Selling cash-secured puts is a low-risk option-selling strategy geared to generating cash flow and beating the market on a consistent basis, explains Alan Ellman of The Blue Collar Investor.

In certain scenarios an additional goal of buying the stock at a discount is added to traditional put-selling. This article will analyze such a dual-purpose trade proposed by Safi on April 23, 2021.

A Real-Life Example with NIO Inc. (NIO)

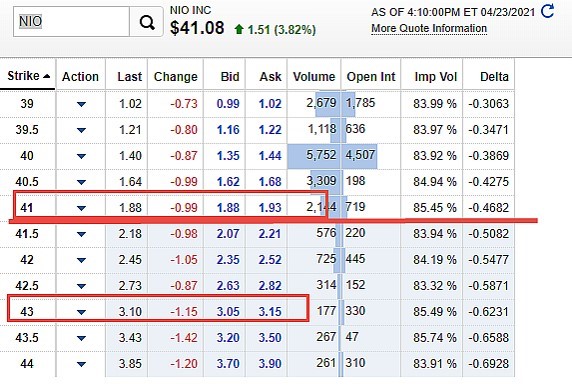

SAFI was quite bullish on NIO and was seeking to sell a near-the-money or in-the-money cash-secured put to accomplish both goals. At the time, NIO was trading at $41.08 and the $41.00 (slightly out-of-the-money) and $43.00 (in-the-money) strike puts were being considered. Both contracts expired in one week on April 30, 2021. We will focus our initial trade evaluation using the $41.00 strike, which showed a bid price of $1.88.

Option Chain for NIO 4/30/2021 Expirations

NIO Option-Chain for 4/30/2021 Expirations

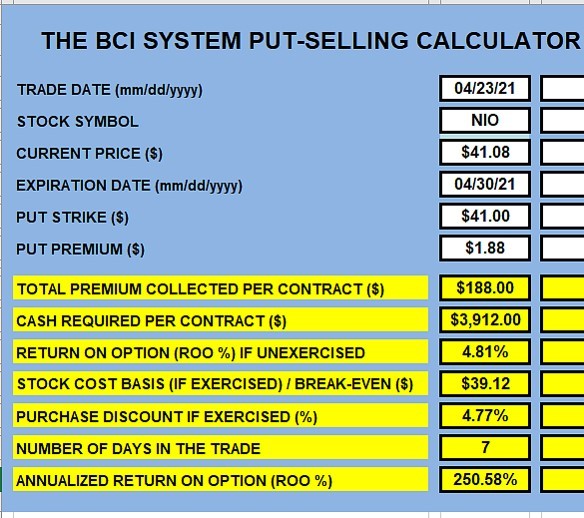

NIO Initial Calculations with the BCI Elite Put-Selling Calculator

NIO 1-Week Put Calculations

Note that the one-week unexercised return NIO remains above the $41.00 strike) is 4.77% or 250.58% annualized over 52 weeks. This type of huge return reflects a high implied volatility and the first thought that comes to mind is to check for an upcoming earnings report. Sure enough, NIO was projected to report on 4/29/21, a day prior to contract expiration. The BCI earnings report rule requires us to avoid selling options if there is an earnings release prior to expiration Friday.

What Should Safi Do?

Start by taking no action (not entering the put trade) until the earnings report passes. If the NIO bullish assumption remains, sell an in-the-money or near-the-money put strike that meets the stated time-value return goal range (up to each investor, for me, it’s 2%-4% per month or 1/2% to 1% per week). Post-report, the option-chain stats will be quite different than the one provided by Safi because the implied volatility will subside drastically as will the option premiums and our exposed risk.

What Happened?

NIO Chart after 4/30/2021 Earnings Release

A disappointing earnings report resulted in a$10.00 per-share price decline (blue arrow).

Discussion

When establishing a put-selling strategy with the goals of both premium generation and purchasing the underlying security at a discount, we sell in-the-money or near-the-money cash-secured puts that meet our time-value return goal range. As with all our option-selling trades, earnings reports must be avoided.

Learn more about Alan Ellman on the Blue Collar Investor Website.