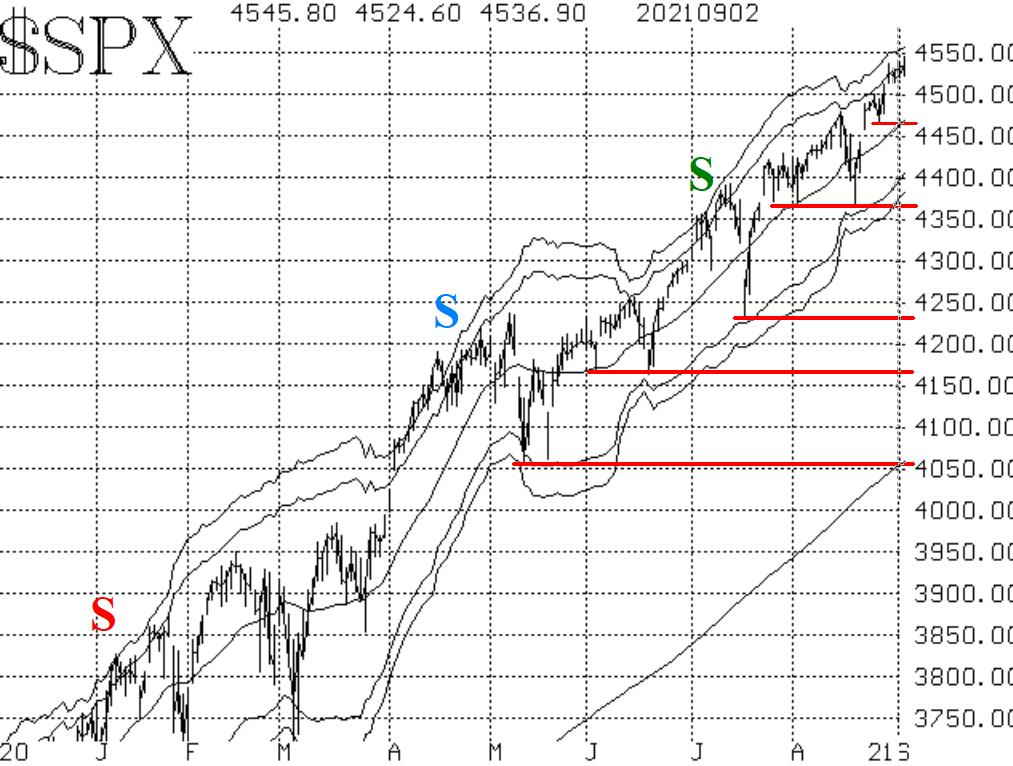

There is nothing unusual about this past week's market action. SPX continues to rise after the brief pullback on August 16-19, says Larry McMillan of Option Strategist.

The NASDAQ-100 (NDX; QQQ) is very strong as well and is making new all-time highs along with SPX almost daily.

The major support level for SPX is still 4370, although that is beginning to fade into the distance as the Index plows ahead. For now, we are still of the opinion that the SPX chart is bullish as long as support at 4370 has not been violated.

