If you’re wondering whether to trade options vs. stocks, then this article is for you, states, Markus Heitkoetter of Rockwell Trading.

There’s no simple answer for that question, because it depends on how much money you have and your risk tolerance level. This post will cover the seven topics that you need to know to answer the question “Is Options Trading Better Than Stocks?”

1. What Is the Difference Between Buying Stocks and Buying Options?

Let’s keep it simple. When you buy a stock, you then own a share of the company and get paid dividends. Buying options, on the other hand, means that you only have the right to buy or sell a stock at a specific price before the option expires. But you don’t own the stock (yet).

As you will see in a few moments, options trading requires much less capital than buying a stock, and therefore it’s very attractive. It can be very confusing, so my goal is to make it simple for you.

Let’s start with an example.

2. Which Is Better: To Buy a Call Option on a Stock or to Buy a Stock?

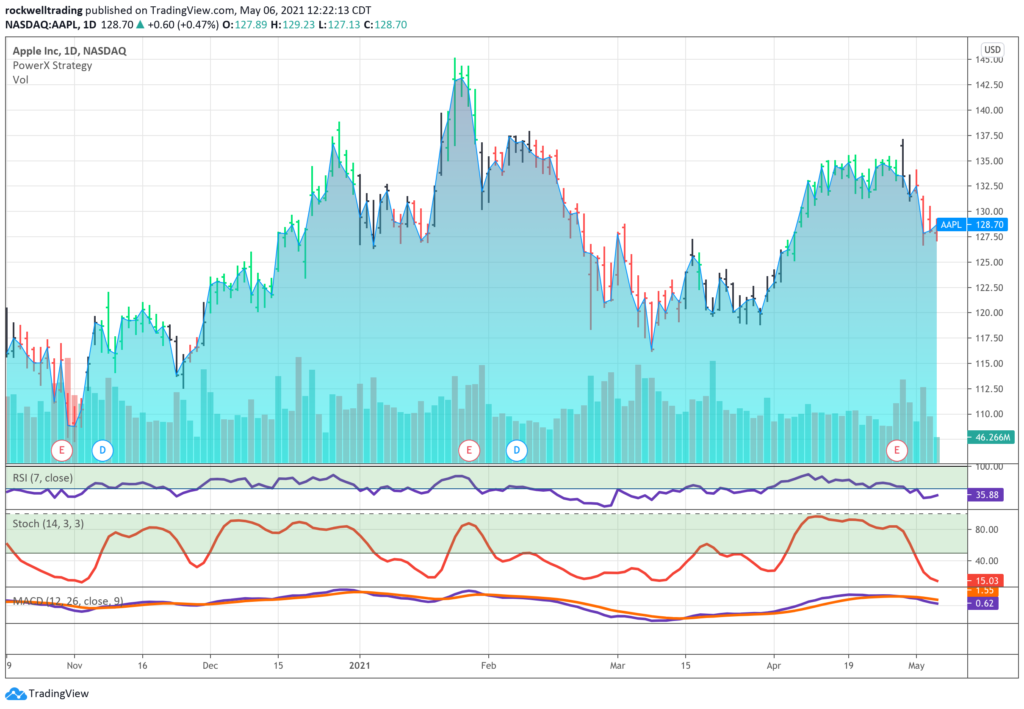

Let’s use Apple (AAPL) as an example. Right now, the market price of AAPL is 128.70.

Let’s assume you’re bullish on Apple and expect AAPL to go higher. You could buy 100 shares of AAPL, but this would come with a high price:

100 shares * $128.70 per share = $12,870

If you have a small account, this might be too high of an investment. The good news: You can trade options instead. When you buy a CALL option, you have the right to buy 100 shares of AAPL at a set price (the strike price) on or before the expiration date of the option.

