As of this writing, we are in the fourth week of the Russian-Ukrainian war, states Brett Friedman of Winhall Risk Analytics.

As is usually the case with war, its progress has been unpredictable and even surprising. Yogi Berra put it best: “It’s tough to make predictions, especially about the future.” The Russians, as well as most foreign policy, defense, and strategy experts, initially speculated that their forces would quickly and easily overwhelm Ukraine and Putin and his new nomenklatura would emerge victorious.

Needless to say, it hasn’t turned out quite like that. Ukrainian resistance is more widespread, and the Russian military is facing severe logistical, tactical, and leadership problems. It is a major understatement to say that, as usual, the consensus was wrong and the outcome unclear.

The number of options traders that have lived through the start of geopolitical hostilities seems to be growing smaller every year (and that’s a good thing, since that means that prolonged shooting wars are becoming less frequent). Institutional memory fades and lessons learned the hard way, like the peculiarities of analyzing and trading options in an environment in which an extreme fundamental shock dominates the market, are forgotten. The effects are not obvious, usually run contrary to consensus, and are sometimes counterintuitive. In short, the short-term effects can contain some interesting surprises and the long-term effects are not as drastic as one might think.

Short-Term Market Effects: Crude Oil Volatility is Acting Abnormally

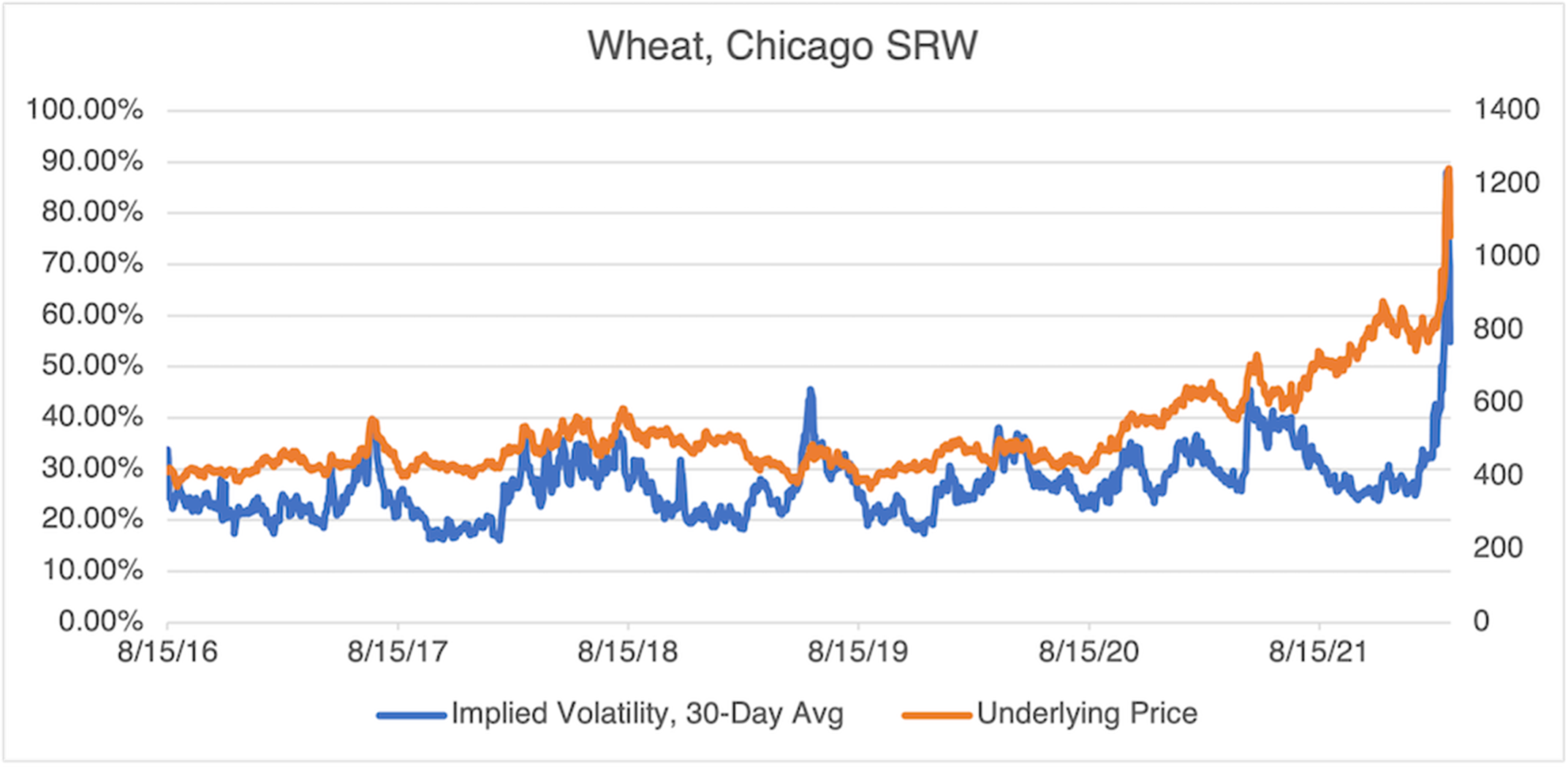

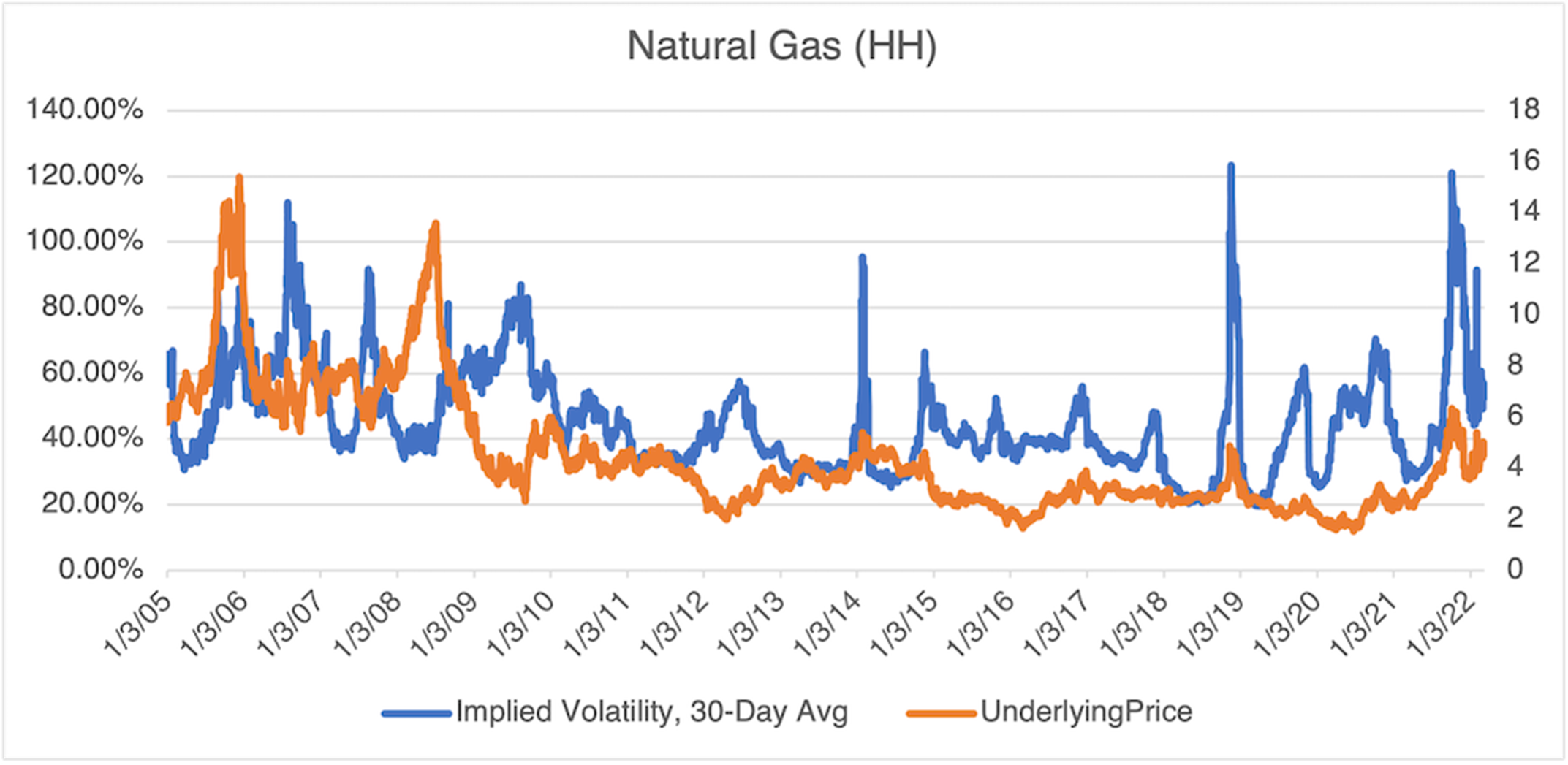

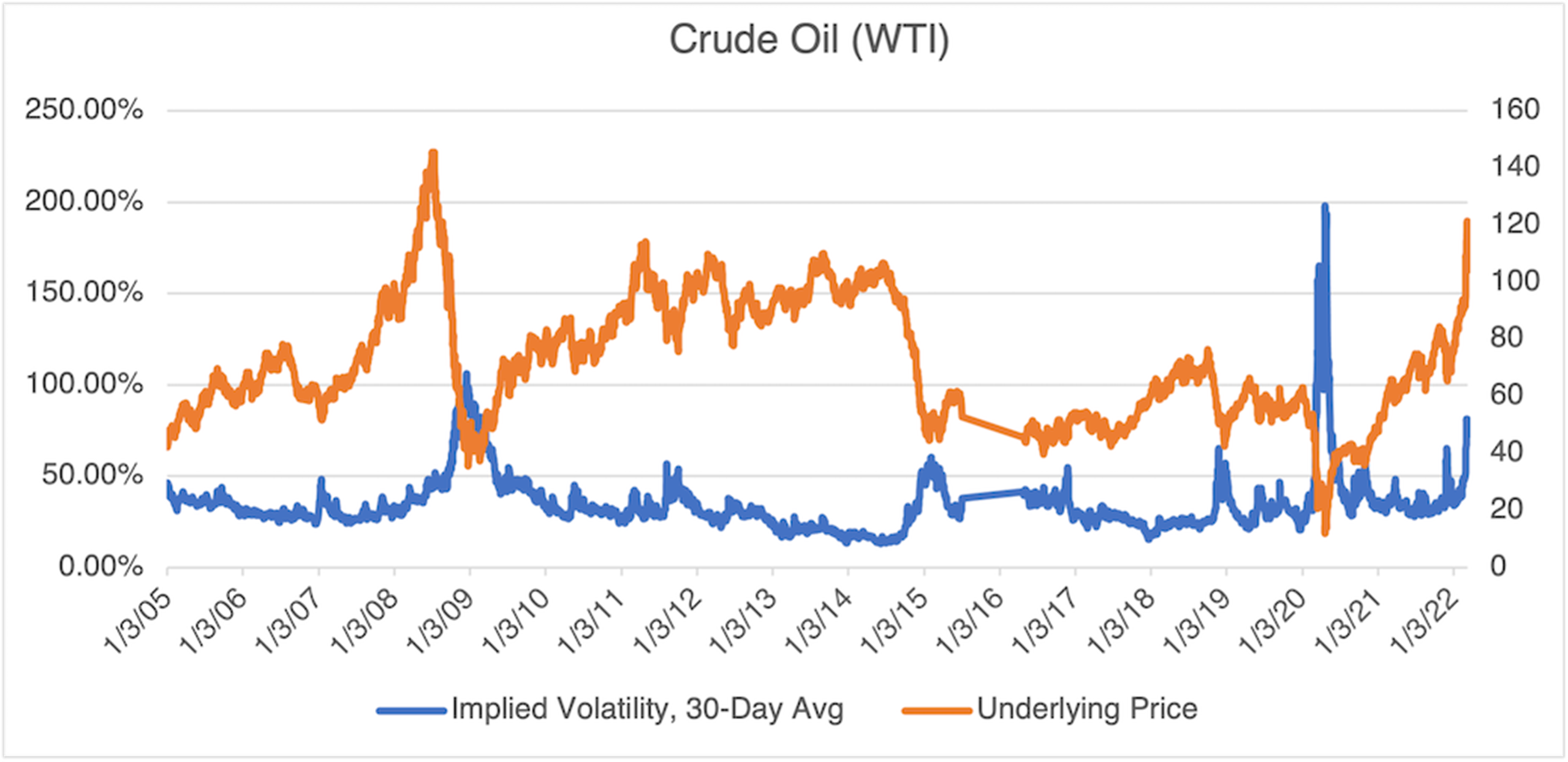

Russia’s economy is commodity-based (crude oil, natural gas, coal, wheat, and base and strategic metals), so it is not surprising that the related futures markets have shown the greatest short-term effects in both underlying prices and implied volatility. A few examples:

