Today we're trying to give you a complete angle of where Fed policy stands, the central bank's mandates of maximum employment, as well as inflation, and how it guides our decision making, states Bill Baruch of Blue Line Futures.

The latest episode of the Fed's series towards tapering took place in Jackson Hole, Wyoming. While Jay Powell wasn't physically present and presented the committee's latest thoughts via video, there are some additional insights we'd like to brief you on. We're facing a tale of two stories where 30 million workers were displaced within two months and output fell 2x of that in 2007-2009 while the recovery surpassed the prior peak in just four quarters' time.

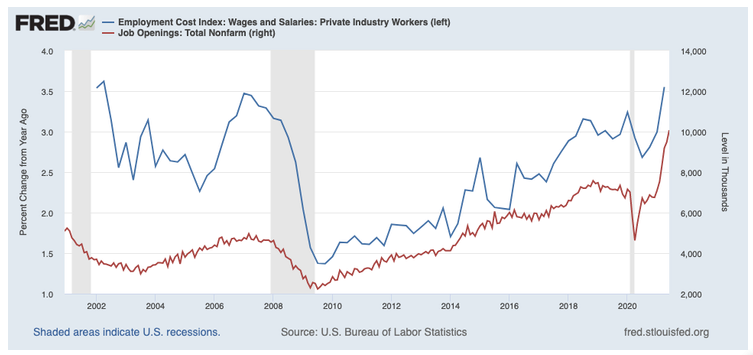

While the Fed acknowledges the natural lag of employment to economic output, its primary concern is the degree of unevenness in the recovery. 5/6 of the six million jobs gap compared to pre-pandemic levels remains in services and spending is at 7% below trend. In contrast, durable goods see spending running 20% above trend. The asymmetric recovery coincides with record job openings and quits as businesses around the country have a hard time finding staff.

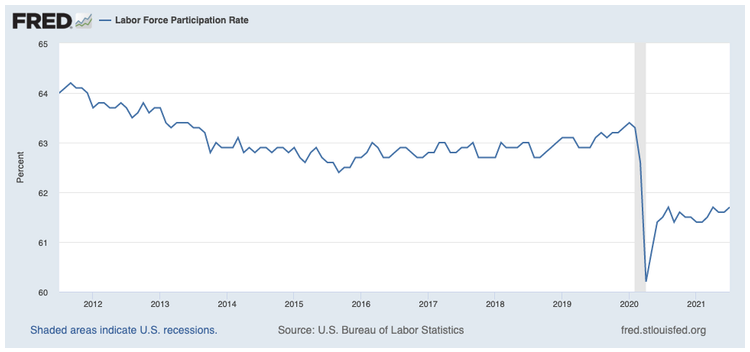

Despite the Fed's belief that favorable conditions for job seekers should lead to maximum employment, 5.4% unemployment is believed to overstate the degree of the jobs recovery. Additionally, weak labor participation/long-term employment have ways to go. Transitory was mentioned five times in Powell's speech, primarily informed by the idea of supply chain constraints and surprises in the recovery—the Fed deems those as "inevitable". Monetary policy makers point to five points when it comes to their transitory assessment:

- Broad-based inflation is absent; durable goods and energy prices have been contributing to personal consumption expenditures; computational effects overstate reported inflation

- Supply chain constraints in used cars causing a reverse in a quarter-century long trend of declining prices is temporary

- Wages are consistent with 2% inflation over time and while the Fed welcomes higher wages, a "wage-price spiral" is not desired

- Long-term inflation expectations have moved less than short-term fluctuations and remain anchored

- Globally present disinflationary forces such as technology have been in place since the 1990s and are expected to remain deflationary

One of the most interesting parts about Powell's Jackson Hole speech were thoughts on "Implications for Monetary Policy" where he covered the monetary landscape from 1950 into the 1980s.

Much of the dovish tone stems from the view that tightening early in a recovery—during a time where the labor market still faces slack—would spark a response that comes at a time when inflationary factors are already dissipating. Hence, the Fed prefers to stay patient for longer (particularly with interest rates.) At the same time, the central bank is determined to distinguish between transitory and more troubling factors as it pertains to the inflation framework.

