The long-awaited trigger in the Help Strategy finally arrived in yesterday’s session, states Ian Murphy of MurphyTrading.com.

After an opening gap, the S&P 500 (SPX) traded strongly all day and closed near the high. It’s always difficult to enter a trade after a gap up, but that’s what this strategy calls for. The gap up was so large and the candle so tall, the distance between the entry price and initial protective stop required a smaller position than previous trades.

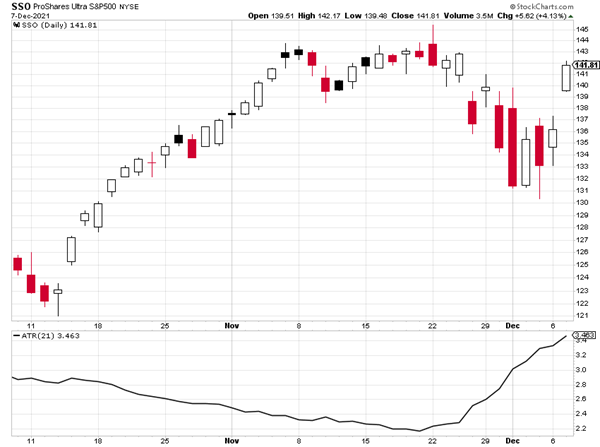

A query has come in about trading the strategy if not using TradeStation or Interactive Brokers platforms. The process is the same. The initial protective stop is set 0.5ATR below the low of the bar we enter on. Looking at the Stockcharts.com chart above, with an ATR setting of 21, the stop is set half that amount (1.73) below the bar’s low of $139.48—so the stop is at $137.75. If/when the price moves up, the trailing stop will be moved to 1.5ATR below the low of the previous sessions bar with an ATR setting of 63, or 1.75ATR below with a setting of 21.

Learn more about Ian Murphy at MurphyTrading.com.