Source: OptionMetrics

Source: OptionMetrics

Source: OptionMetrics

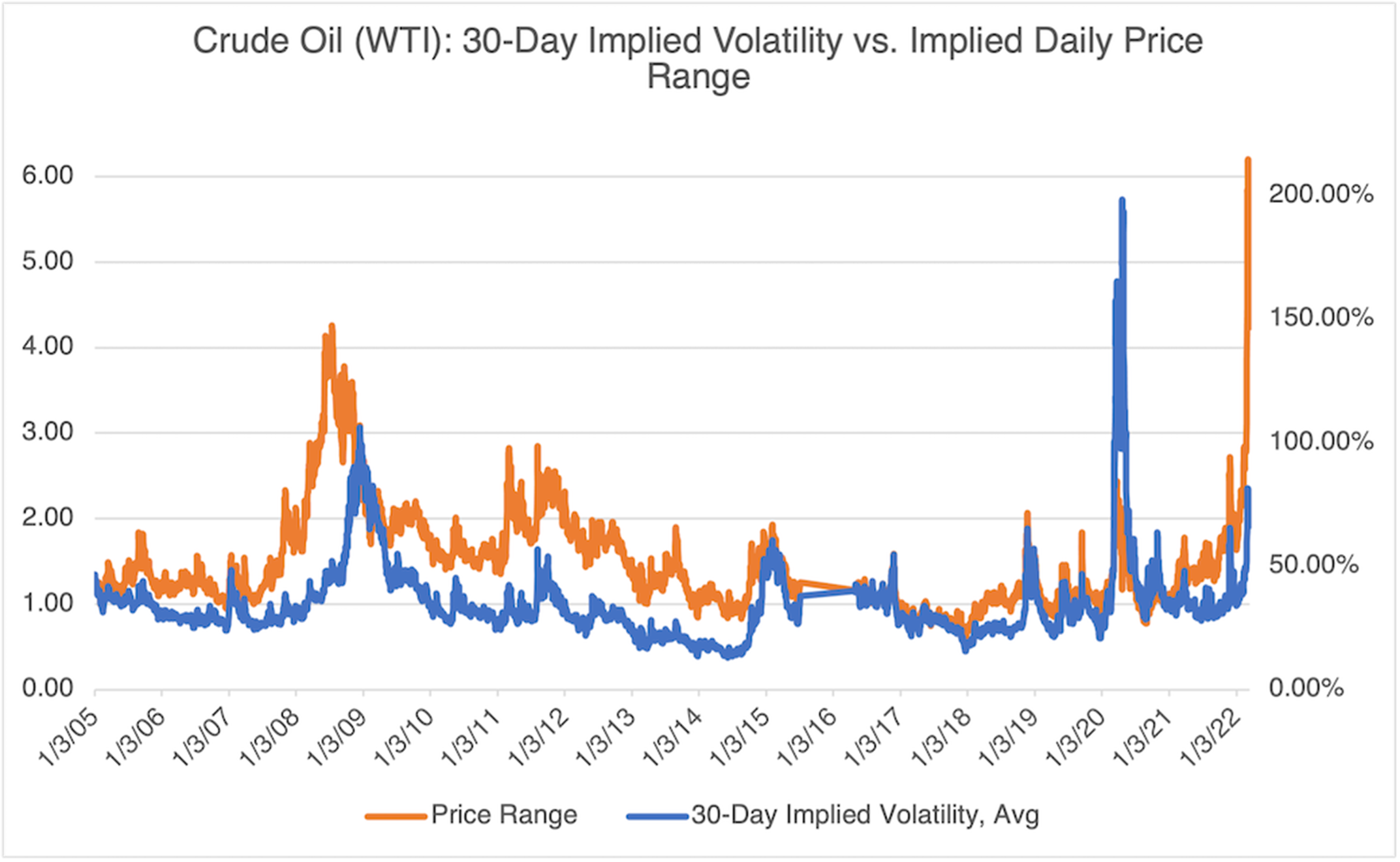

Crude Oil (WTI) futures are experiencing implied volatility shocks commonly seen during periods of major geopolitical, societal, and financial disruption: Gulf Wars I and II, the 2008 financial crisis, the onset of Covid, and negative oil prices. Given the seriousness and potential of the Ukrainian war, this is not surprising.

Historically, crude oil implied volatility tends to spike most quickly and sharply when prices are declining rapidly. Indeed, the highest implied volatility ever recorded in crude oil (198.25%) was in April 2020 when the front month futures price went temporarily negative during the trading session. Conversely, when crude oil prices increase sharply, the upward response of implied volatility (IV) tends to be more muted. This behavior has obvious implications for options strategy and positioning in crude oil.