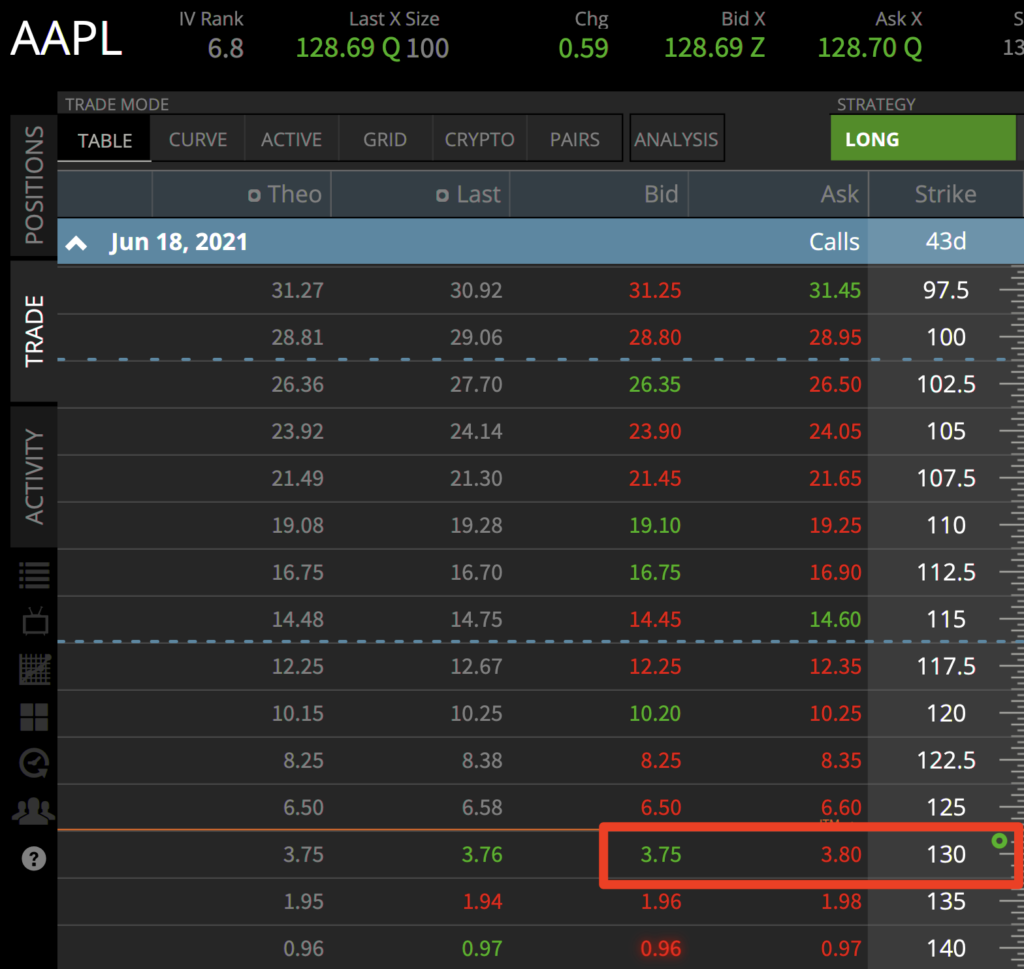

Let’s take a look at an options chain:

You could buy a call option that expires on June 18. Today is May 6 (at the time of writing this), so you have 43 days before this option expires worthless. The price of the option is $3.75.

Options come in “100 packs,” so your investment to buy this call option is only $3.75 * 100 = $375.

Why buy options instead of stocks? First of all, it’s much cheaper. Compared to the investment of $12,807 to buy 100 shares, that’s only 3% of the money that’s required. And because of that, options are more profitable than stocks.

Let me explain.

3. Are Options More Profitable Than Stocks?

Since you are bullish on AAPL, you expect the stock to go up. Let’s say that over the next few weeks the stock goes to 140.

Let’s take a look at the profits from your stocks first. You bought 100 shares of AAPL at a price of $128.70 per share. Now each share is worth $140. Your profit is $140—$128.70 = $11.30 per share * 100 shares = $1,130.

Based on your investment of $12,870, that’s 8.8% return on investment (ROI). That’s not bad, but let’s take a look at the call option.

How Are Options More Profitable Than Stocks?

The call option that you bought gives you the right to BUY 100 shares of AAPL for $130 before June 18. If AAPL shares move up to $140, you can buy 100 shares of AAPL at $130 and sell them immediately at $140. This means that your profit per share is $140—$130 = $10. And since you are trading 100 shares, your profit would be $1,000.

But keep in mind: You paid $375 for the right to do this, so you need to subtract this from your profits:

$1000 - $375 = $625.

Your total profit is $625. Doesn’t sound like much, but based on your $375 investment, that’s a 167% return on investment (ROI).

In Summary:

You made more money in terms of absolute dollars on the stock ($1,130 vs. $625), but the money you needed to make this profit was much less: $375 vs. $12,870.

