In 2020, BCI developed two ultra-low-risk option strategies, one using implied volatility and the other using Delta to establish low– and high-end trading ranges during our covered call writing and put-selling option contracts, explains Alan Ellman of The Blue Collar Investor.

We will use five real-life examples to analyze the trading ranges predicted by each approach. The data was taken on 8/30/2021 for the 10/1/2021 contract expirations.

Strategy Goals

- Generate weekly or monthly cash-flow with ultra-low-risk 84% probability trades.

- Establish a trading range for the specific option period using implied volatility and Delta.

- Craft the strategies to align with defensive and capital preservation trading using deep ITM calls, deep OTM calls, and deep OTM puts.

What is Implied Volatility (IV)?

IV is a forecast of the stock’s price movement as implied by the option’s price in the marketplace. It is based on one standard deviation (68% accuracy) and expressed in annualized terms. Therefore, a conversion factor is used to align with days-to-expiration. Since 16% of the data points will fall above the range and 16% below, the probability of a successful trade is 84% (68% + 16%). This means that there is only a 16% chance of the price ending below or above the range.

What is Delta?

Delta has multiple definitions. The one we are using on this topic is the probability of the option expiring in-the-money or with intrinsic-value. To compare apples-to-apples with IV, we will use Deltas of 16% which aligns with our 84% probability IV trading ranges.

Real-life Examples Used in This Article:

- Nike, Inc. (NKE)

- ETSY, Inc. (ETSY)

- Invesco QQQ Trust (QQQ)

- Vaneck Vectors ETF (SMH)

- PayPal Holdings, Inc. (PYPL)

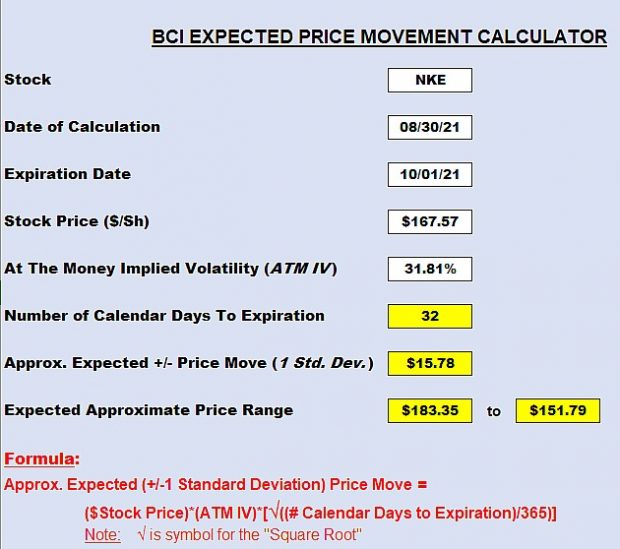

IV Trading Ranges Established with the BCI Expected Price Movement Calculator (Available to Premium Members for Free)

NKE: Expected Price Movement Using Implied Volatility

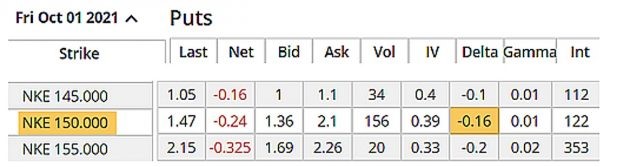

Delta trading ranges established by viewing 16 Delta strike prices for calls and puts.

NKE: Put 16-Delta Strike to Establish Low-End of the Trading Range

A 16-Delta call strike is used to establish the high-end of the range.

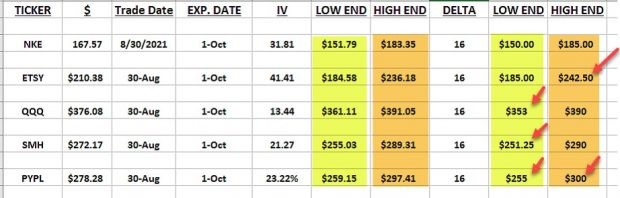

Final Results

Implied Volatility and Delta Comparison Results

Both approaches will work. The ranges were quite similar, but the ranges established via Delta were wider is some cases and therefore safer. Not all options had Deltas of precisely 16, so some calculations will need to be done for greater accuracy. IV calculations were based on mean averages for a wide range of both call and put options. The range established by the calculator needed no adjustments.

Discussion

Using either Delta or implied volatility to establish trading ranges specific for option contracts will result in highly accurate results. Delta has the advantage of slightly wider and, therefore, safer ranges (but lower premiums); but many options do not have Deltas of precisely 16. Implied volatility will create ranges specific for every IV stat. So, what do we want for dessert… a banana split or seven-layer chocolate cake? Either will work well.

Learn more about Alan Ellman on the Blue Collar Investor Website.