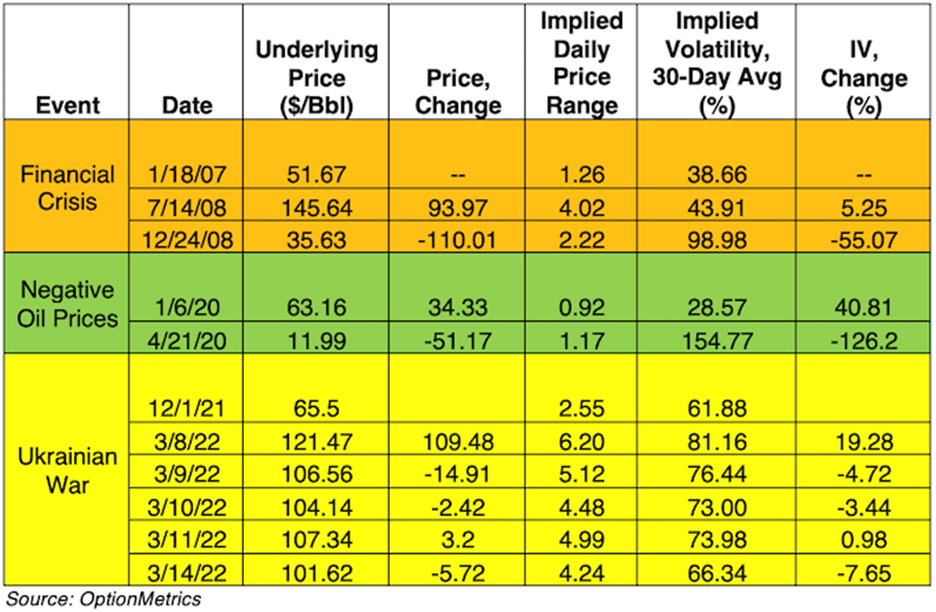

The Ukrainian war is obviously affecting the market, but its effect on implied volatility has not been that impressive. From the beginning of last December, roughly when war news started to affect the market, crude topped out at $121.47, an increase of about $56. At the same time, implied volatility increased by only 19.3% at its peak. It is even lower now: With the market growing accustomed to the war, crude IV is showing only a 4% gain since early December. However, this is somewhat deceptive, as we shall see below.

Converting the daily implied volatility values to its implied daily price range yields a range that is the highest it has been since 2007, and by a wide margin:

