Earnings season is back around, and US financial giants JPMorgan (JPM), Goldman Sachs (GS), and Wells Fargo (WFC) will start the ball rolling, exclaims Ian Murphy of MurphyTrading.com.

Expect guidance to be closely watched this quarter as economic headwinds increase, and central banks appear determined to bring inflation under control even if it means imposing a recession on an unsuspecting (and in some cases unprepared) public.

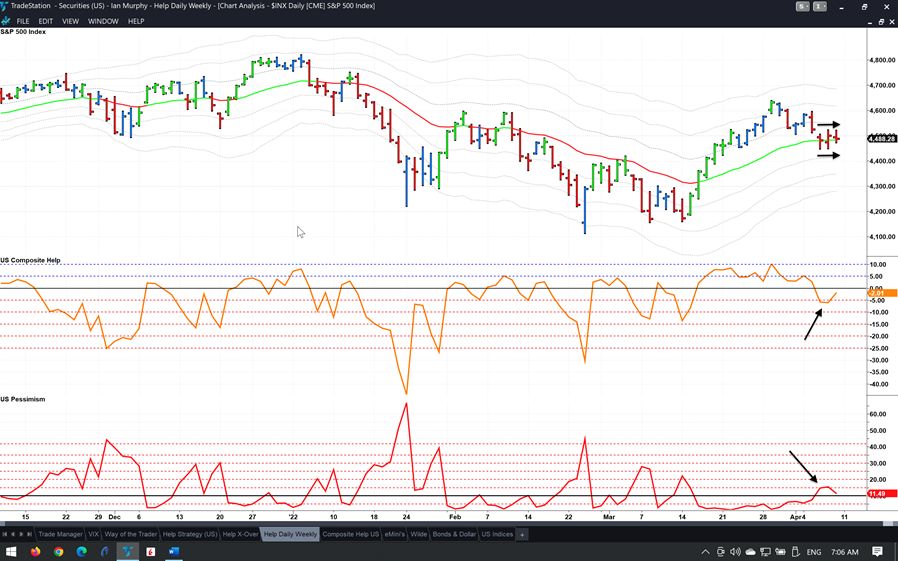

Click chart to enlarge

On the S&P 500 (SPX), we had a bounce in March followed by a pullback in April, and now market participants are looking for something (or someone) to tell them what to do next. The S&P 500 marked time in the neutral zone on Wednesday, Thursday, and Friday but pessimism is above the trigger level of 10% while Composite is below zero—two short-term bearish signs.

Volatility is elevated and traders are on edge, so the slightest thing this week could cause a dramatic move in equities. As always, make sure protective stops are in place and positions are correctly sized in accordance with your risk-management profile.

Learn more about Ian Murphy at MurphyTrading.com.