As earnings season develops it’s likely that we will see a fair amount of volatility in the stock market, states Joe Duarte, editor of In the Money Options.

That’s just the nature of things. In fact, this earnings season could be a bit worse than usual given the uncertainty created by the Federal Reserve, the war in Ukraine, and of course: inflation.That means that many companies will likely see their share price fall significantly either because they missed expectations, due to poor guidance or lack of “visibility,” or some combination of all those factors.

Nevertheless, the dust will clear. And investors who can see what the future may hold may be in a position to benefit from the eventual change in the currently prevailing trends.

Keep Your Eye on the Ball

Certainly, it’s easy to get distracted when company shares are blowing up all over the place. But that’s why we use sell stops, buy in small lots, and consider hedging strategies as part of our trading plan.

It’s equally important to recognize that the stock market not only predicts the future but also reflects the present. And the current price posture of the major indexes and derivative indicators such as the New York Stock Exchange Advance Decline line (NYAD) suggest that the market is uncertain about the future.

One thing is certain; however, money will always flow in the direction in which traders expect that conditions will increase the odds of profit.

The Big Trends

Macro trends set the stage for money flows and the big trends of the moment are all based on supply chain problems and the subsequent inflation created by the pandemic and the subsequent sequelae. Specifically, when Covid struck in March 2020:

- The Federal Reserve delivered unprecedented QE and is now in the midst of raising interest rates to quell inflation.

- The shutdowns, some of which are still being deployed in China, snuffed out production and there are now supply chain snags everywhere, which have become structural.

- Geopolitical power shifts led to a change in the White House and elsewhere.

- This power shift has led to the Russian invasion of Ukraine.

- Population migration from the third world is increasing but is also evident within the US.

Now, even though earnings season may be painful, consider the fact that at some point the Fed will stop raising rates. Meanwhile, the macro trends will have continued to unfold and develop.

All of which means that there will be places which will benefit from these macro trends and their effects on humanity. And as cynical as this may sound, that’s where the next investment opportunities will be.

Where We’ve Been

What we are witnessing is a major behavioral shift in the global population where the one thing everyone can agree on seems to be that populations are migrating in search of something better than what they are experiencing in their current location. And so far, the big beneficiaries are the food and energy sectors.

The chart for the Van Eck Vectors Agribusiness ETF (MOO) bears witness to the opinion that food prices will rise and remain high for some time.

Now, I’ve been bullish on housing for a long time and I’ve seen this sector get hammered. So, I’ve been wrong, in the present.

But, here’s my line of thought. The Fed can’t raise interest rates forever. And regardless of rising mortgage rates, homebuilders are not slowing down, at least in their preparations for when the Fed eases again.

For example, DR Horton (DHI) a stock that I own, and that I feature in my Rainy Day Portfolio for subscribers, recently bought Vidler Water Resources, a company with strategic water and water management resources in Colorado, New Mexico, Arizona, Nevada, and Idaho.

What that tells me is that Horton is thinking about the future. Moreover, it’s likely that they are seeing that the movement of people into those states and others in the South US is not slowing down. So Horton is doing what every contrarian investor does when times get hard, look for bargains in preparation for when the inevitable turnaround occurs.

What’s the bottom line? From where I stand, I agree with Horton. The biggest macro trend is the relocation of people to the Southern US where there aren’t enough houses and where water can be scarce.

You fill in the blanks.

Big Move Setting Up in Stocks as NYAD and SPX Remain Below Key Support

The New York Stock Exchange Advance Decline line (NYAD) remains below its 50-day moving average while the RSI also remains below 50. And while that’s a Duarte 50-50 sell signal, a market crash is not etched in stone. That’s because these signals, however, can quickly reverse but it they are always reasons to be cautious.

