All eyes on Jackson Hole today as they expect Jerome Powell to indicate when the US central bank will reduce their large-scale purchasing of assets, exclaims Ian Murphy of MurphyTrading.com.

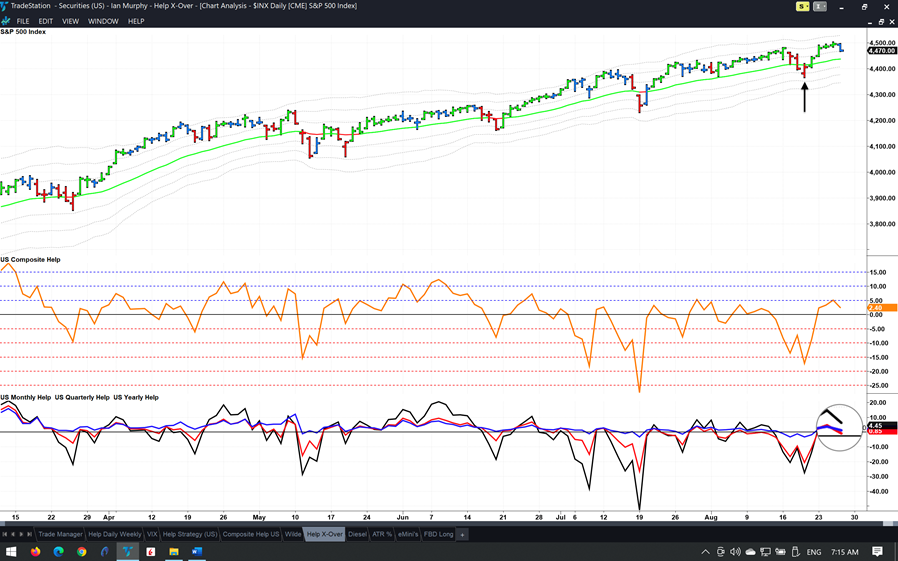

US equities as measured by the S&P 500 (SPX) climbed 2ATRs to the upside and made another new high since the close of the reversal bar last Thursday (arrow). Yesterday’s close was above the 1ATR line on a daily chart and all three Help indicators are above zero (circle), so these are two confirmations the bullish trend continues.

Numerous queries have come in about the GameStop (GME) trade which appeared on the FBD screener on August 9 and I highlighted in a note on August 13. Some traders closed out the position last Friday even though there was a positive price bar. They are now kicking themselves because the stock has gained over 40% and the initial protective stop was never violated (red dashed line).

On the other hand, clients who stuck with the trade are nicely in the money but unsure what to do next. Will they close the position and bank the profits, or stick with it in the hope for more to come?

First, let me commiserate with those who missed the opportunity, trust me I have been there! But don’t despair, there will be plenty more opportunities to come.

For those still in the trade, let’s not forget we should always have a plan on how to manage a position regardless of what happens, and how we will exit. If I was in this trade, I would have scaled out ⅔ of the position by now and be trailing a stop under the remaining ⅓. The stop is currently at $171.21 based on yesterday’s closing price.

Learn more about Ian Murphy at MurphyTrading.com.