Everything we have discussed about the market the past two months remains the same, says Steve Reitmeister, editor of Reitmeister Total Return.

That being the illusion of the conservative stocks in the S&P 500 making new highs as the overall market is actually in risk-off mode with most groups seeing stiff corrections. Unfortunately, that situation is unchanged.

Instead, let's turn our attention to Q2 earnings season because it is important to appreciate the early trends as we enter the heart of earnings season. This is especially true as nearly all our portfolio reports in the next couple weeks so we will want to be prepared for what is likely to come next.

Market Commentary

Long story short, this looks like another spectacular earnings season. Here are some of the key stats as gathered this morning by industry friend, Nick Raich of EarningsScout.com.

- In total, 152 companies in the index have now reported Q2 2021 results.

- 89% have exceeded their EPS estimates, on average, by +18.93%.

- Collectively, Q2 2021 EPS is up +102.85% over Q2 2020 for these 152 companies.

- 86% have topped sales estimates, on average, by +4.40%.

The above is pretty spectacular. Not just the percentage of companies beating estimates. But also, the magnitude of the beats on both the top and bottom line.

Then you have the notion that we have enjoyed a string of strong earnings seasons in a row. This leads to elevated expectations, which at times can be harder and harder to topple. So that makes the percentage and magnitude of the beats that much more impressive.

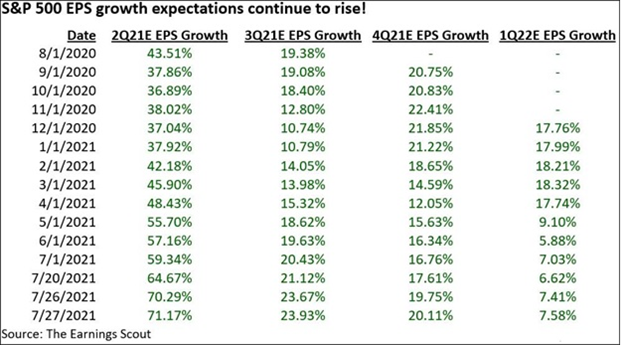

Now let’s look at the strength of this earnings season from another perspective. That is the change in EPS growth expectations for the S&P 500 over time. As you will see below that all year long estimates came higher for Q2. Yet as the actual reports came in the earnings growth projections rolled higher. Not just for this quarter, but for the next three quarters as well.

The sum total of above is that Wall Street expects the good times for earnings to continue. And since earnings growth is the main catalyst for share-price advances, then it bodes well for the future of this bull market. Thus, any notion that the recent pause in stock prices has to do with worries about the outlook for the economy or corporate earnings is complete nonsense.

And yes, these estimates are rolling higher even as the delta variant picks up speed with more cases popping up on a daily basis. Yet as I shared last week, I do not believe this will prove to change the mid-to-long-term trajectory of the economy or market. Here is that section again:

“I don’t believe the delta variant will truly hamper the economy to any significant degree. That is because the rate of vaccination in the US is very high. And really the main issue with delta is for those who have not been vaccinated. Thus, I expect this to lead more folks to get the vaccine.

Also, most state and local governments realize after the first go around with Covid, that the cost of shutdowns to society is far too high. This should make it easier to greatly limit shutdowns to the entire population when only a minority of them are affected. And thus, we do not have the makings worthy of a serious market sell off.”

All of this news foreshadows strong results for our 12 stocks set to report earnings this quarter. Almost all of that activity to take place between tomorrow morning and next week, Thursday, 8/5.

However, let me make something perfectly clear. NO ONE escapes earnings season totally unscathed. Even if you avoid the pain of an outright miss, you can still have stocks that don’t respond well to the report. Or analysts see glimpses that the future may not be as bright and estimates head lower crushing the stock price.

The point being that the POWR Ratings is a truly stellar tool to put the odds of earnings season in our favor. But even still you cannot expect perfection as typically 20-30% of the stocks will need to be jettisoned from the portfolio and replaced with stocks whose futures are brighter. Gladly if the other 70-80% outperform then you will enjoy results well ahead of the pack.

Normally I recount the details of the economic calendar as well. However, that is getting boring these days as it truly has been nearly a year since declining economic activity. Let’s simplify the discussion by saying all the reports the past week speak to economic growth.

The only event that deserves some conversation is the Fed’s rate decision. No, I do not expect them to raise rates just yet. However, they very well could start to change their language about inflation, which signals higher rates ahead. So, let’s keep a close eye on that event as it would have ripple effects for the market and some of our direct trades on rates.

Portfolio Update

As noted above, it is time to be on high alert for upcoming earnings reports for RTR positions. Here is the current calendar (some dates are estimates and not fully solidified. So consider this announcement dates semi-fluid).

7/28 b-VRTS, a-MKSI, ?-VALE

7/29 b-BC, b-GPI, b-SNDR

8/2 b-TKR, a-COLM, ?-NSP

8/4 a-KLIC

8/5 a-JCOM

8/31 ?-BBY

(b = before market open, a = after market close, ? = report details not available)

As stated above, the POWR Ratings gives us a strong advantage in being in fundamentally sound stocks that are much more likely to produce strong earnings results with share prices on the ascent. However, that is about putting the odds in our favor...certainly not a guarantee of success. Thus, I am prepared to quickly cut ties with any weaklings and replace them with healthier stocks.

Insperity (NSP): This continues to be one of my favorite stocks right now as there is no denying the improvement in the employment picture. Thus, was interesting to see NSP on the rise again yesterday even though the rest of the market was battered and bruised. Still believe $100 is in the cards before their August earnings report and hopefully higher after the announcement.

What to Do When the Chips Are Down? (KLIC & MKSI): Chip stocks were downright brutalized yesterday reminding us of the obvious...that semiconductors are one of the highest beta groups around. So, the thing to do when the chips are down is to first determine if they are down because of fundamental issues or sector rotation. If fundamentals have gone south...then time to sell as it usually only gets worse. But if the outlook is still strong, like it is now, and the selloff is just sector rotation nonsense, then you hold on expecting that high beta to work to your benefit with outsized gains on the way.

On top of that MKSI will be reporting earnings after hours on Thursday. Given that they haven’t had an earnings miss in over five years, then odds are in our favor that their announcement will impress with shares getting back in the black shortly.

Virtus Investment Partners (VRTS): This is our first company to report earnings this earnings season. Their earnings track record is not as spectacular as noted above for MKSI. However, 11 straight beats is still a pretty impressive claim. Hopefully that comes to our rescue getting shares finally on the march towards $300+ where it belongs.

Best Buy (BBY): Shares are looking good out of the gate and only a minor pullback yesterday. I bet shares are closer to $120 to $125 coming into their August earnings report given their history of strong results.

J2 Global (JCOM): You may be tired of me pointing out how much I love the price action on this stock because once again yesterday it wound up in the plus column. That was NOT an easy feat with all the red being applied to other stocks. Gladly the good times continues at 104% gain to date and rising.

Closing Comments

With so many earnings reports on the docket the next couple weeks we need to remain nimble to respond to results. If all good, then enjoy the gains as they roll in. However, if weak, then be ready to act if a trade alert comes your way.

Remember this is not my first time to the earnings rodeo. In fact, the strength of Zacks Investment Research, where I worked for nearly 20 years, is the analysis of earnings and how it effects share prices. I will certainly use that knowledge to our benefit in the weeks ahead to determine which stocks stay in the fold and which need to hit the bricks.

Learn more about Steve Reitmeister at StockNews.com