The equity market is performing solidly as the S&P 500 Index (SPX) ended up 5.8% for the first quarter 2021, states Joon Choi of Signalalert Asset Management.

In addition, the second quarter is off to a good start with a 2.4% rise in the first three trading days of April. Moreover, the index saw 17 new record daily closes in 2021, and it feels as if equities will continue their upward march. However, SPX’s relative strength versus Bank of America Merrill Lynch High-Yield Index (MLHY) seems to suggest that equities are ready to take a breather, at least in relative terms compared to MLHY.

The Study

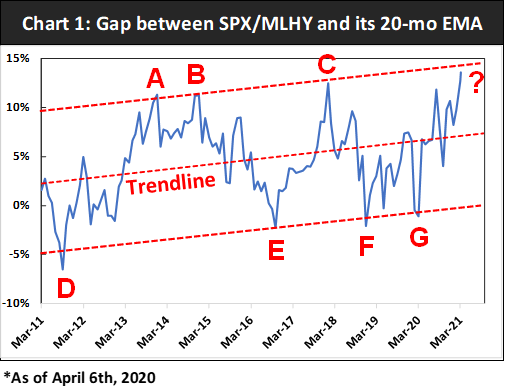

Using the last 10 years of monthly total return data for SPX and MLHY, I created a ratio between the two by dividing SPX by MLHY (RelStr). Then I calculated the 20-month exponential moving average (EMA) of the ratio and charted the difference between the RelStr and its EMA (DIFF); as a percentage of EMA (Chart 1). The best-fit-line (trendline) was also drawn along with equal-distanced channels (one above and one below). The SPX/MLHY ratio is currently 13.6% away from its EMA; meaning that SPX has significantly outperformed MLHY, and SPX may underperform in the near future.

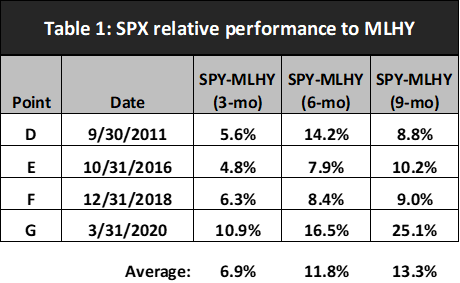

Table 1 below summarizes SPX’s outperformances of MLHY after its DIFF touched the bottom channel during the ensuing 3, 6 and 9 months (Points D, E, F and G). SPX outperformed MLHY by an average of 6.9% in 3 months, 11.8% in 6 months and 13.3% in 9 months. These data suggest not only are equities a better bet than high-yield bonds but that the increase in equity exposure is warranted when DIFF greatly deviates below the trendline, as was the case in March 2020.

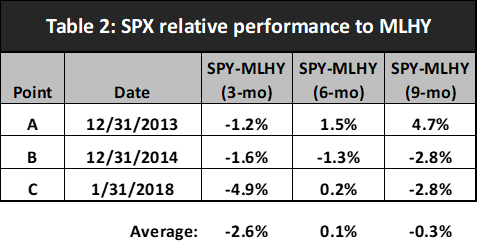

In contrast, Table 2 displays how SPY has fared against MLHY after touching the upper channel for the ensuing 3, 6, and 9 months. There were three such occasions (Points A, B, and C) with SPX lagging MLHY by 2.6% 3 months later and about the same for the 6- and 9-month periods. Currently DIFF is near the upper channel, which means that equities valuation is stretched when compared to high-yield bonds.

Conclusion

It appears the relative valuation of the S&P 500 Index to MLHY Index provides insight into their relative performance when DIFF is significantly stretched from its trendline. Since DIFF has not reached the upper channel, SPX may continue to outperform MLHY, but not by much if history serves as a guide. Although high-yield bonds are yielding less than 4% (low by historical standards), they may offer a better bang for the buck in the coming months. Lastly, I recommend increasing equity exposure if and when DIFF ever falls to the lower channel again, likely after a sizable correction.

To learn more about Joon Choi, please visit Signalalert Asset Management.