Realized volatility on E-Minis of the Nasdaq index (as measured by ATR%) has been on a crazy roller coaster ride recently, explains Ian Murphy of MurphyTrading.com.

When the regular stock market session opens at 9:30 am ET, volatility jumps but settles down again after the close at 4:00 pm ET. Yesterday’s session was particularly volatile hitting both 3ATR lines on a 30 min chart (circle), but then it flatlined again overnight, as if nothing happened.

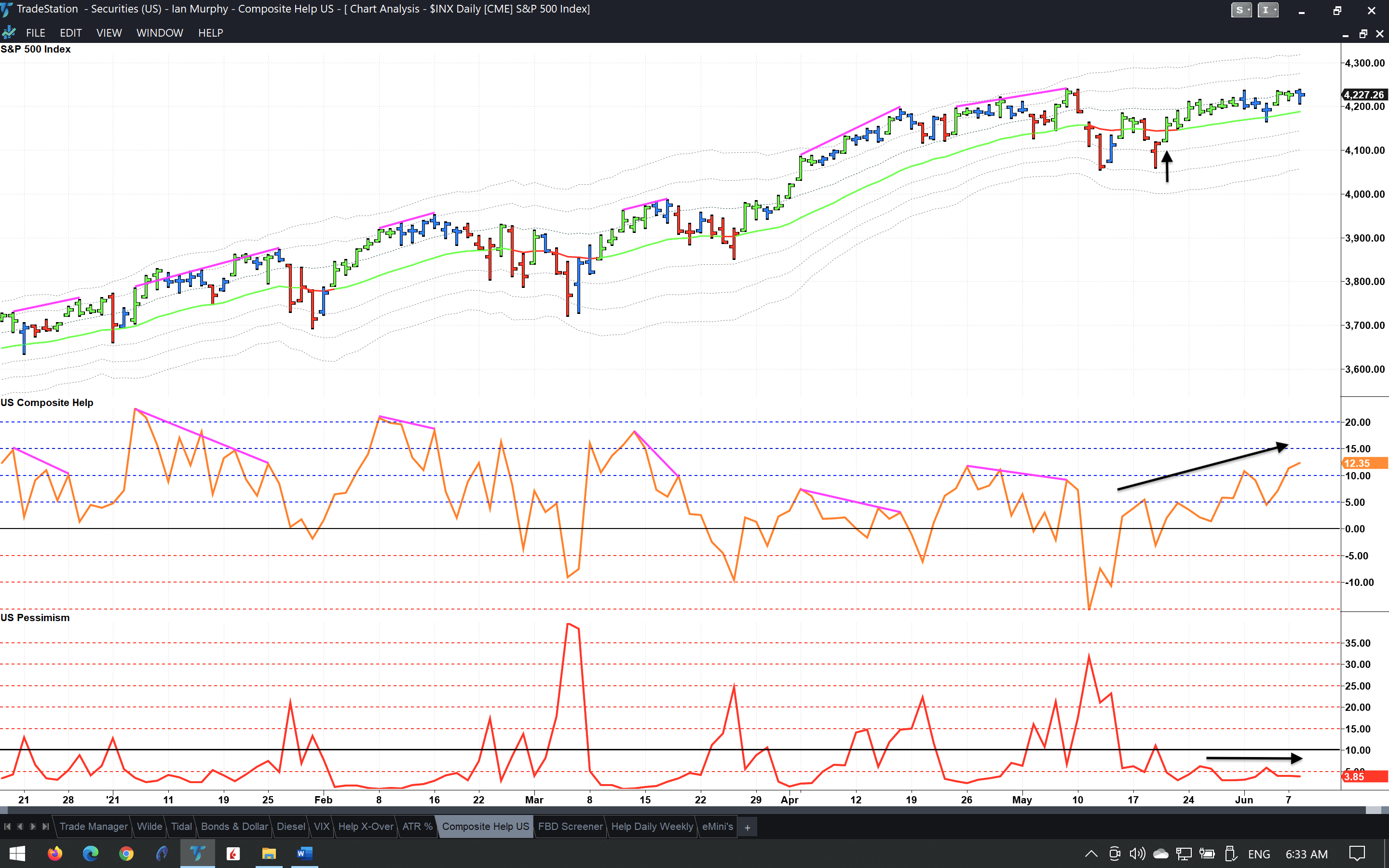

Meanwhile, the broader-based S&P 500 (SPX) is like a spoiled child who stubbornly refuses to close above the 1ATR line. Since the reversal bar on May 20 (arrow), thirteen sessions have passed but the index has gained only 1.63% and still has not crossed the line. However, the EMA is green and pointing up, pessimism is low and flat, and composite is rising (arrows).

So, what to make of all that? The market is technically bullish but very anxious. Look at the price bars above, they are short and unsure, frequently closing lower coming into the close. Not a single tall confident striding bar among them. It would take very little to spook this market.

Learn more about Ian Murphy at MurphyTrading.com.