Source: OptionMetrics

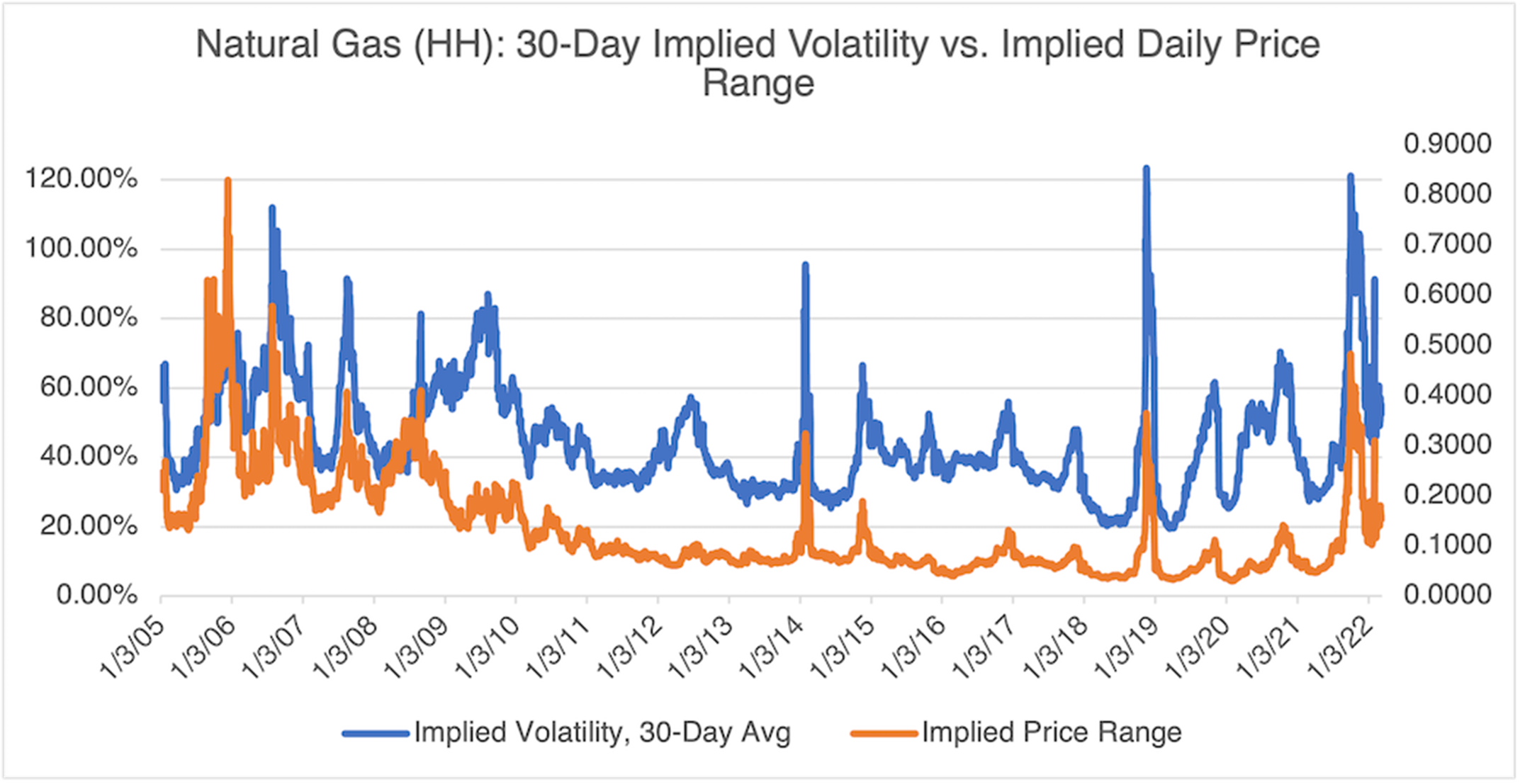

The high implied daily price range is not displayed in natural gas:

Source: OptionMetrics

For crude oil, this suggests that the current implied volatility levels are, likely, not justified given the abnormal implied range.

Long-Term Market Effects: Not What You Might Think

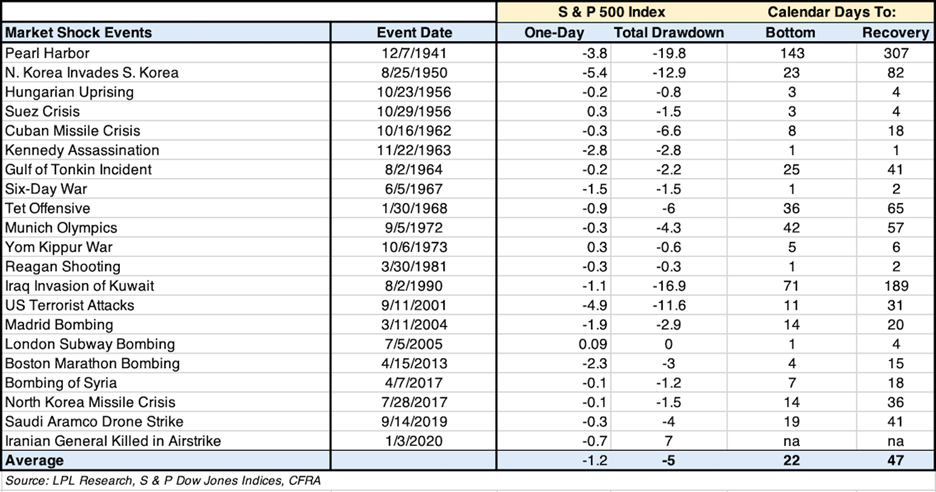

Despite the current uncertainty and accompanying anxiety, one should keep the Russian/Ukraine conflict in perspective. As the table below indicates, the long-term effect on financial markets from war and other violent shocks are not as significant as one might think.

Our Conclusions:

- Geopolitical shocks that cause truly lasting equity market effects (i.e., longer than roughly three months in the S&P 500 index from bottom to recovery) are rare: Only two events out of 21, Pearl Harbor and Gulf War I, qualify in the last 81 years.

- Pearl Harbor, one of the most consequential events of the Twentieth Century, led to a market decline of slightly less than 20% (the level generally perceived to be a bear market). Even so, the market recovered in less than a year, and you can’t get much more of a shock than WWII.

- Geopolitical shocks require pre-existing economic conditions and must be truly global in nature to have a lasting effect. In other words, they don’t tend to change the underlying trend as much as act as a catalyst for the factors that have been weighing on the market previously. For example, in the current environment, the Ukraine war has served to accelerate the inflationary trend already established before the war.