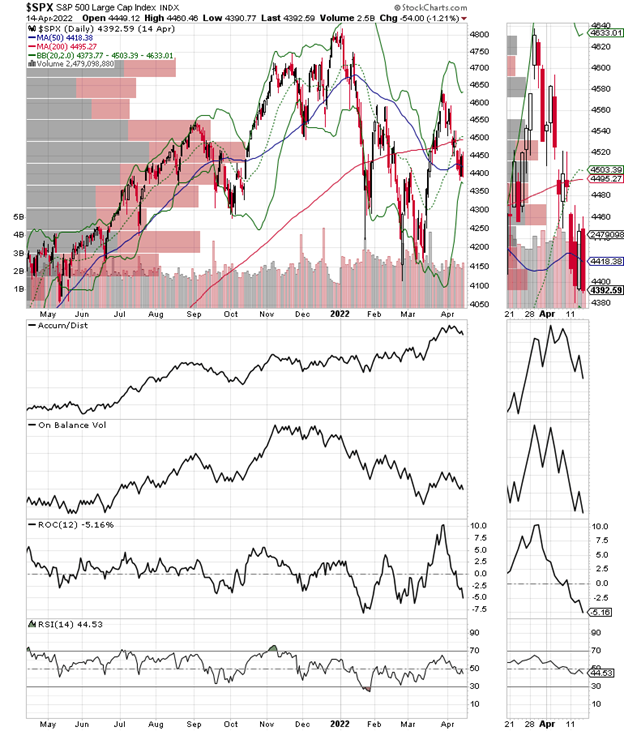

However, the Bollinger Bands around the S&P 500 (SPX) are closing in on the 20-day moving average as it fluctuates in a tight trading range near 4500 area. That’s a sign that a big move is coming.

Meanwhile Accumulation Distribution (ADI) suggests that short sellers are starting to cover some of their positions while On-Balance Volume (OBV) is showing signs of trying to turn up. That means that the move could be to the upside.

So while the recent rally has stalled, the market could be setting up for another bounce. Nevertheless a bullish move with some staying power will still require the following:

- A decisive move above 4600

- The S&P 500 needs to hold above its 200-day moving average and rally from there

- Further improvement in OBV and

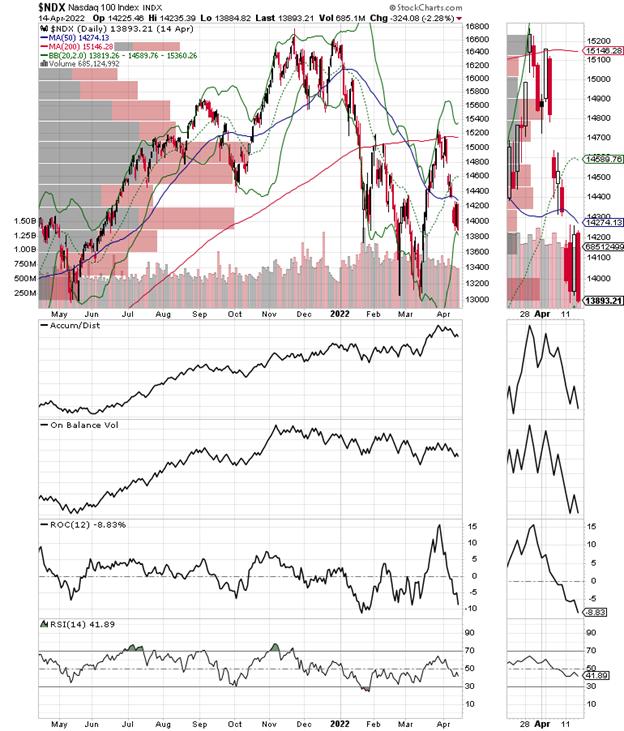

The Nasdaq 100 index (NDX) has been sold more aggressively but is also showing signs that it could move higher if conditions set up just right.

VIX Declines But Prices Still Fall

The CBOE Volatility Index (VIX) has been falling of late. Normally that’s a positive for stock prices. And of late, the weakness in VIX is probably the major reason stocks have not crashed.

Remember that a rise in VIX signals that put option volume (bets that the market is going to fall) are on the rise. What follows when put volume rises is that market makers to sell puts and simultaneously hedge their bets by selling stocks and stock index futures. This causes the market to fall.

So as long as VIX is falling, it suggests that stock prices may fall less than they would otherwise, such as when VIX is rising.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.