And that’s why your ROI is 167% when trading the option vs. 8.8% when trading the stock—even though the stock price is exactly the same. Pretty cool, huh?

4. How Much Money Do You Need for Options Trading?

As you can see from the previous example, you need MUCH less money when trading options vs. trading stocks. When trading options, you can get started with as little as $2,000.

Check with your broker about the minimum requirements to open an options trading account. If you have a smaller account, trading options might be much better for you than stock trading.

5. Can You Lose Money Trading Options?

Let’s talk about the risks of options trading, specifically the question “Can you lose money trading options?” The answer: YES, of course!

In the example above you could lose the premium you paid for the option, i.e. $375, if the stock price does not move above the strike price of $130.

If AAPL remains below $130 until the expiration date of June 18, your option expires worthless. And here’s why:

With a call option, you have the right to BUY 100 shares of AAPL for $130.

If AAPL is trading below $130, let’s say at $128, you don’t want to exercise your right to buy AAPL at $130. Because then you would pay MORE for the stock than you would if you bought it right away.

Making sense?

So if AAPL stays below $130 until expiration, your option expires worthless and you lose the premium you paid for the right to buy the stock.

Can You Lose More Than You Invest in Options?

When you are BUYING options, you cannot lose more than the premium that you pay when buying options. So that’s good. However, when you are SELLING options, that’s a different story, and we will cover that later.

In summary: When BUYING options, the maximum amount that you could lose is the premium you pay when buying the option.

6. What Are the Risks Of Options Trading?

YES, there are risks when trading options:

a) Selling Options Can Be Dangerous.

As you have seen, when BUYING options your risk is limited to the premium you pay when buying the option. However, as a seller, there’s a lot more risk. In some cases, you can have UNLIMITED risk.

We will cover this in detail in a later article.

b) Buying Out of The Money Options.

Risky before the probabilities are low.

c) Know What You’re Doing

When trading options, there are a few more things to consider:

- Call Options vs. Put Options

- Strike Prices

- Expiration Dates

… and then there are also these pesky “Greeks” like delta, gamma, theta, rho, etc.

And when you have more things to consider, there are more possibilities to make mistakes.

Make sure that you understand all these factors before you start trading options. We will talk about “The Greeks” later.

Are Options Riskier Than Stocks?

YES, because it’s easier to lose ALL of your investment.

Let’s continue our example from above:

Trading Stocks

You bought AAPL at $128.70 per share. If AAPL drops to $125, then you would lose $3.70 per share, or $370 for 100 shares. Based on your initial investment, that’s only 2.9%.

Trading Options

You bought the 130 call option for $3.75. If AAPL doesn’t move above $130, you lose ALL of your investment, i.e. 100%.

Yes, the investment is much lower, but instead of losing 2.9% as you would when trading stocks, you would lose 100%.

Selling Options

And when selling options, you can lose A LOT of money. Selling options can be very profitable. In fact, I made more than $75,000 in less than five months selling options…

… BUT it’s also very risky.

Compare options vs. stocks like riding a bicycle and riding a motorcycle. Riding a motorcycle gets you to your destination quicker, and it can be more fun. But it’s also much riskier than riding a bicycle.

7. Can You Really Make Money Trading Options?

Absolutely! There are many advantages to trading options, and it is possible to make money with options.

Is There a Safe Way to Trade Options?

You need to know what you are doing, and you need to have a solid trading strategy. Find a strategy that you understand and then practice it on a simulator. And when you are ready, start making money with it.

Can Option Trading Make You Rich?

When trading options, you will often see returns of 167%, 200%, or even 300%. Therefore, it’s easy to believe that options trading can make you rich. But keep in mind: With these high returns comes high risk.

Yes, you can make 200% or 300% when trading options. And you can lose ALL your investment, as you have seen above. Don’t think of options trading as a “get-rich-quick-scheme.”

But when used correctly, options trading is perfect to grow a small account into a bigger one.

Summary: Should I Trade Options

YES!

Should I Trade Stocks or Options?

Why not do both? Best of both worlds!

Is Options Trading Worth It?

YES! It can be very rewarding! As we just covered with trading options, there are many, many advantages. If you are not trading options yet, I highly recommend that you start looking into them.

Learn more about Markus Heitkoetter at Rockwell Trading.