In economic news, the big story today will be US Nonfarm Payrolls for November, with a forecast increase of 550k new positions over October and the unemployment rate expected to fall to 4.5%, states Ian Murphy of MurphyTrading.com.

Reports yesterday that the Omicron variant could be more contagious than Delta but may lead to less hospitalizations buoyed equity investors, yet the mood has cooled overnight.

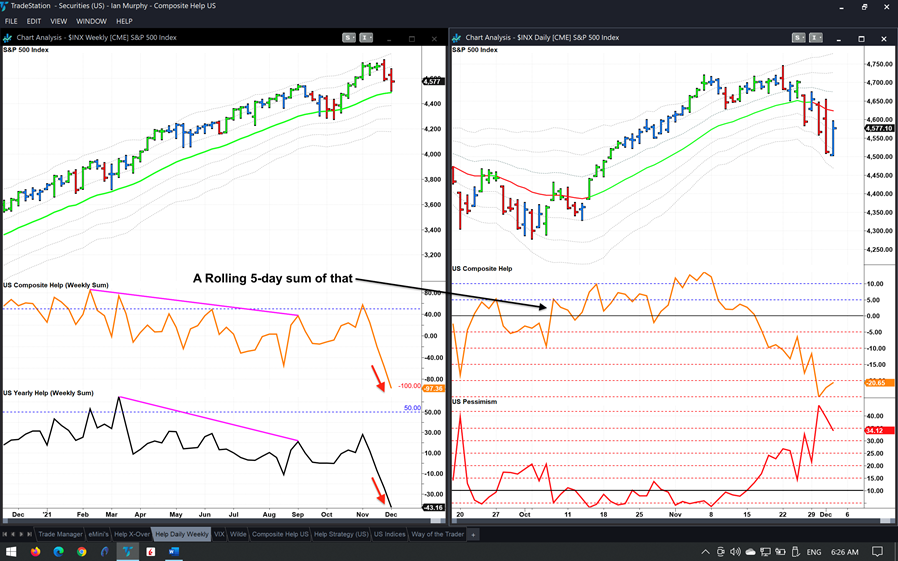

The Composite and Pessimism indicators are deeply negative (right chart), while the S&P 500 (SPX) remains on the edge of returning to a bearish trend. Yesterday’s price bar closed on the -1ATR line and the previous two days closed below it, confirming the index is on the edge.

Things are looking even less rosy on weekly charts (left) with the rolling 5-day sum of Composite close to -100, a much deeper reading than previous pullbacks.

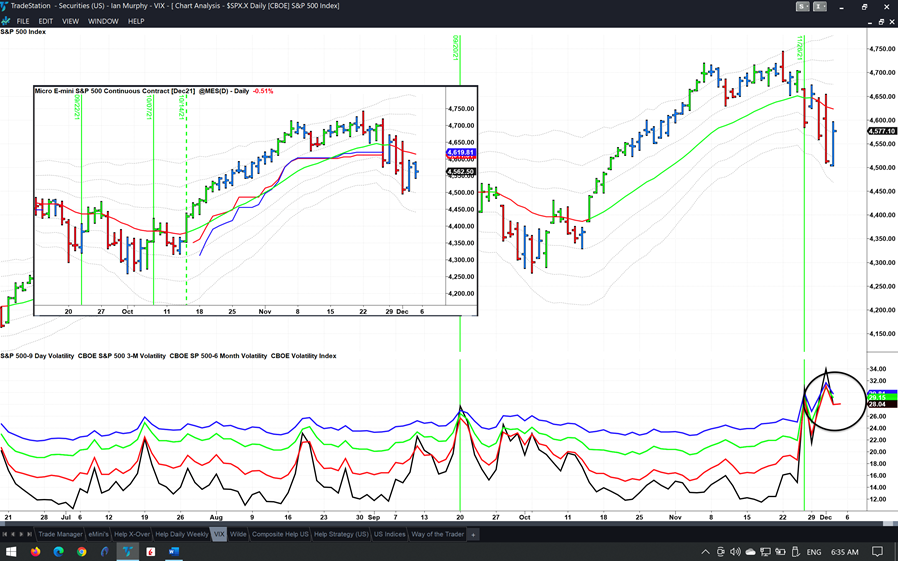

S&P 500 futures were down 0.51% at 06:30 ET (insert) and implied volatility, as measured by CBOE SPX Volatility Index (VIX), is rising again before the open (circle). Today will be interesting—volatility is back and all is not well under the surface.

Learn more about Ian Murphy at MurphyTrading.com.