The OODA loop was designed by John Boyd for pilots to reduce accidents and crashes in the 50's and it is still used today, says Anne-Marie Baiynd of TheTradingBook.com.

The goal is simple—observe your environment before you choose a course of action. If used properly, it will confirm you are seeing markets the right way. For trading it means it is far better to be out of a trade you wish you were in than being in a trade you wish you were not.

Stay present and in the near term and pay attention to the players before you decide on a plan. BE PATIENT AND WAIT FOR YOUR PRICES TO COME TO YOU to give you the edge.

Whether you trade from a swing perspective, or intraday, your formations are the ones governing the charts—so use them.

Here's how to use this very powerful tool

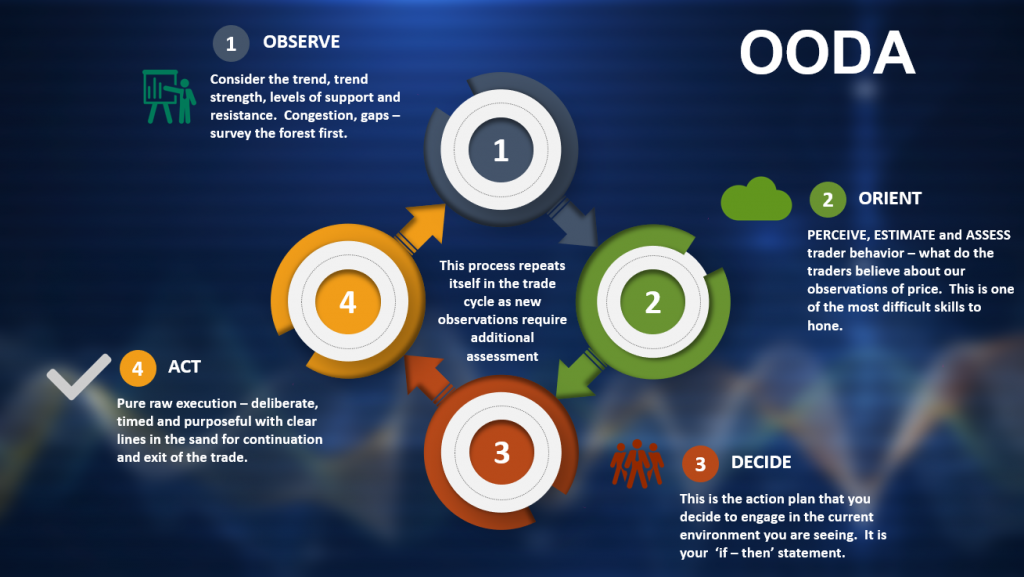

The OODA loop - OBSERVE, ORIENT, DECIDE, ACT

- What do you see?

- This means – is my trend in continuation or do I see signs of a reversal motion?

- Where were the buyers last engaged if they were value buyers?

- This means – is my price action far from the last region that value buyers engaged, or is it in that congestion?

- Where were the sellers last engaged if they were value sellers?

- This means – is my price action far from the last region that value sellers engaged, or is it in that congestion?

- Who won the last strategic price battle—buyers or sellers? This answers the big question of trend

- Have we tested significant levels of support or resistance? This answers the question of whether we are near a critical pivot

- What is the relative trend?

- This means – relative to the day at hand, who is forcing the most pressure on price? Look at your moving averages to tell you this

- Have you established risk relative to:

- 1) The last battle won and

- 2) The relative trend? This answers the question of how far you are away from strong support or strong resistance

PAY ATTENTION TO YOUR STOPS

Let the VWAP help you with the strength of pressure. The loss of the VWAP will force some selling action, and the breach above the VWAP that holds will bring buyers to attempt stronger positioning.

INTRADAY – Keep an eye on the daily resistance and support that we discussed and expect battles at these regions as buyers have a lot to prove to maintain bullish price flow on monthly formations—technical damage is present but likely to be repaired on this larger timeframe. BIG time frames will help you position with the wind at your back.

Deep dips remain staging grounds for buyers—quick strikes to support and back to resistance appear to be the highest probability for success today—dips could certainly get deeper and spikes could get higher as price action shifts.

Anne-Marie Baiynd is a full-time independent trader and can be found at TheTradingBook.com.