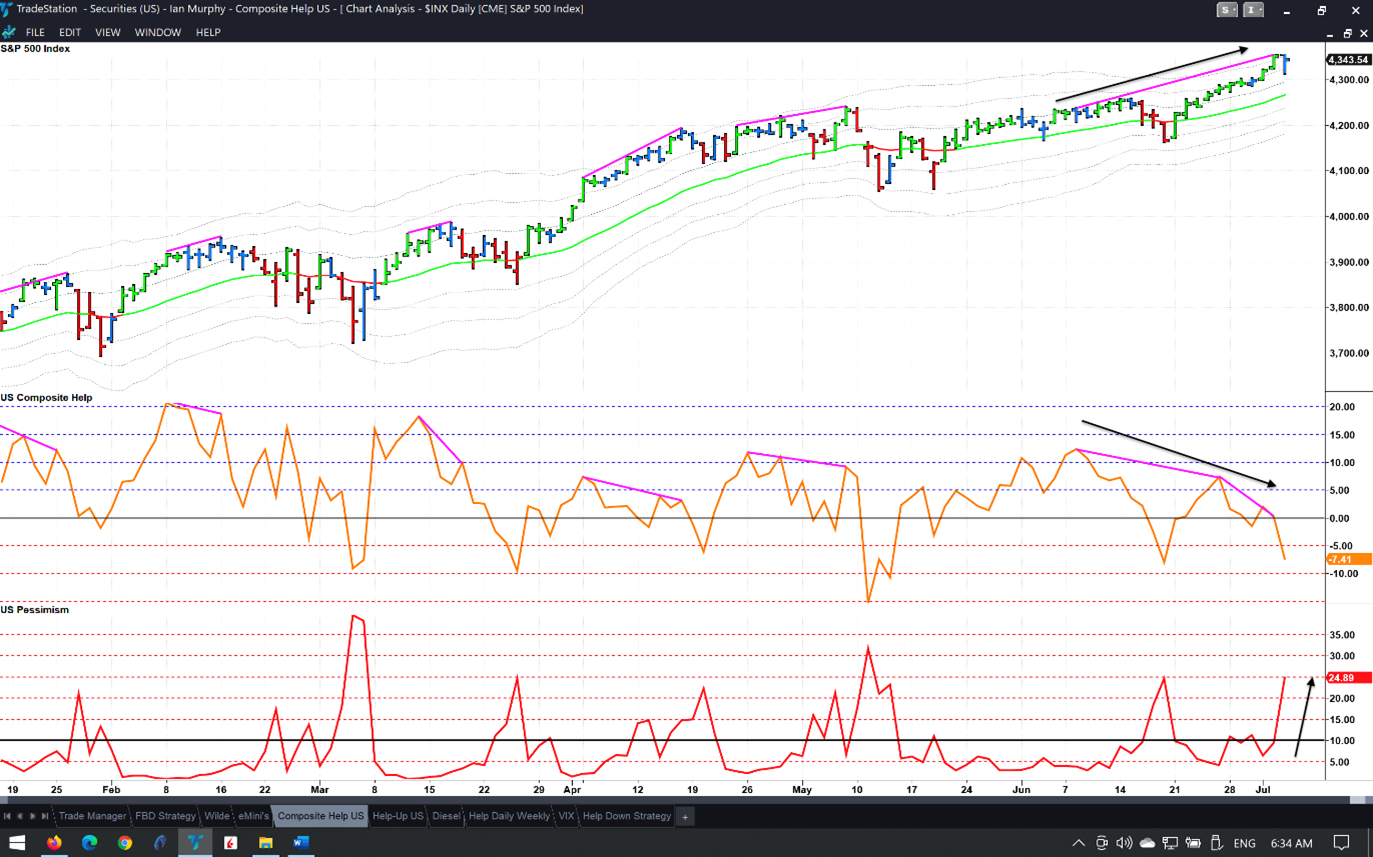

Earlier we observed how divergences eventually bear fruit and often in a dramatic way. Has the day arrived, asks Ian Murphy of MurphyTrading.com?

Composite plunged below zero yesterday and Pessimism shot up to almost 25%, meaning a quarter of all US stocks made a new 20-day low. The S&P 500 (SPX) was down 0.87% during the session but recovered much of the lost ground coming in to the close.

A selloff is not guaranteed at this point, but I would not open new long positions on the S&P 500 until this situation gets resolved, especially with the Fed minutes due today at 2:00 ET.