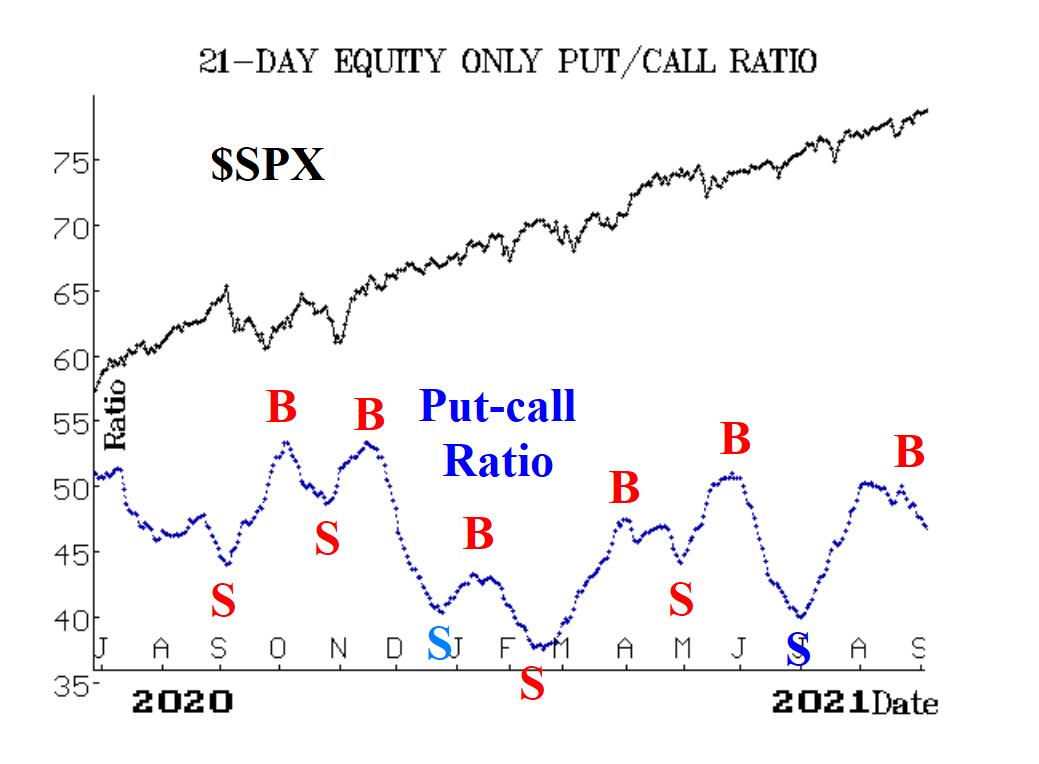

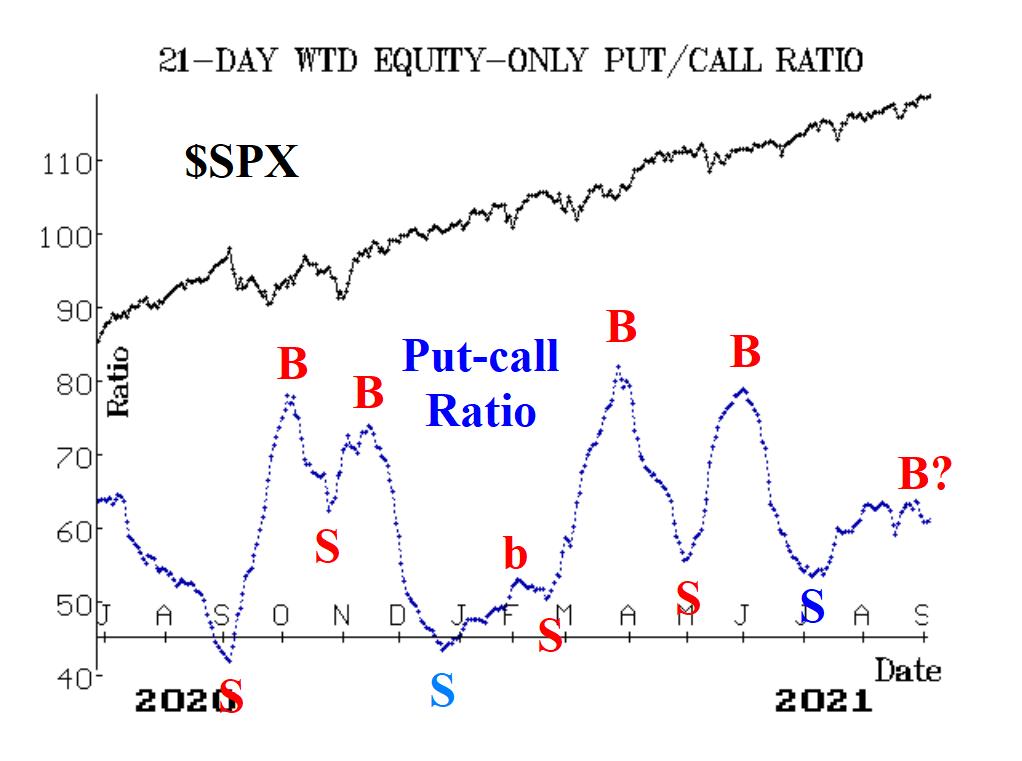

Equity-only put-call ratios have begun to fall, reflecting the improvement in sentiment via call option buying. A local maximum on these put-call ratio charts is a buy signal for the broad stock market. Thus, these are turning bullish.

Market breadth has improved quite a bit. Both breadth oscillators are on buy signals, and they are finally both overbought, but that is what we expect (and want) to see with SPX making new all-time highs.

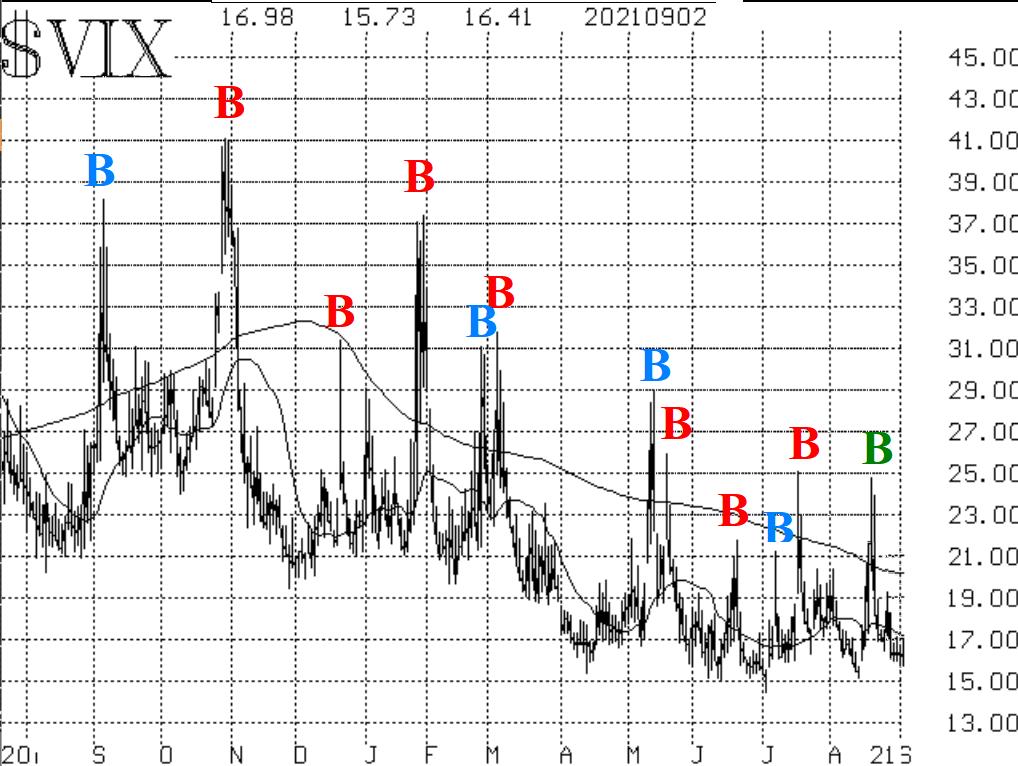

Indicators involving implied volatility remain bullish for the stock market as well. The VIX "spike peak" buy signal of August 19 remains in place. The trend of VIX remains downward, as it is below both its 20-day and 200-day moving averages, and those are both declining.

In summary, the indicators are bullish, for the most part. Therefore a "core" long position should still be maintained. It is still wise to avoid complacency. Continue to raise stops where appropriate and, most importantly, adhere to your stops if they are hit. One of the worst forms of complacency is ignoring your sell stops in a bull market.