Stocks sold off a bit after last week's news that the Consumer Price Index jumped 6.2% from a year ago, the highest inflation reading in 30 years, explains Marvin Appel of Signalert Asset Management.

Persistently higher inflation wouldn’t be the worst thing for equity investors, as stocks have been one of the better inflation hedges that have also been profitable during periods of low inflation (real estate actually has an even better track record from 1970-2020). Until the Fed starts tightening, high yield bonds should also benefit from the current non-transitory inflationary environment, where rising prices make it easier for risky borrowers to service their debts.

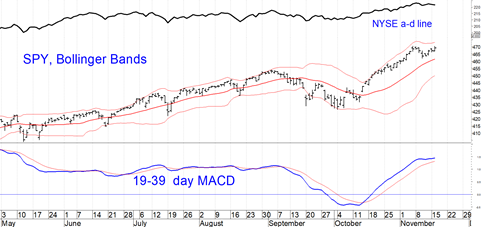

Since the inflation report, the S&P 500 (SPX) has recovered and retested it's November 8 highs. The 19-39 day MACD has flattened out at an overbought level where market advances in recent years have slowed down temporarily. (See chart below.)

Bonds have taken a bigger hit from the inflation news than stocks have. Since the CPI report, the Vanguard Total Bond Market Index Fund (VBMFX) has lost 1.3%. As would be expected, corporate high yield bonds have held up better, with the benchmark BAML High Yield Master Index down 0.6%. Municipal bonds normally parallel moves in Treasuries, but they have held up better so far.

Implications

There is no question that inflation is high. The question is whether it will remain at current levels for more than a year or revert to normal over the course of the coming year. If inflation shows signs of abating by mid-2022, it would allow the Fed to continue its dilatory pace of restoring more normal monetary conditions. In that case, stocks and below-investment-grade bonds would remain attractive. On the other hand, if inflation remains elevated above 3% by the time the Fed is finished tapering its asset purchases in mid-2022, its hand may be forced, and rate increases will begin.

For now, the S&P 500 SPDR (SPY) remains attractive for equity exposure. I also like Consumer Staples (XLP), a defensive sector which has lagged in 2021 but which should hold up well in the event of a market correction. XLP is now trading in the 72.50-73.00 range. I like covered call writing with XLP if you can buy the shares at 71.50 or lower.

In terms of bond strategy, floating rate funds such as Credit Suisse High Income Fund (CHIAX), which we track in the newsletter high income portfolio, seems a good bet. If the Fed raises rates, the dividend income from CHIAX will increase in parallel, so interest rate risk is low. As long as the economy remains solid, default risk should also remain low.

To learn more about Marvin Appel, please visit Signalert Asset Management.