Stocks continued to push higher, towards the all-time highs at 4238, states Larry McMillan of Option Strategist.

The pace of the advance has slowed, but there has been some improvement in the internal indicators that paints a more bullish picture in that regard than we've seen in some time. However, if resistance at the old highs holds, then there is a distinct possibility of a retest of the lows of this trading range, at 4060. A move to new highs or a drop below 4060 should propel a stronger move in the same direction as the breakout.

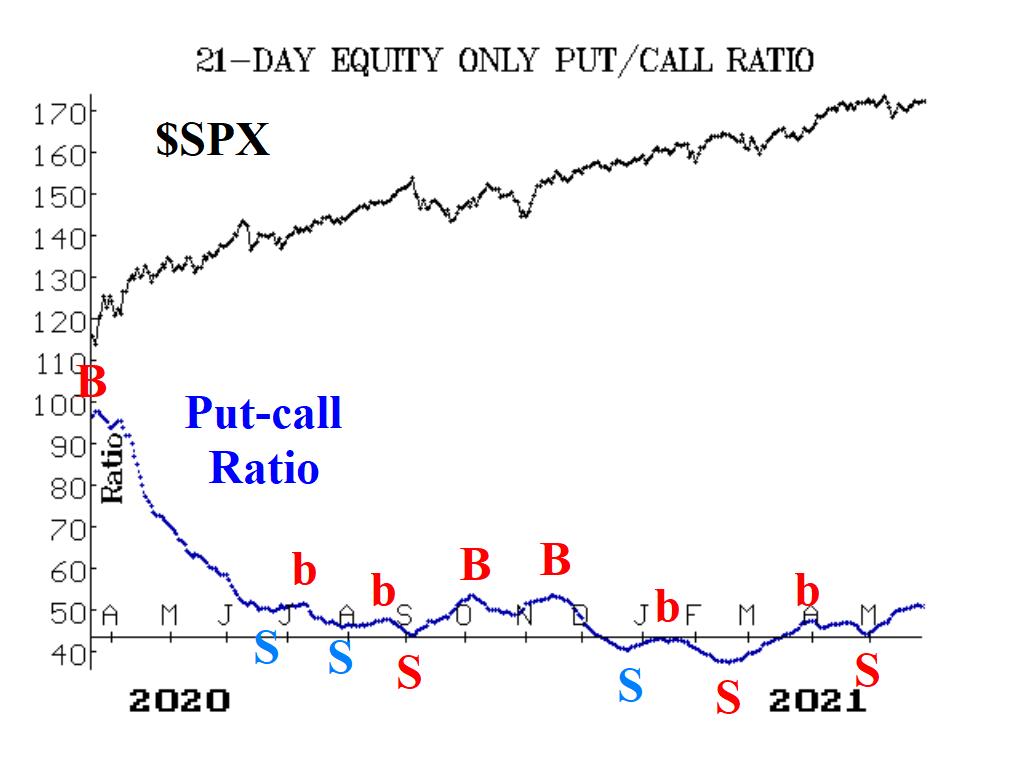

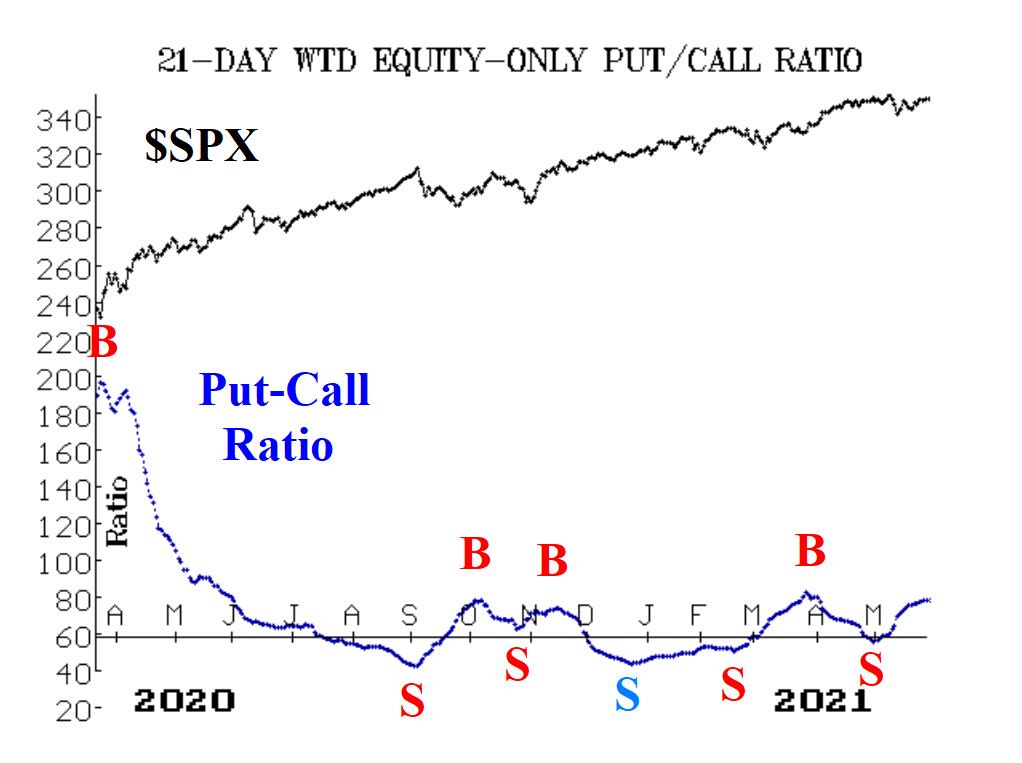

Equity-only put-call ratios continue to rise and thus remain on sell signals. The pace of that rise has slowed, though, as heavy call buying in the last couple of days has put some pressure on this sell signal, but it has not reversed.