Fed Chair Powell also noted "substantial further progress" on the inflation front and "clear progress" towards maximum employment. Taper, which is believed to set in some time this year, is again very distinct from interest rates and any change thereof!

On the other side of the dovish coin is a peak in dovish language when it comes to the Fed's communication.

As we have written about in prior Top Three Things, it will be upon the Fed to put stickier factors into consideration and determine what transitory means as a guide for monetary policy. Has the Fed missed the taper hole or is patience prudent?

As employers around the country have a hard time filling jobs, we will continue to monitor the Fed's commitment to maximum employment ahead of any interest rate raises and spillover effects into inflation metrics.

Long-term unemployment is at depressed levels. Some may argue the Fed is trying to solve issues that are beyond the scope of monetary policy, which may make substantial strides towards higher Fed Funds after tapering a challenge.

Nonfarm Payrolls are set to be released at 7:30 am CT on Friday:

- Nonfarm Payrolls exp. 728k (prev. 943k)

- Private Nonfarm Payrolls exp. 610k (prev. 703k)

- Unemployment rate exp. 5.2% (prev. 5.4%)

The degree to which employment comes back—especially in services—will be on everyone's radar.

After the last report where the BLS noted seasonal hiring distortions in education, any further comments will be taken notice of.

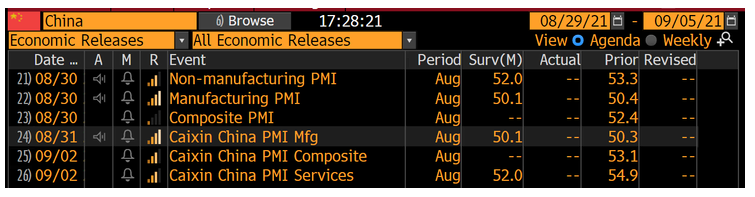

China PMI

Amidst harsh lockdown measures in China, leading to port congestions and supply chain issues across the globe, we're set for another slew of PMIs.

Will data contract below 50 or can Asia's primary economic force see through the country's zero-Covid policy as it pertains to managers' views on the state of the economy.

Covid-19 Closure at China's Ningbo Port Is Latest Snarl in Global Supply Chains

The developments in China are of particularly interest since companies, who try to outsource their manufacturing to Vietnam and elsewhere, have found a lack of engineering talent putting constraints on their supply chains.

Covid Slows Apple and Google Production Shift Away from China

We will continue to monitor the situation as Taiwan Semiconductors announced a price hike of 20% with components increasing in price by 40% QoQ.

Raw material production by country

Source:USGS

Note: Apple CEO Tim Cook noted high freight prices during Apple's last conference call but pointed to component prices going down. Is that set to change?

Food for Thought

On the back of Jay Powell's dovish tone out of Jackson Hole, it was risk-on Friday in stocks while dampened expectations caused 10-yr Treasury yields to settle at 1.30%.

We've pointed to the vast amount of Treasury issuance on the back of a future debt ceiling resolution in previous editions and we will continue to track markets in their entirety.

Gold settled above $1,800 as the metal thrives under stagflationary conditions, which Powell gave mere credence to on Friday.

The million-dollar question: Will a potential re-acceleration in economic growth or sticky inflation dominate the macro landscape going forward?

Dovishness from Jackson Hole and a Dollar Index below 93. It has been a tug of war and economic data in conjunction with monetary and fiscal policy will continue to dominate.

Earnings

Zoom (ZM) after the bell on Monday:

- Consensus: EPS est. $1.16; Revenue est. $990.96 mil

- We have the name on our radar as we watch Zoom as a proxy for the reopening and the extent to which behavioral changes persist

Crowdstrike (CRWD) after the bell on Tuesday:

- Consensuses: est. $0.13 EPS; Revenue est. $323.16 mil

- Cloud focus, can the company sustain a higher multiple against peers; guidance on our radar

Chewy (CHWY) after the bell on Wednesday:

- Consensus: EPS est. ($0.01); Revenue est. $2.20bn

- CAC and customer churn in focus; spending on customer acquisition

- Can the company guide favorable and retain a higher multiples against peers?

Learn more about Bill Baruch at Blue Line Futures.