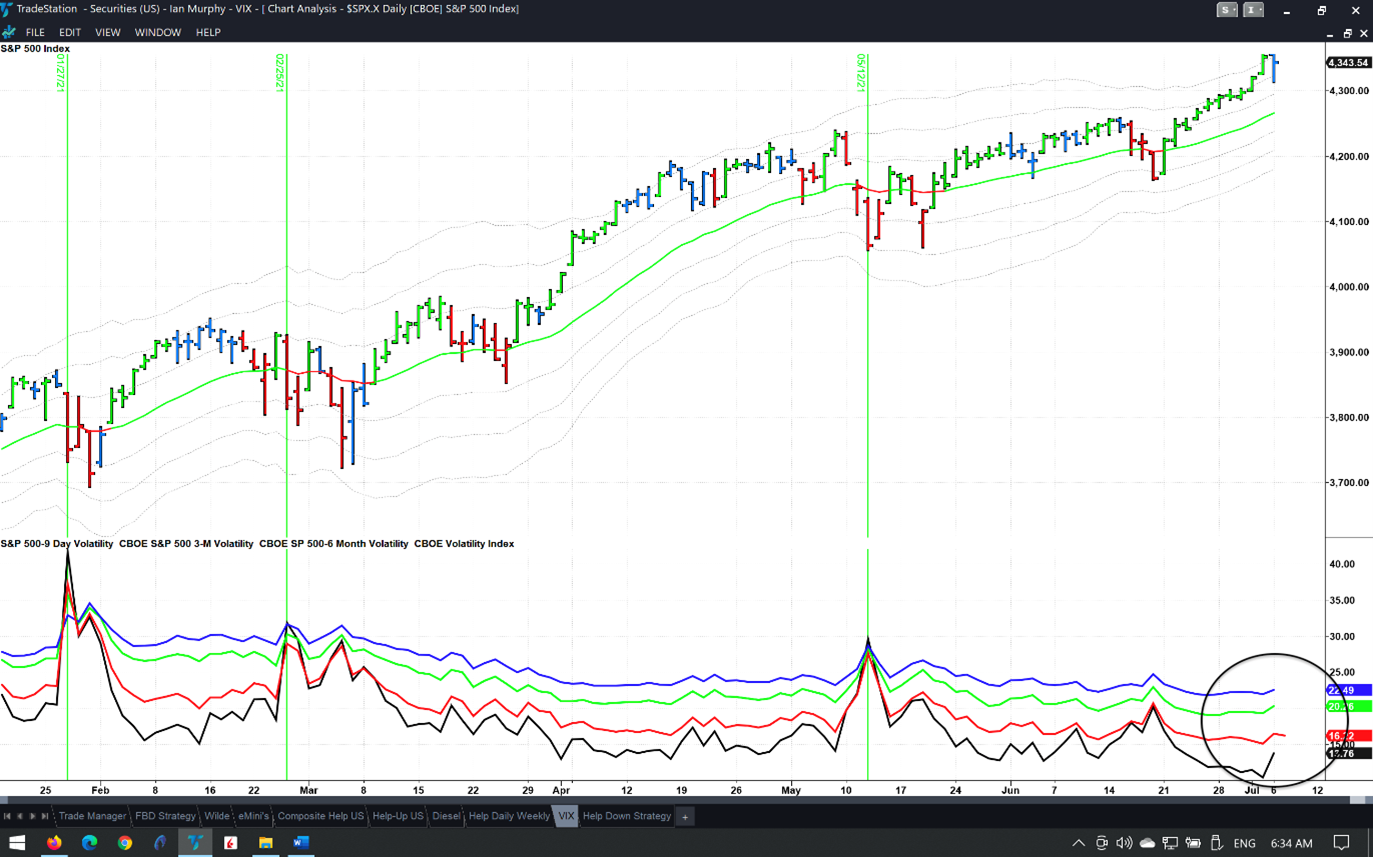

Surprisingly, volatility remains calm with just a little rise in the nine-day reading (black line). The commonly used 30-day VIX is still flat (red line).

Finally, the FBD Strategy has not triggered a new entry since this day last week, and I see this as an informal market internal indicator. If 1000 highly liquid stocks are unable to provide a single candidate which is bouncing off a lower low pattern, things are not bullish.

Editor's Note: If you want to go more in-depth into Ian Murphy's trading strategies, please join him at The MoneyShow Virtual Expo next week, July 13, 11:00 am - 1:00 pm. Register here.

Learn more about Ian Murphy at MurphyTrading.com.