The collar strategy is a covered-call-writing-like strategy where protective puts are added to our covered-call trades, explains Alan Ellman of The Blue Collar Investor.

This creates a ceiling (the short call) and a floor (the long put). Typically, the expiration dates of the calls and puts are the same. We must also ensure that the call credit and put debit result in a net credit scenario. On 8/26/2021, Saafi wrote to me with a proposed collar trade where a Weekly call option and a Monthly put option were used. This article will analyze this real-life trade with Direxion Daily S&P Biotech Bull 3X Shares (LABU). This is a leveraged ETF.

Saafi’s Proposed Collar Trade

- 8/27/2021: Buy 100 x LABU at $60.50

- 8/27/2021: STO 1 x 9/3/2021 $63.60 call at $1.85 (ceiling)

- 8/27/2021: BTO 1 x 9/17/2021 $59.00 put at $4.85 (floor)

- The trade incorporates a one-week call and a three-week put

Conversion to a One-Week Trade

We all (okay most) remember high-school algebra where we convert fractions to a common denominator. In this case, let’s simplify the trade analysis by breaking up the three-week put premium into three weekly premiums of $1.62 ($4.85/3).

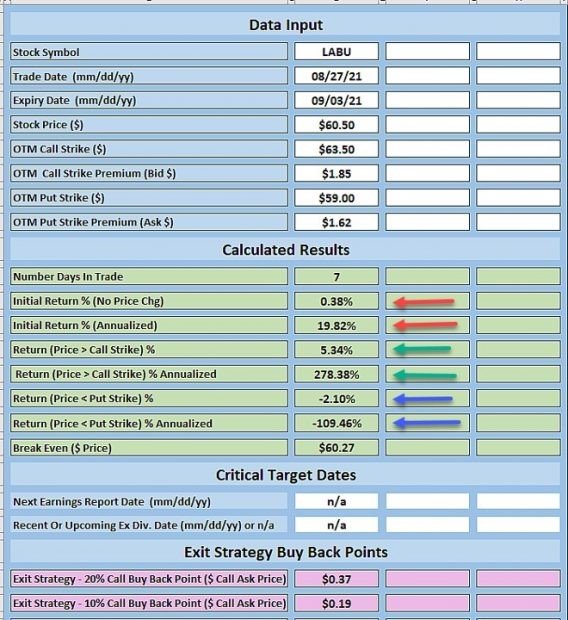

Calculations Using the BCI Collar Calculator

LABU: Collar Calculations

- The red arrows show an initial one-week time-value return of 0f 0.38%, 19.82% annualized

- The green arrows show a maximum one-week return (with upside potential) of 5.34%, 278.38% annualized

- The blue arrows show a maximum one-week loss (to the put strike) of 2.10%, 109.46% annualized

Discussion

To appropriately analyze a collar trade with a longer-term protective put, we must convert the put premium to a similar time frame as the short call. These stats are then entered into the BCI Collar Calculator to ensure the return meet our initial time-value return goal range, which will differ from investor-to-investor.

Saafi’s trade incorporated a leveraged ETF, which creates a good-news-bad-news high volatility and high premium trade. Using a protective put will mitigate potential losses to the downside. Generally speaking, leveraged ETFs are not appropriate for most retail investors.

Learn more about Alan Ellman on the Blue Collar Investor Website.