Do you know what interest rate hikes are like for the markets? Rain, states Mike Larson, editor of Safe Money Report.

A half inch or two of it falling on a city does’t matter. The ground will soak some of it up and the rest will get shunted away into the sewer. An occasional downpour won’t flood a farmer’s fields, at least not for long.

But when you get storm after storm in your area...dumping inch after inch of rain over a long period of time...you’re in trouble. As Led Zeppelin sang in 1971, the proverbial “levee’s goin’ to break.”

Now, I’m seeing signs investors are worried about exactly that scenario...and that means you have to be on high alert!

Consider: just last Friday, the Dow (DOW) tanked 981 points while the S&P 500 (SPX) lost almost 3%. It was the worst day for the Industrials since October 2020. The technology-heavy Invesco QQQ Trust (QQQ) just keeps coughing up more points, and it’s now down around 17% year-to-date.

But what I found even more noteworthy is that selling pressure spread. Formerly strong sectors got swept up in the selling, joining their weaker cohorts.

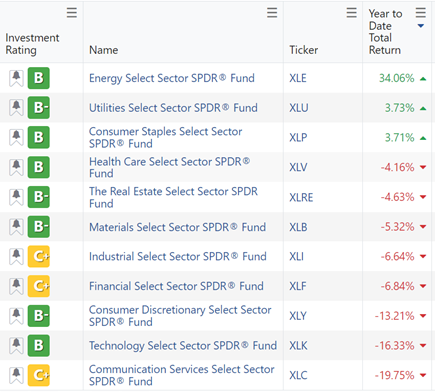

As of earlier this week, only three of the 11 S&P 500 sectors were showing positive returns for 2022. Energy (XLE) was the only one with double-digit gains. On the flip side, three of the losing sectors have double-digit losses, as you can see in this table.

Source: Weiss Ratings, Data date 4/25/22

Broader indexes like the Russell 2000 are lagging even more. In fact, the iShares Russell 2000 ETF (IWM) is trading at the same level now that it first hit in December 2020. That’s almost a year and a half of gains wiped out.

Plus the formerly “red hot,” highly speculative junk...the stuff I told you to avoid like the plague ages ago...is continuing to implode.

The Defiance Next Gen SPAC Derived ETF (SPAK)? An ETF chock full of Special Purpose Acquisition Companies (SPACs) Wall Street cranked out like crazy a while back? It’s down 25% this year.

The Renaissance IPO ETF (IPO)? An ETF packed to the gills with money-losing turkeys and other stocks our Weiss Ratings system grades as “Sells”? Down 35% YTD.

The ARK Innovation ETF (ARKK)? An ETF loaded up with wildly overvalued, overhyped names that needed rock-bottom rates to thrive? Down 42% this year.

This is all happening with the Fed having only one 25 basis point rate hike under its belt, too. The next policy meeting wraps up on May fourth. It’ll be followed by meetings that end on June 15, July 27, September 21, November second, and December 14.

Investors expect rate hikes to “rain down” at each of those meetings. And not just 25-point increases. Increases of 50 points at one or more.

Translation: More and more water is going to be piling up against the market levee. We’re already seeing it spring leaks. The question is, how many hikes are enough to cause it to break?

Rather than wait to find out, I recommend you take “Safe Money” actions and adopt Safe Money strategies immediately. They’re designed to help you prepare now so that you don’t get swept away later

Specifically, raise some more cash. Trim some losers that are holding you back. Scrub your portfolio using the Weiss Ratings we provide, eliminating “Sells” that don’t deserve your hard-earned money.

Rotate out of overvalued, over-owned junk like tech or consumer discretionary stocks and into defensive, late-cycle sectors like utilities, consumer staples, REITs, and the like. Favor dividends and defense.