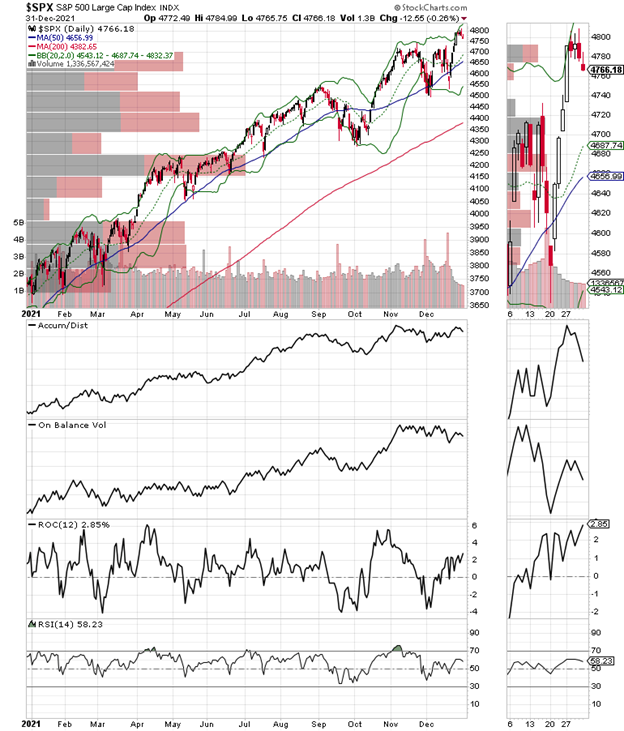

The headlines blared the new highs on the S&P 500 (SPX), but the market’s breadth, although not completely falling apart has been lagging behind, says Joe Duarte of In the Money Options.

The combination of a breadth divergence with the Fed’s taper lurking in the near future makes me a bit worried. As a result, I’m pulling back my horns just a little, which is not to say that I’m turning outright bearish. That said, it is important to remember that markets love to climb walls of worry. So, if my worry level is representative of widespread concern in the market, maybe we’ll have another successful year. Still, successful investing is all about being patient and disciplined. Thus, if the market unravels remember these key points:

- Don’t fight the Fed

- Don’t fight the market’s momentum

- Trade in small lots

- Use well-placed sell stops

- If a position is not stopped out, then stick with it until it is

The Big Four

Last week I introduced what I call The Big Four Macros for 2022:

- Dueling central banks: China is easing while the Fed is hellbent on tapering and maybe actually raising rates

- The MELA system (Markets, Economy, Life Decisions, and Algos) are beating to their own drum, albeit influenced by central banks

- The virus thing: whatever that will mean next

- The stock market’s technical divergence

Of the four, the focal point is the MELA system. And here is why:

- Trading and the state of retirement plans such as 401(k)s and IRAs for financial support is widespread.

- When trading and retirement plans are doing well, because stocks are rising, people feel wealthy.

- People who feel wealthy spend money and the economy prospers as long as the stock market is doing well.

- Algos speed up information and transactions, so people make decisions faster and the economy grows faster.

That said, let’s look at the China situation, which all boils down to this one question: If everything is going so well in China, then why is the People’s Bank of China easing monetary policy while other global central banks are tightening?

Yeah, it doesn’t make sense, which means that a nasty surprise from China may be lurking and could be sprung in the New Year, as the mainstream press emerges from its holiday slumber. Mostly, I’m expecting something along the lines of yet another supply-chain surprise as Covid again spreads there.

Moreover, given the way the news cycle works, such a news item could upend markets, just as the Fed pulls the trigger.

So, again I ask: What’s the bottom line?

And the answer remains: If it’s bad for stocks, it’s going to be bad for just about everything. All of which sums up why I’m pulling back my horns just a bit.

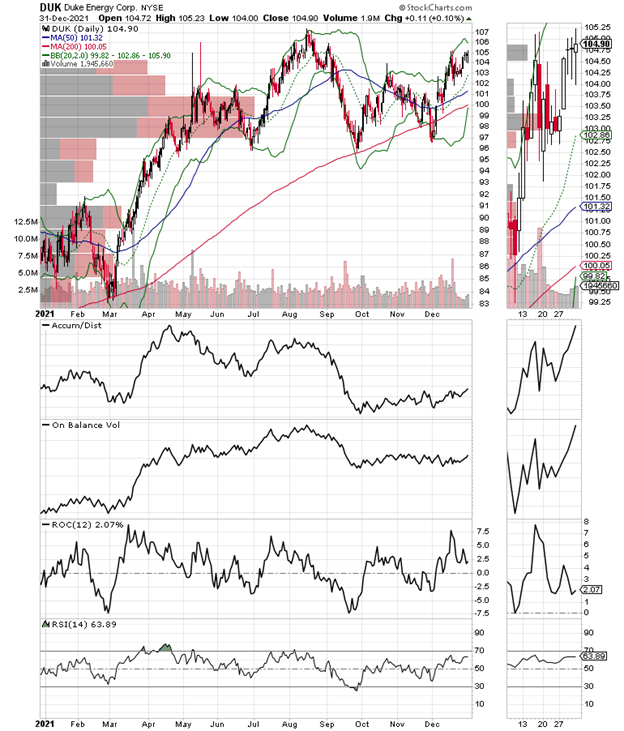

Duke Energy Turns on the Lights

I recently recommended shares of electric utility company Duke Energy (DUK). And regular readers are probably scratching their heads and wondering why I’m writing about the usually unglamorous utility sector.

