The third quarter earnings for Apple (AAPL) are on deck for Thursday, October 28, after market close, states Garrett DeSimone of OptionMetrics.

Earnings attract serious volume from options traders, since the news can incite massive reactions in the stock price. The expectations of an outsized price move make volatility bets in options popular.

A straddle is a trade consisting of buying an at-the-money call and put with matching strikes. This strategy is long volatility, with the buyer profiting in situations where volatility is higher than anticipated. At first glance, the straddle is often appealing to investors because it doesn’t require that the trader get the direction of the price correct; all he/she needs is for the magnitude to be large enough.

However, (in addition to their being impacted by holding periods, time to maturity and bid/ask spreads, and other factors) straddles can often be big-time losers following earnings news. This is because market makers often anticipate the news in advance of the earnings announcement and raise premiums accordingly. In options parlance, this is called a volatility crush.

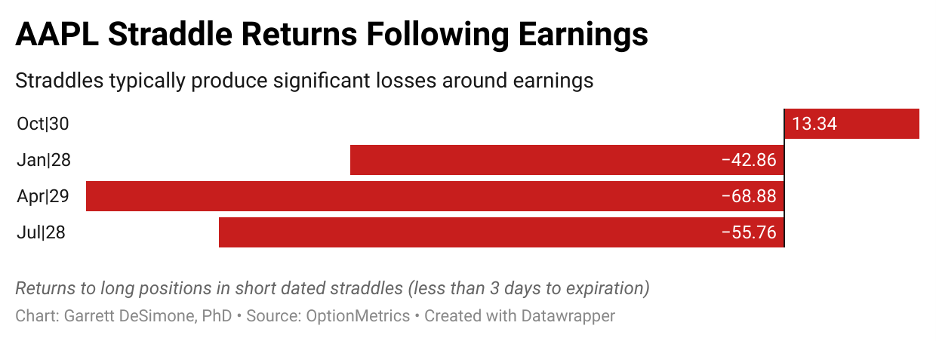

The graph below shows negative previous AAPL straddle returns from buying a straddle before and selling after the earnings release.

It is clear a trader buying a straddle and selling after the earnings release would have lost a ton of premium in the last year. These losses range between 40% and 60% of the total paid premium.

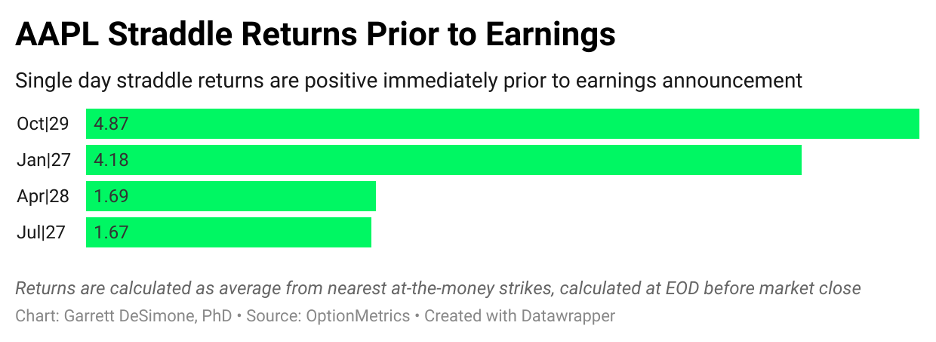

But what if the strategy consisted of buying a straddle immediately prior to the earnings release instead? Let’s explore the profitability of a straddle, where the trade is shifted to one day before earnings are to be announced, as opposed to after they are announced. The graph below shows one-day holding period returns right before earnings are announced end-of-day.

Buying AAPL straddles a day before earnings, and closing the position before the report, is substantially more profitable than buying and holding during the news. This is likely attributed to an increase in uncertainty around AAPL’s report. Rumors and ambiguity about the outcome of earnings result in higher volatility right before the news, which can cause an increase in option premiums.

As seen from above, savvy traders might use straddles around earnings to trade the rumor on stocks like AAPL and others. It should be noted that while timing around news can be critical, other factors, such as holding period, time to maturity, and bid/ask spreads, can also greatly impact potential profitability of this strategy.

Garrett DeSimone, PhD is Head of Quantitative Research at OptionMetrics, LLC. His company is an options database and analytics provider for institutional and retail investors and academic researchers that has covered every US strike and expiration option on over 10,000 underlying stocks and indices since 1996. It is online at www.optionmetrics.com.