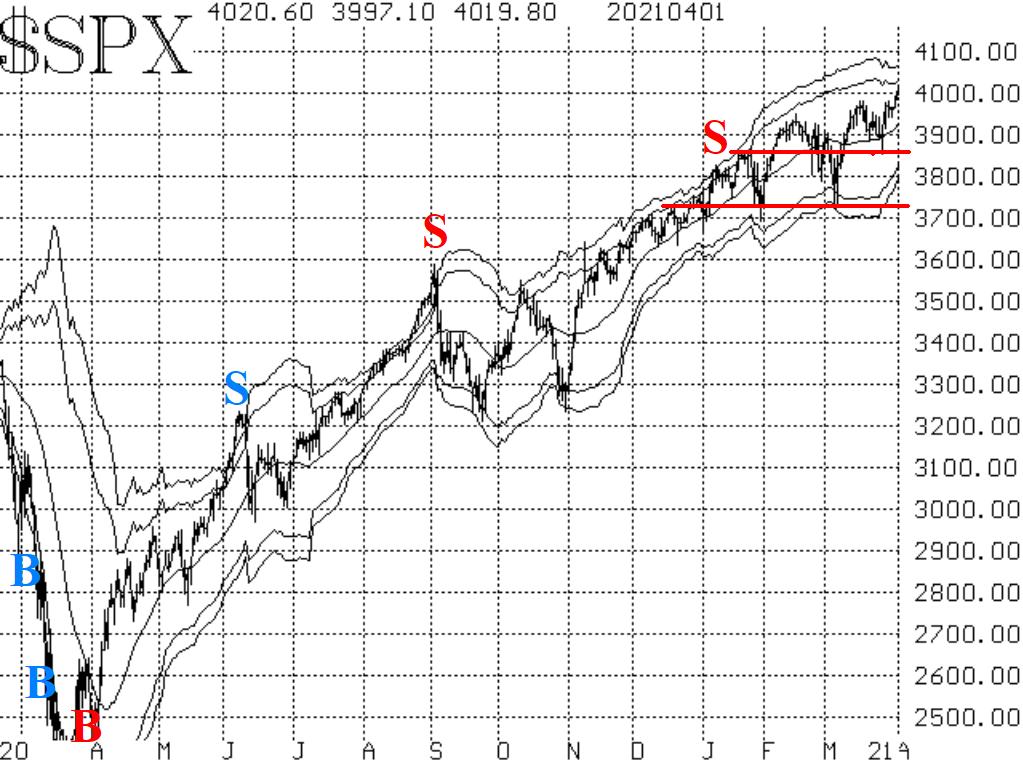

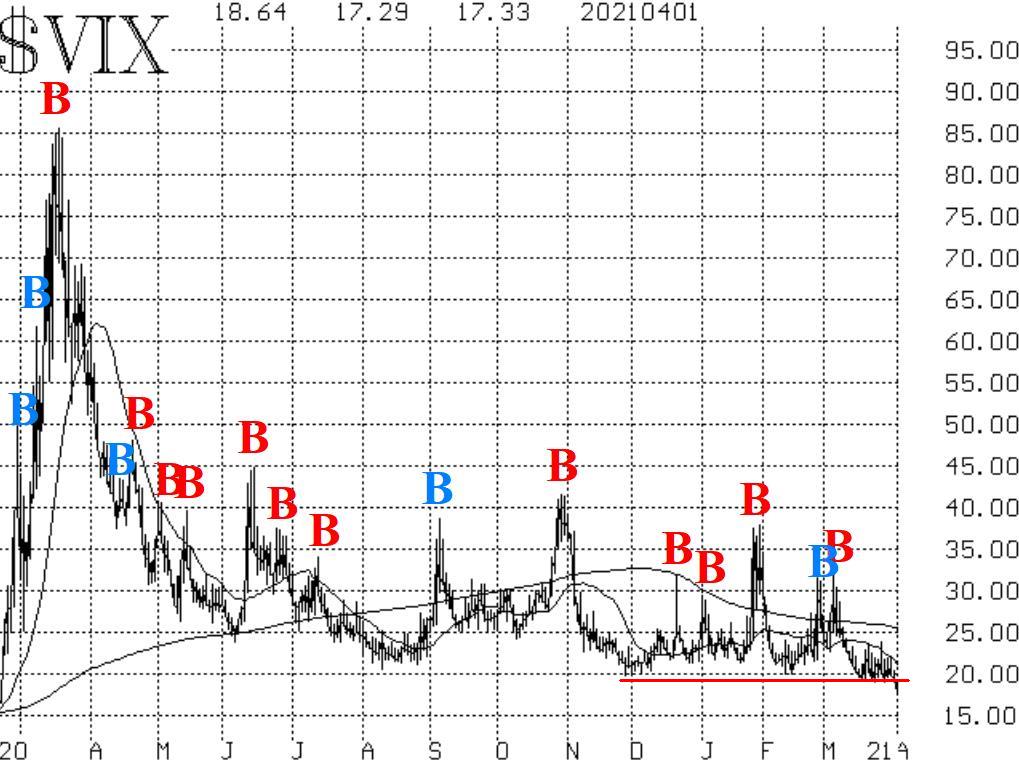

The bulls may have kick-started another new upward leg by the fact that S&P 500 (SPX) broke out to a new all-time high and VIX broke down to a new relative one-year low at the close on Friday, April 1st, states Larry McMillan of Option Strategist.

This comes amidst improving internals, but skeptics still exist. The first upside target—if this is truly a new leg to the bull market—is 4068. Conversely, a close below 3870 would negate the recent upside breakout.

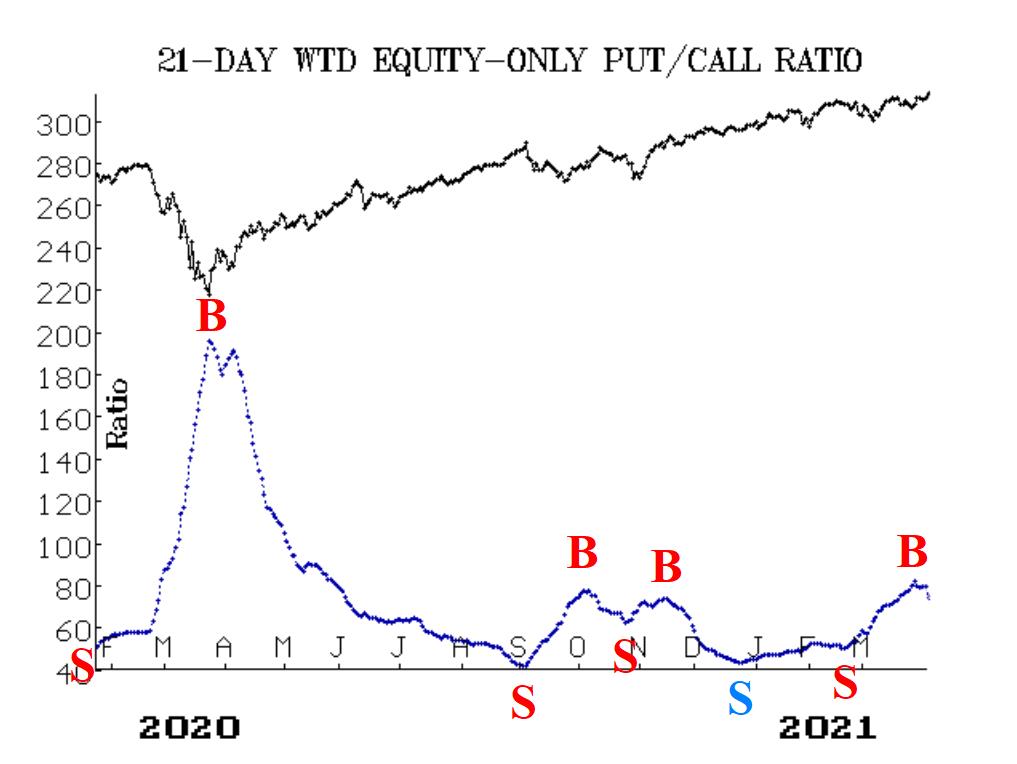

One of those "improving internals" is the weighted equity-only put-call ratio. It has rolled back over to a buy signal, and that buy signal is coming from a "height" on its chart about equal to where two successful buy signals were generated last October and November (see Figure 3).

Market breadth has improved with this rally. The breadth oscillators rolled over to buy signals on March 25th and have now moved into overbought territory.

Volatility continues to be a friend of this bull market. The CBOE SPX Volatility Index (VIX) "spike peak" buy signal of March 5th is still in place, and the trend of VIX continues downward, and on Thursday, April 1st, VIX broke sharply to a new relative low.

So, we continue to recommend a "core" long position, around which small positions can be traded if confirmed signals appear.

To learn more about Larry McMillan, visit Option Strategist.