The story of the “Turtle Traders” is probably one of the greatest trading stories of all time, says Markus Heitkoetter of Rockwell Trading.

It started with Richard Dennis and Bill Eckhardt, two great commodity traders, who argued about whether or not great traders were born or made. Richard believed he could TEACH people to become great traders, and Bill thought that they were born.

So eventually they made a bet, and they took out ads in Barron's, The Wall Street Journal, and The New York Times, looking for individuals who wanted to become traders but didn’t have any trading experience.

Turtle Traders

Out of 1,000 applicants Richard Dennis recruited 23 people—and taught them his trading methods. He called them his “Turtles,” after visiting turtle farms in Asia, where they were growing turtles. He said: “I will grow traders like they grow turtles on these farms.”

And these turtle traders—traders who have never traded before—collectively made over $426 million in profits.

So How Did They Do It?

For years, there was a lot of secrecy around their trading methods. But eventually, they revealed their “secret trading system.” Stick around, and I’ll give you the exact system a little bit later.

How Did They Select “Good Traders”?

They received 1,000 applications. Out of these applications, they conducted 80 interviews, and they only selected 23 “Turtles.”

So, what were they looking for? What made them reject 9,977 applicants and only select 23?

They were looking for people who had an unusual combination of:

- Patience

- Discipline

- Focus

Yes, they also had specific entry and exit criteria for every trade, and I’ll give them to you in a moment.

Good Trader vs. Bad Trader

But first, let’s talk about these character traits and what makes a good trader vs. bad trader.

Discipline

A good trader has a trading plan and has the discipline to follow it.

A trader plan consists of three things:

- What to trade?

- When to enter?

- When to exit?

That’s it. Simple enough right? Yet most traders don’t have this simple plan. Many traders have a bad habit of hopping from one trade to another—following the next “hot tip” from Reddit, their friends, or the talking heads on TV. They don’t have a specific plan.

Step 1 is to have a plan.

Step 2 is to FOLLOW your plan.

Let me tell you a quick story:

You have a plan. Let’s say you are trading the “PowerX Strategy“ or “The Wheel Strategy.“ You have your set of rules and know exactly WHAT to trade, when to ENTER, and when to EXIT. You know that you should only trade “value stocks” when trading “The Wheel Strategy.” But you see this stock on the scanner with AWESOME premiums. It’s not a “value stock”…but boy oh boy: You can make a few thousand dollars in a few days!

Do you trade it? Well, of course you do. And at first, things go well. It seems that the market is rewarding you for breaking the rules. But then reality catches up with you and the trade goes against you. Now you get mad, upset, frustrated. And the next day, what do you do? You break your rules again.

Many traders do this over and over again. No surprise most traders lose money when trading. Discipline is extremely important when trading. It’s also one of the most difficult things for a trader to master. It’s completely necessary if you want to be a successful trader. Let’s talk about the next character trait of good traders:

Patience

Boooooooring, isn’t it? Aren’t you tempted to skip ahead in this article to see the rules of the turtles and how they made millions of dollars? Well, we will get to this in just a moment—I promise. A good trader is patient. A good trader waits for HIS entry. He waits until HIS stocks are showing up on the scanner. The A+ stocks. A good trader doesn’t have the itch to trade.

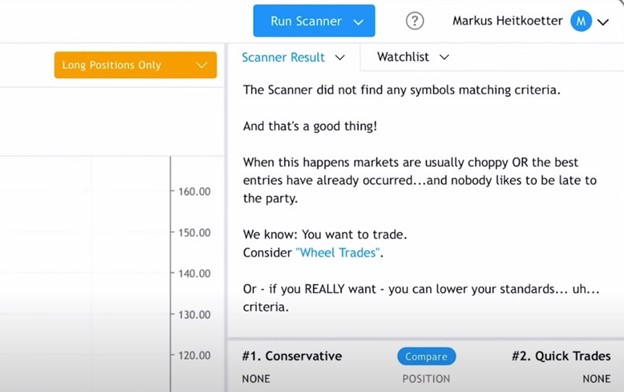

As an example, today (at the time of this writing), if you ran the PowerX Optimizer, you might have seen that the scanner did not find any symbols matching the criteria.

Well, this is actually a good thing. When this happens, the markets are usually choppy, like they are right now. A good trader knows that you don’t have to trade everyday and that you shouldn’t trade everyday. A good trader is patient and knows that it’s better to be relaxed about trading than panicked or anxious.

A bad trader—on the other hand—is impatient. A bad trader wants to make money in every trade. If they don’t place a trade for two-three days, they get nervous.

And so, they start bending the rules and take trades they shouldn’t take, just because they are not patient. They take their profits early since they are not patient enough for the trade to play out. Or they panic on a day when the markets are down.

Being patient is extremely important in trading. It’s not easy—but you have to find a way to become a PATIENT trader and wait for the right opportunity. Trading is a marathon and NOT a sprint. This leads us to the next key character trait of good traders:

Focus

Good traders stay focused on THEIR trading plan. They have a set of rules, and they follow them religiously. They don’t jump around from one trading strategy to the next like a squirrel.

They also don’t have many trades going at the same time. I personally don’t have more than five positions for each trading strategy at any given time. I only trade two trading strategies: The “PowerX Strategy” and “The Wheel.”

I don’t attend “webinars” in which another trader is showing me how he turned $2,000 into $2,000,000 using his “secret sauce.” I don’t change the rules of my plan every few days. I have been trading my strategies for many, many years. They work for me—and they will probably work for you. Anyhow…if you want to be a good trader, focus on YOUR trading plan and stick with it.

There you have it.

It’s only these three character traits that set apart good traders from bad traders:

- Focus

- Discipline

- Patience

And yes, if you are still reading, you are patient enough and will be rewarded.

So here is the trading strategy that the turtles used to make millions:

The Turtle Trading Strategy

The Turtle Trading Strategy is a simple breakout strategy.

Here are the entry rules:

- Take the high and the low of the last 20 days

- Buy when the price moves 1 tick above the high.

Exit Rules:

- Sell at a 10-day low

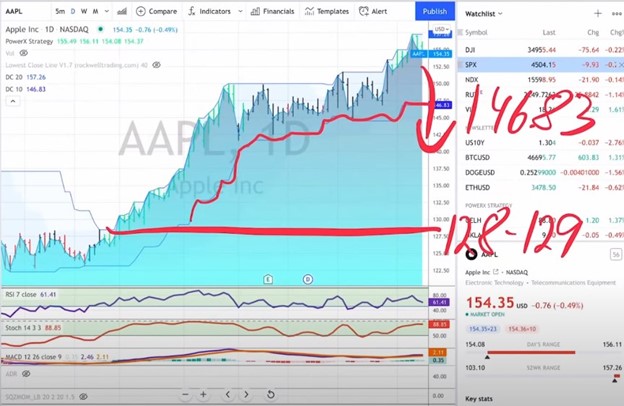

Yes, it’s that simple. It’s basically a Donchian Channel. Let me show you an example:

There you go. That’s the Turtle Strategy. Now, keep in mind that this strategy was developed and used in the 80s, and the markets were completely different 40 years ago.

These days, the Turtle Strategy doesn’t work anymore.

Learn more about Markus Heitkoetter at Rockwell Trading.