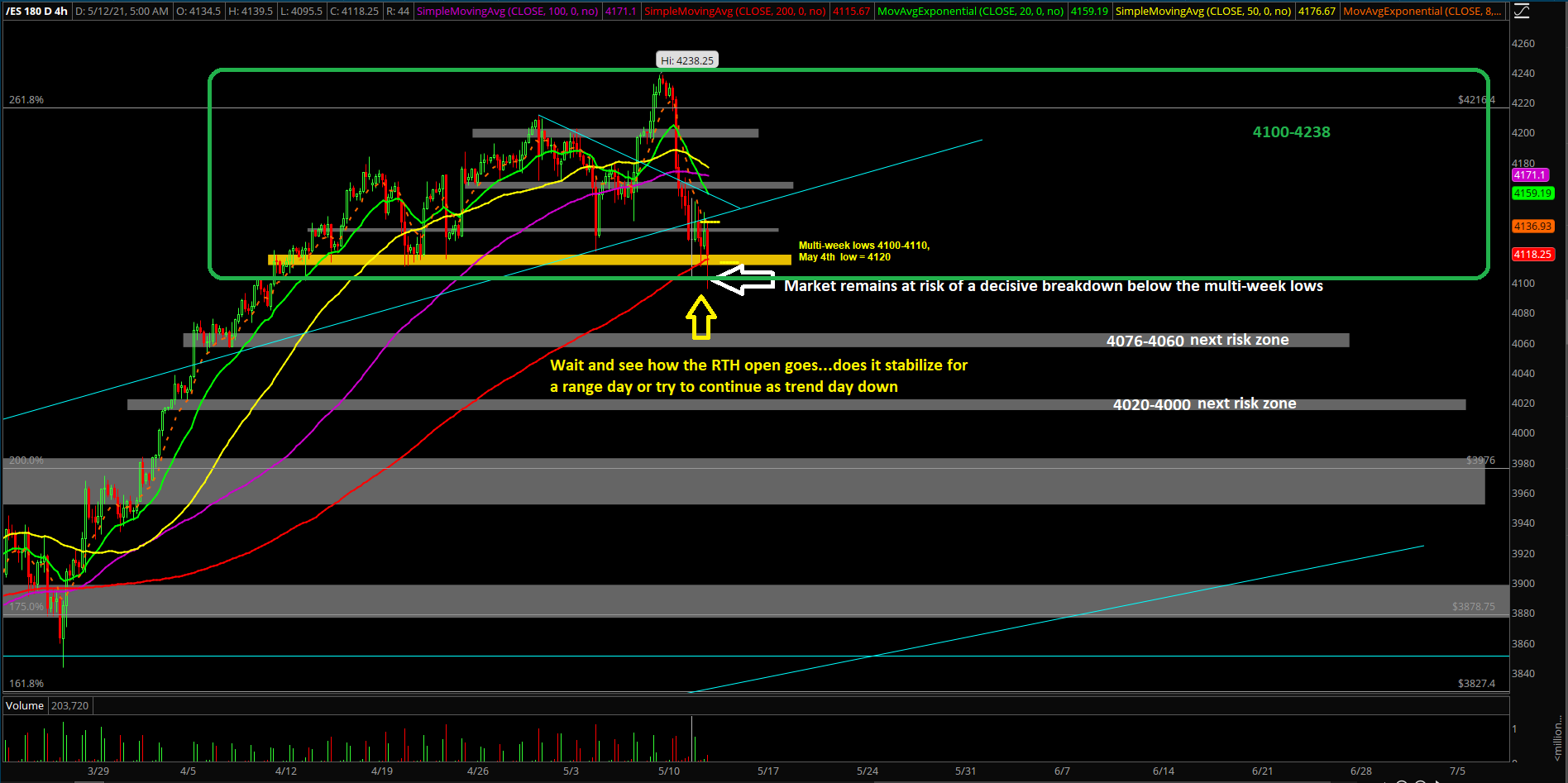

The E-mini S&P 500 closed earlier this week around 4140 with a little "stick save" from the intraday 4103.75 low. However, price action remained weak with a new nominal lower low, reports Ricky Wen of ElliottWaveTrader.net.

In addition, we need to see after the regular trading hours open, whether the multi-week 4100-4110 low area keeps holding or we open up 4075-4060, then 4025-4000 as next downside risk zones.

