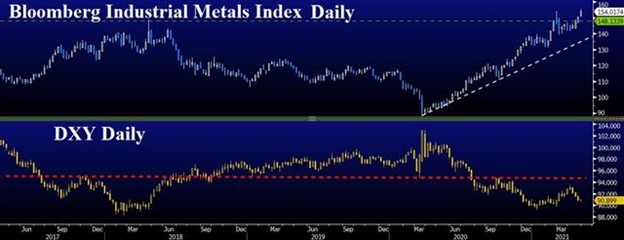

If copper has a doctorate in economics, then the prognosis is very good; it hit a 10-year high on Monday, says Adam Button of ForexLive.com.

Equally notable is Aussie's underperformance this month. US consumer confidence beat expectations in April. CHF and GBP are the only gainers vs. USD in late European trading. Our group was told to reduce USD exposure ahead of Wednesday's FOMC and we picked a non-USD cross as a preferred pair for long positions.

Copper has consolidated for the past eight weeks but broke out on Monday, hitting the best levels since 2011. The climb comes on widespread speculation of looming supply shortages as government spending and private demand jump following the pandemic. If copper can rally another 8%, it will clear the 2010 high and rise into technical blue skies.

There is little debate that the global economy will be strong over the next year, it's more of a question of how strong and how sustainable it will be. Followed by questions about inflation.

Monday's US durable goods report was soft with non-defense capital goods orders excluding aircraft up 0.9% compared to 1.8% expected. Despite that, overall orders have risen in 10 of the past 11 months and commentary from manufacturing surveys has been almost universally upbeat.

Ultimately, it will be consumers and how willing they are to spend pent-up savings (and new housing wealth) that determines the length and strength of the expansion.

Learn more about Adam Button by visiting ForexLive.com.