Stocks have been bouncing all over the place with the S&P 500 Index (SPX) moving more than 1% up or down on five of the past six trading days, explains Marvin Appel of Signalert Asset Management.

Recently, the S&P 500 lost more than 1% early in the day but recovered after news broke that Republican Senate Minority Leader McConnell would permit a six-week suspension of the debt ceiling. Default would be a disaster for the financial markets in the short-term and would be sand in the gears over the long-term due to the loss of confidence in US assets that even a temporary default would cause.

Besides the risk of default due to the political game of chicken that is occurring in Washington DC, the other major cause of weakness is investors taking profits in large-cap growth stocks that have led the market lower in the past month. The five largest such stocks (AAPL, MSFT, AMZN, GOOGL, FB) comprise 20% of the S&P 500 and 40% of QQQ. With so much market capitalization concentrated in so few growth stocks, the entire cap-weighted market is vulnerable to changing leadership. The chart to the left shows how much weaker QQQ has been compared to SPY. (QQQ / SPY ratio falling, circled in the chart.)

Support for QQQ should lie around 343 and at yesterday’s close of 357 which is at the trendline that began at the March low. (See the lower half of the chart on page one which is QQQ price) The support level of 369 that I mentioned in the last newsletter (9/22) only lasted through 9/27. Now 369 is a potential resistance area at the middle Bollinger band (not shown in the chart).

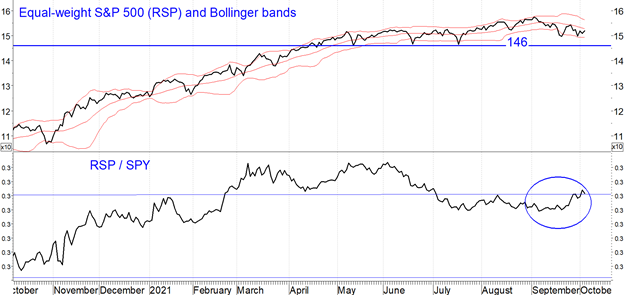

The silver lining in the QQQ sell-off is that market weakness does not necessarily represent economic weakness. For example, the chart of the equal-weighted S&P 500 Index ETF (RSP) shows that in September, RSP held up much better than the cap-weighted SPY (circled in the plot of RSP / SPY), reflecting a stable economy able to support a broad swarth of businesses. The recent ADP estimate that more than 500,000 private sector jobs were created in September goes along with this notion, although we await confirmation from Friday’s monthly employment report from the Bureau of Labor Statistics. RSP has been relatively flat since the end of May, and I think that represents that most of the good economic news has been priced into the financial markets and that expectations are being met. The fact that corporate high-yield bonds were flat in September even as stocks tumbled is consistent with this outlook.

Implications

Investors should position themselves for a sideways market beset with short-term volatility. As long as our equity model is on a “hold” or “buy”, SPY is a good choice. Those looking for additional nuance could include covered calls on SPY since VIX is above-average at 21. I also like XLP, either long or as a covered call position.

High yield taxable bond and floating rate bonds also appear attractive in a sideways market with stable underlying economic fundamentals. High-yield municipal bonds are a question mark now.

To learn more about Marvin Appel, please visit Signalert Asset Management.