When we roll down our covered call trades, we generally do so to an out-of-the-money (OTM) strike to allow for share price recovery, explains Alan Ellman of The Blue Collar Investor.

However, in the final week of a monthly contract, if we hold a security we will not use in the following contract month, it frequently makes sense to roll down to an ITM strike. This will have two positive impacts on our trade: First, we will benefit from the time-value premium component of the ITM strike. Second, we will generate additional downside protection via the intrinsic value component of the option, without the disadvantage of assignment risk, since we have decided to eliminate this security from our portfolio for the upcoming contracts.

A Real-Life Example With Materials Select Sector SPDR Fund (XLB)

- 5/24/2021: Buy 300 x XLB at $87.18.

- 5/24/2021: STO 3 $88.00 calls at $1.44.

- 6/11/2021: BTC the $88.00 calls at $0.15 (10% guideline).

- 6/11/2021: STO the $87.50 calls at $0.20 (roll down #1 to an OTM strike for a small credit).

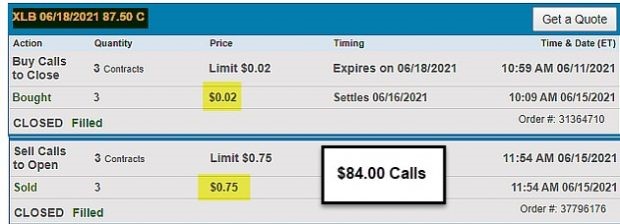

- 6/15/2021: BTC the $87.50 calls at $0.02 (10% guideline).

- 6/15/2021: XLB trading at $84.30.

- 6/15/2021: STO the $84.00 calls at $0.75 (roll down #2 to an ITM strike).

Pros & Cons of Rolling Down to the ITM strike

Pros: We are generating an additional time-value profit of $0.45 per share ($0.75 – $0.30), as well as an additional downside protection of $0.30 per share (84.30 – $84.00).

Con: We are locking in a share loss of $3.18 ($87.18 – $84.00).

Broker Statement Showing Rolling Down to the $84.00 ITM Strike

XLB: Rolling-Down to an ITM Strike

How Did Covered Call Writing Plus Position Management Maneuvers Mitigate the Loss of $3.18 Per Share?

The three option sales totaled a net premium of $2.39 per-share. The option debits (BTC) totaled $0.17 resulting in a net option credit of $2.22 per share. The net loss of the XLB trades were mitigated from $3.18 per share to $0.96 per share.

Discussion

Not all our trades will be profitable. Exit strategy execution will mitigate losing trades and enhance returns on our winners. Position management is the third critical required skill for successful option trading. When we roll down in the final week of a monthly contract on shares we will not be considering for the next contract period, we can roll down to ITM strikes, which generate both time value and intrinsic value without the concern of assignment risk.

Learn more about Alan Ellman on the Blue Collar Investor Website.