When using the PMCC strategy, a covered call writing-like strategy, our goal is to generate cash flow with a lower cash investment than traditional covered call writing, explains Alan Ellman of The Blue Collar Investor.

The BCI PMCC Calculator shows initial time-value returns from this short call premium as well as the upside potential should share price accelerate. This article will analyze this potential benefit from the PMCC strategy.

What is the PMCC strategy?

This is a covered call-like strategy where a LEAPS option is purchased instead of the corresponding stock or ETF. Typically, the LEAPS is deep in-the-money expiring 1 to 2 years out. Deep ITM LEAPS will have Deltas approaching “1” and, therefore, mirror the price movement of the underlying security.

Real-life example with Intel Corp. (INTC)

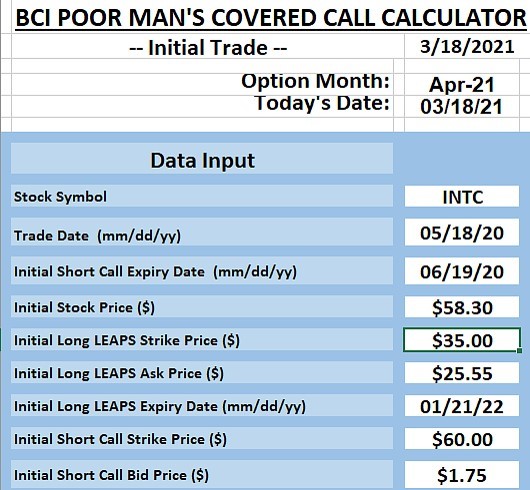

- 5/18/2020: INTC trading at $58.30

- 5/18/2020: The 1/21/2022 $35.00 LEAPS has an ask price of $25.55

- 5/18/2020: The $60.00 1-month out-of-the-money short call has a bid price of $1.75

Next, we enter this information into the blue cells of the BCI PMCC Calculator.

Data entry: INTC PMCC trade

Entering Option-Chain Data into the PMCC Calculator

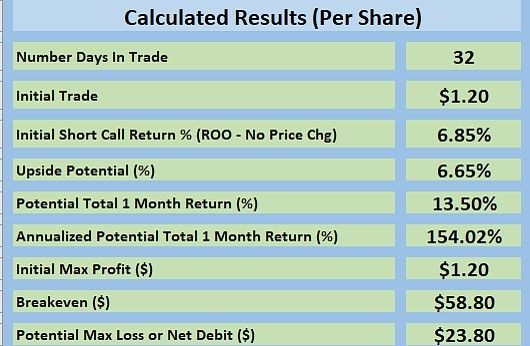

Calculations: INTC PMCC trade

INTC: PMCC Initial Trade Calculations

Key takeaways

- The initial 32-day time-value return from the short call premium is 6.85%

- The upside potential from current market value of $58.30 to the $60.00 strike is 6.65%

Upside potential as it relates to the PMCC strategy

Upside potential is exactly as presented… potential. It is not realized until the trade is closed. If our LEAPS is closed, we benefit from share appreciation, keeping in mind that our deep ITM LEAPS have Deltas approaching “1” and price movement will be similar to that of the underlying. A rise in price of $1.70 in INTC, will translate to a similar benefit in LEAPS price. If the short call is not exercised or rolled out-and-up, we benefit from an increase in the strike spread. As an example of the latter, if we sell a higher short call strike the next month (after share appreciation near or to $60.00), such as a $62.50 short call the spread will increase from $25.00 ($60.00 – $35.00) to $27.50 ($62.50 – $35.00).

Discussion

In the PMCC strategy we benefit from upside potential in 2 ways. First, share appreciation will enhance the value of our long LEAPS position. Second, if the option is not exercised or rolled-out-and-up, we will create a scenario to sell at a higher short call strike, thereby benefitting from a larger strike spread.

Learn more about Alan Ellman on the Blue Collar Investor Website.