But here is the simple answer. Money is moving aggressively into DUK, and a short-term reason is that we are getting close to the time of year when winter could bite in the Southern US and Duke’s earnings could get a nice boost.

However, there is more to DUK than meets the eye, as it has interests in clean energy and natural gas storage and delivery.

In addition, aside from the 3.7% dividend yield, here’s a purely technical snapshot, which shows how favorable the odds of the stock moving higher are:

- Short sellers are exhausted as ADI has bottomed out and is starting to move higher.

- Buyers are starting to trickle in as On-Balance Volume (OBV) has bottomed out and is starting to show signs of perking up.

- The stock is trading above two huge Volume by Price (VBP) bars, which means that the algos are using intraday dips to nibble at the shares.

Moreover, the stock is within striking distance of a breakout at the $107 area.

Of course, here is what may be moving the needle over the long term. DUK has a significant portion of its electricity generating business in the Carolinas while also serving Florida. And with North Carolina and Florida becoming increasingly attractive areas of the US for people migrating from high-tax states, the odds favor an increase in business in the industrial, commercial, and residential segments for DUK over the long term.

Bottom line, DUK is sitting in a good spot from many perspectives as 2021 winds down and 2022 emerges.

NYAD Recovers but Fails to Confirm New Highs in S&P 500

When it comes to market breadth, it could have been a worse end to 2021. For one thing the New York Stock Exchange Advance Decline line (NYAD) after holding support near its 200-day moving managed to close above its 50-day moving average while its RSI closed above 50.

And while those two developments are good news, there is also some not so good news as NYAD came nowhere close to confirming the recent new highs on the S&P 500. So, what we now have is a smaller, but still present technical divergence.

Finally, I’d like to look at NYAD along with the CBOE Volatility Index (VIX) because there is a high correlation between the two. Specifically, note the following about the chart:

- NYAD recently made a double bottom with the second bottom being lower than the first.

- During the second bottom, ROC and RSI made higher lows which signaled a panic bottom.

- The second high in VIX corresponded to the second bottoms in NYAD, RSI, and ROC. The second high in VIX was much lower than its corresponding first.

- VIX has still to cross above the key resistance line.

Thus, the key here is to note if and when these positive developments reverse. Because if they do, it will likely signal that the rally is likely over.

The S&P 500 made new highs recently but faded on 12/31. There is also a lack of upward momentum in On-Balance Volume (OBV) and a weakening of Accumulation Distribution (ADI).

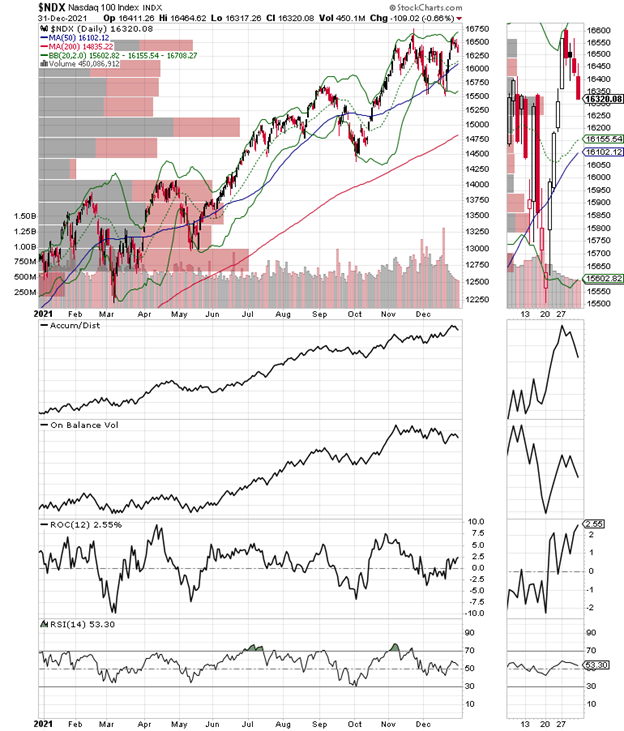

The Nasdaq 100 index (NDX) may have made a double top to end the year. Its OBV is also forecasting future weakness.

In a slight twist, the S&P Small Cap 600 Index (SML) mostly went nowhere after being the weakest area of the market during the recent rally. We’ll have to see what that means.

Watching What VIX Does Next

The CBOE Volatility Index may have bottomed out. And if it starts climbing it will signal that bearish sentiment is rising as put buyers are back in the market.

As the chart in the section above illustrates a rising VIX usually leads to lower SPX, while falling VIX usually leads to rising SPX.

How Options Exert Influence on Stocks

As I note on a weekly basis, the options market influences stocks because of the hedging strategies of market makers and big traders.

Here is how it works:

- Call buyers force market makers to sell calls

- Market makers hedge their call sales by buying stocks and stock index futures – this causes the market to rise

- The cycle self-reinforces as long as call buyers persist, and the stock market moves higher

High put volume leads to a rise in VIX rises. Thus, a rise in VIX signals that market makers are being forced to hedge their bets against traders who are betting against the market.

So high call volume signals bullish stock traders (low VIX), while high VIX signals bearish traders.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.