Breadth has been very strong for the last two days, so the breadth oscillators are on buy signals, and they are moving more deeply into overbought territory now.

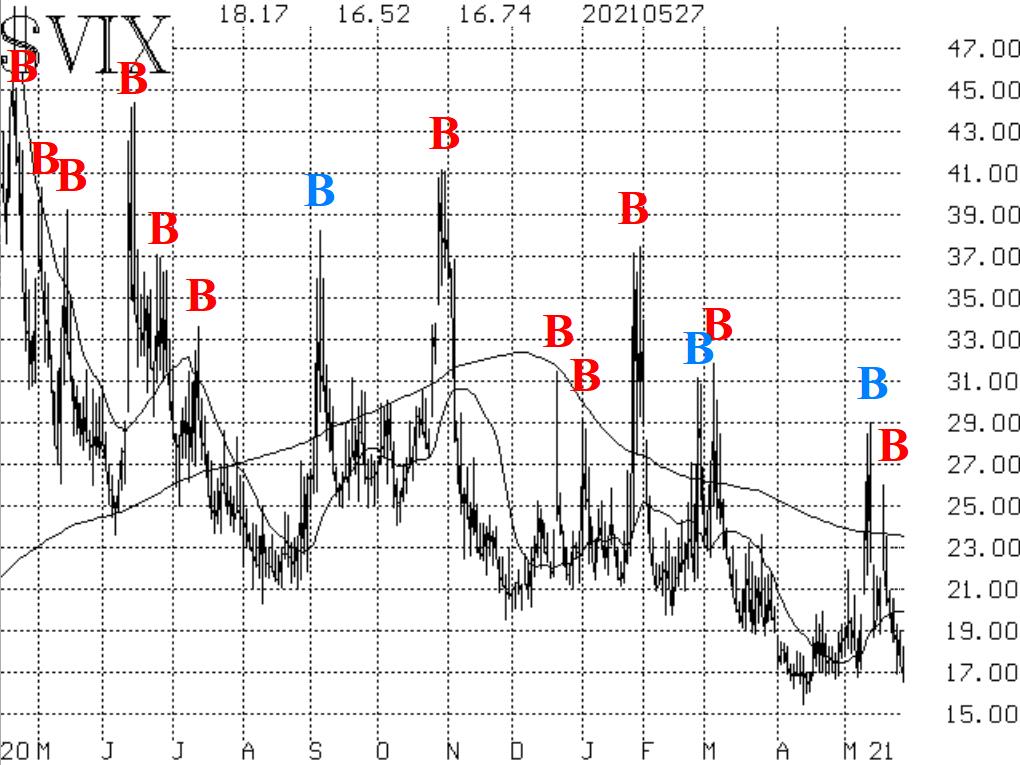

Volatility, as an indicator, remains bullish for the stock market. The latest CBOE SPX Volatility Index (VIX) "spike peak" buy signal, which came right on the heels of the previous one, remains in effect. Furthermore, the trend of VIX is downward again, as it is probing the recent lows near 17.

In summary, there are still some conflicting signals (confirmed buys and sells) as S&P 500 (SPX) deals with the fact that it's still in a trading range. A breakout above the top of the range would be very bullish. However, there is still the possibility that the resistance at or just above current levels will hold. We continue to wait for SPX to break out of this 4060-4238 trading range.

To learn more about Larry McMillan, please visit Option Strategist.