Covered-call writers and sellers of cash-secured puts know the importance of portfolio diversification. If one security under-performs, the others can compensate, states Alan Ellman of The Blue Collar Investor.

This article will demonstrate how to craft a portfolio of large-cap tech and blue-chip companies for our option-selling strategies.

Strategy Goals

- Portfolio mix of blue-chip and technology companies

- User-friendly system

- Broad diversification

- Initial one-month time-value return goal range of 1%-3%

Large-Cap Technology Companies

We will use the Invesco QQQ Trust (QQQ), which consists of 100 of the largest non-financial companies listed on the Nasdaq exchange (MSFT, AAPL, AMZN, FB, INTC, etc.). One security will represent a broad diversification of quality technology companies.

Blue-Chip Companies

We will use the best-performing Select Sector SPDRs, which divide the S&P 500 into 11 sector index funds that each trade as stocks:

- Consumer Discretionary (XLY)

- Consumer Staples (XLP)

- Energy (XLE)

- Financials (XLF)

- Health Care (XLV)

- Industrials (XLI)

- Materials (XLB)

- Real Estate (XLRE)

- Technology (XLK)

- Utilities (XLU)

- Communications (XLC)

Evaluating the Price Performance of Our Securities

We can create a comparison chart for QQQ vs. the S&P 500 in one-month and three-month time frames and check the Select Sector SPDR Tracker also for one- and three-month price performance (as of June 2020):

QQQ and Select Sector SPDRs Price Performances

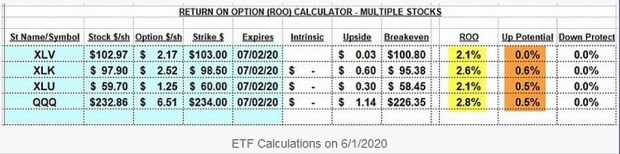

Real-Life Calculations with a 1%-3% Monthly Initial Time-Value Return Goal Range

Using a portfolio consisting of QQQ, XLK, XLU and XLV, the multiple tab of the Ellman Calculator shows an average one-month initial time-value return of 2.4% (yellow field) with an additional upside potential component of 0.4% (brown field):

Covered Call Writing Calculations

Discussion

A practical way of selecting blue-chip S&P 500 stocks is by locating the top-performing Select Sector SPDRs. Similarly, a time-efficient way of incorporating tech companies into our option-selling portfolios is by using the Qs. An initial one-month time-value return goal range of 1%-3% is reasonable using slightly out-of-the-money strikes.

Learn more about Alan Ellman on the Blue Collar Investor Website.