We maintain neutral mode on ES as the market is in the middle of a short-term trend change battle, while Nasdaq 100 and Russell 2000 futures could be classified as short-term bearish already given the May 10th breakdown.

Bulls would need to reclaim 4185 to stabilize this on a daily chart timeframe, followed by 4200.

Remember, trend change battles are one of the toughest environments to trade in, as it’s a shift of strategies so traders should strike when there’s a setup and then manage your overall risk and expectations. Whipsaw back and forth until a true winner appears is the name of the game.

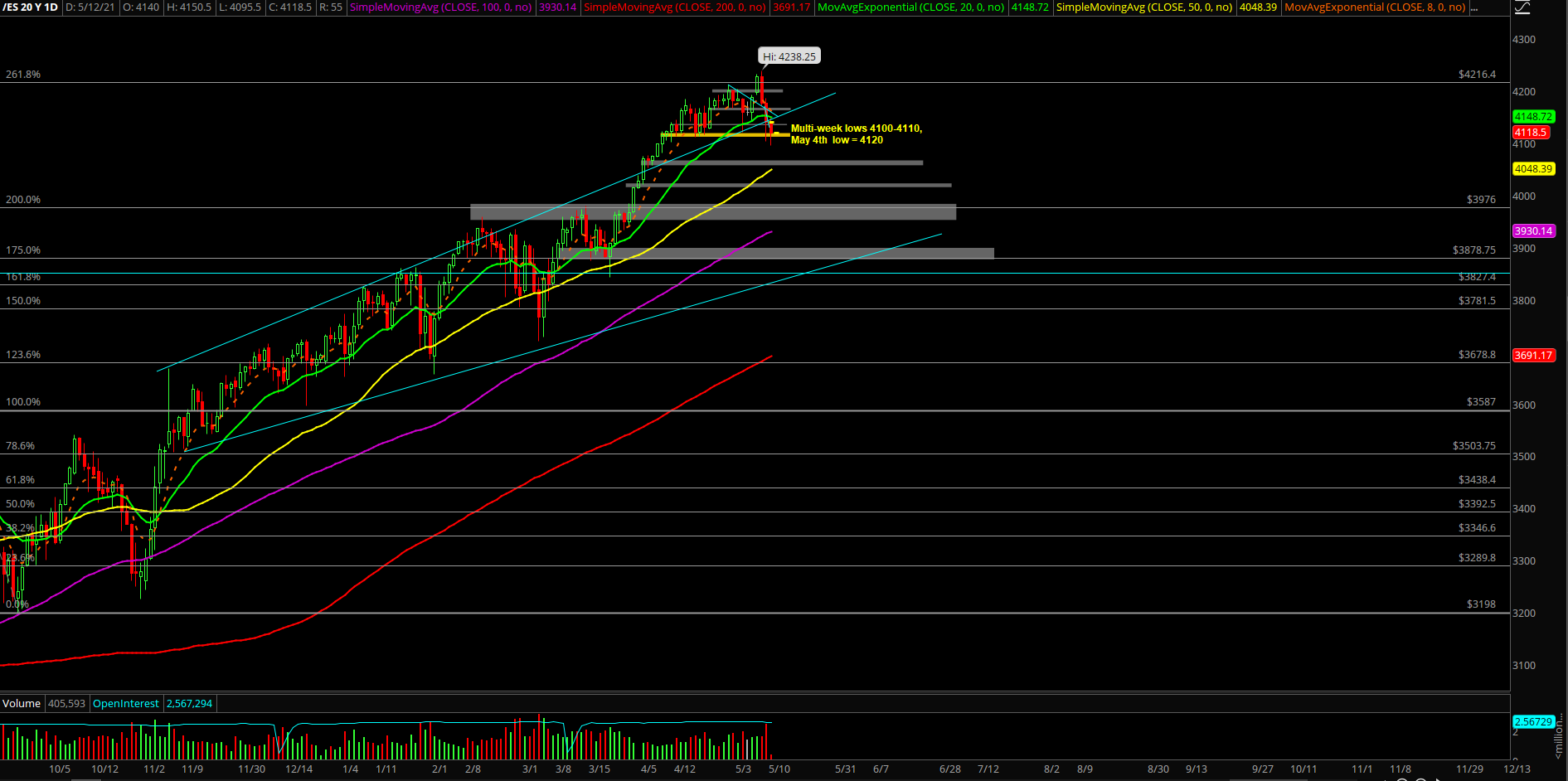

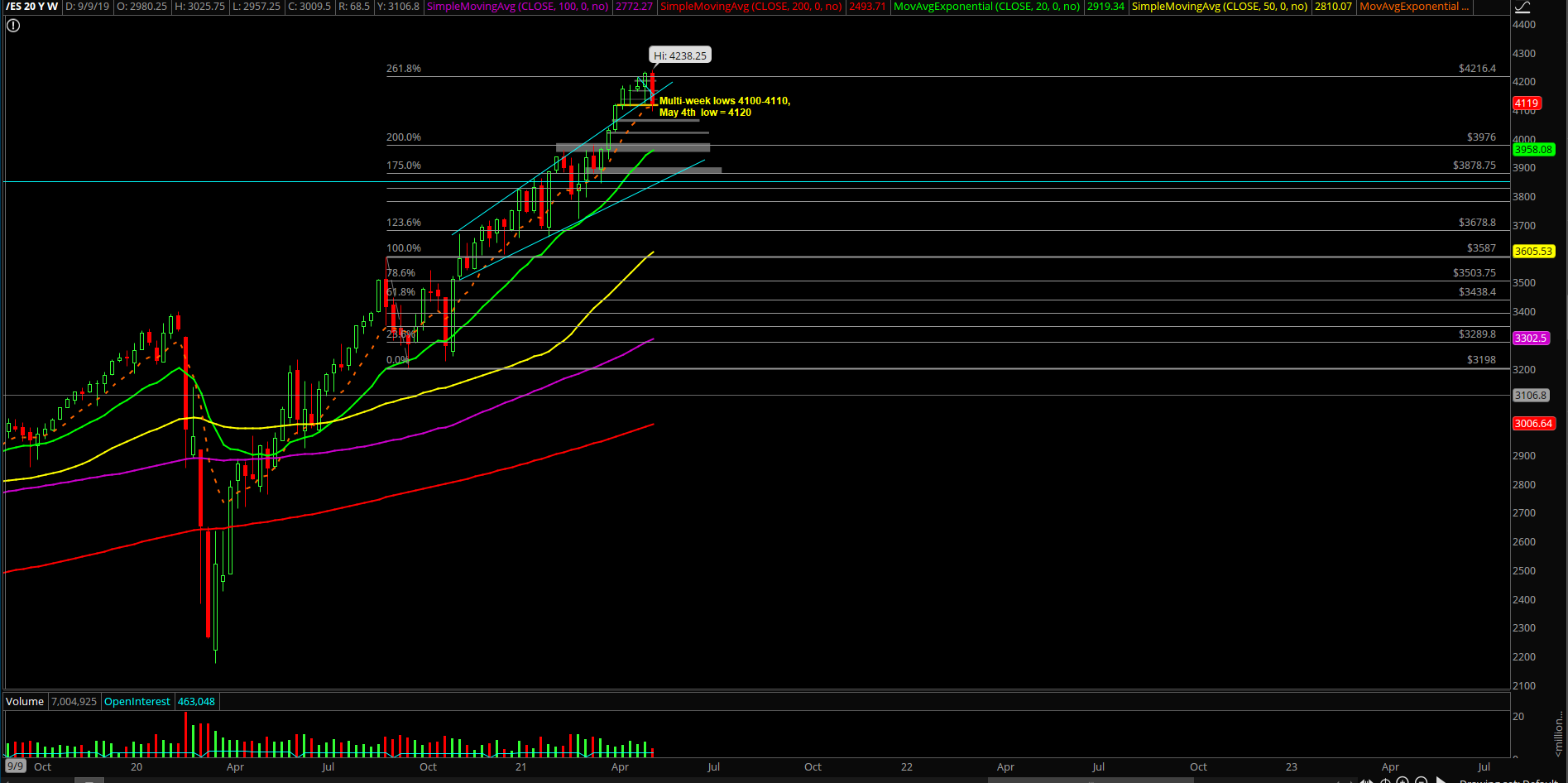

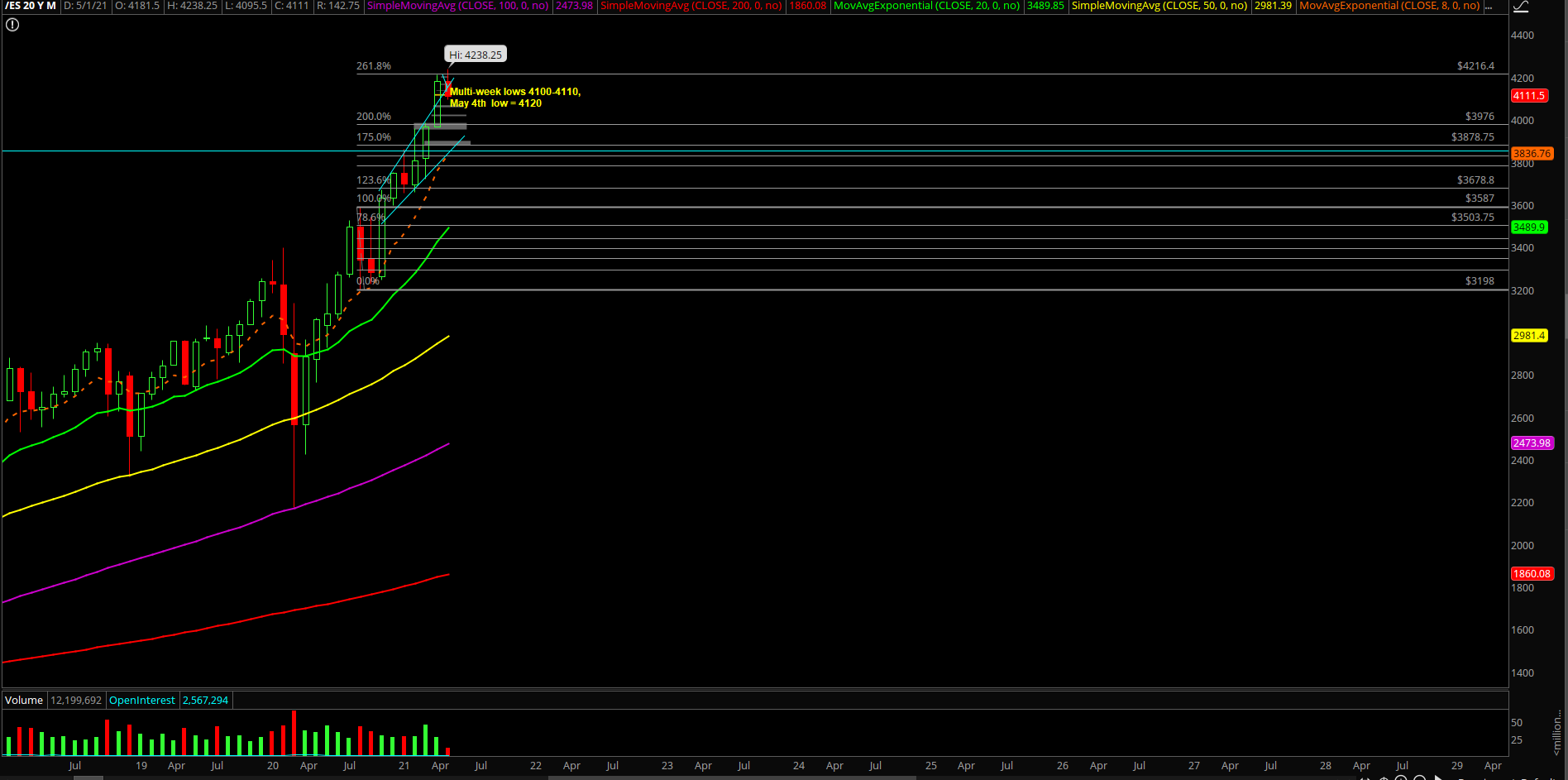

If you recall: The current structure and context of this bull train is that the daily price action has been trending above the daily 20EMA since the first week of March.

Then, this trend accelerated on April 1st when the price action broke above the multi-week resistance of 3950s-3970s, which propelled the bull train to ride on top of the daily 8EMA for an entire month now until the May 4th breakdown into more significant support confluence.

The "sh*t hits the fan" (SHTF) level has moved up to 3965 from 3650. A daily closing print below 3965 is needed in order to confirm a temp top setup/reversal for the daily and weekly timeframe. A break below 3965 would be a strong indication of weakness given the multi-week trend of being above the daily 20EMA train tracks.

Ricky Wen is an analyst at ElliottWaveTrader.net, where he hosts the ES Trade Alerts premium subscription services.