Our covered-call writing and put-selling broker statements can be confusing when starting our option-selling careers, explains Alan Ellman of The Blue Collar Investor.

This article will detail the first three steps of our covered-call trades (stock purchase, option sale and buy-to-close limit order) using The Energy Select Sector SPDR Fund (XLE) as reflected in one of my broker accounts.

Purchase of Shares to Initiate a Covered Position

XLE: Buy 500 Shares

500 shares were bought at $43.74 per-share. This puts us in a “covered” or protected position…we know our cost-basis. The trade was entered as a market order, day-only trade.

Sell the Call Options to Complete the Initial Covered-Call Trade and Set the 20% BTC Limit Order

XLE: Sell Covered Call and Set BTC Limit Order

- 5 call contracts were sold at $1.06 and the order was filled

- Immediately, after entering the trade, a buy-to-close limit order was set at $0.20 (20% of $1.06)

- The last trade was set at GTC (good until cancelled) and is currently “open”

Portfolio Position After the Covered-Call Trade Is Executed

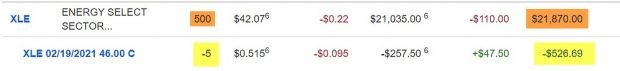

XLE: Portfolio Positions after Executing a Covered Call Trade

- 500 shares were purchased at a cost-basis of $21,870.00

- 5 call contracts were sold (negative, reflecting the short position)

- Total cash generated is $526.00 (also negative reflecting an open short sale)

- The $526.00 is cash in our brokerage account and available for trading

Discussion

Covered-call writing and put-selling are strategies that, once mastered, will allow us the opportunity to beat the market on a consistent basis. Understanding the accounting procedures of a broker statement is also critical to our overall success.

Learn more about Alan Ellman on the Blue Collar Investor Website.