The relentless selloff in global equities continued apace yesterday when 54% of US stocks made a new 20-day low during the regular session, observes Ian Murphy of MurphyTrading.com.

At yesterday’s close, the broad-based index was down 17% from the January high. Another 3% and we will be in an ‘official’ bear market, which is generally accepted to be a decline of more than 20%.

Click charts to enlarge

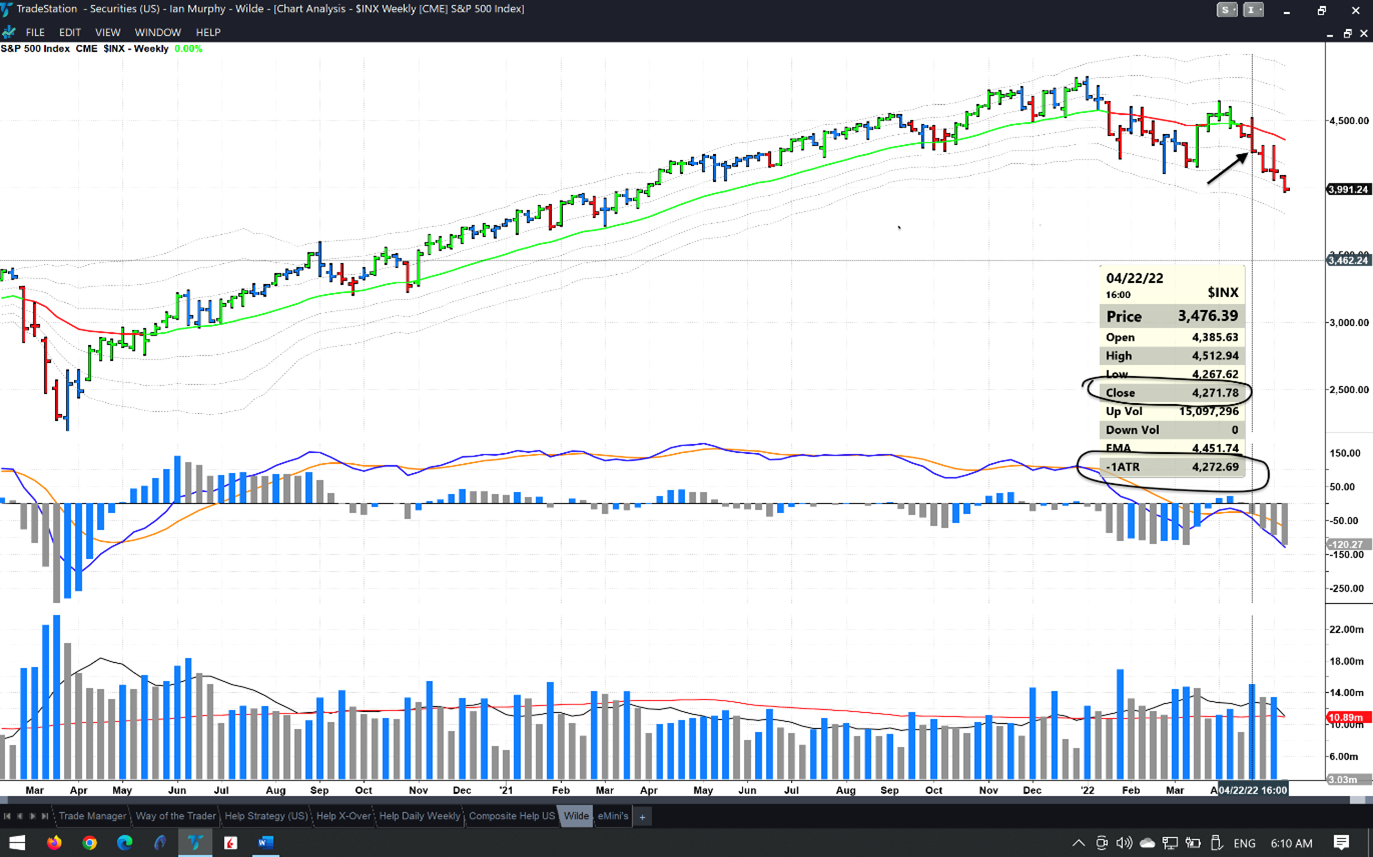

As a trend follower with a preference for technical analysis, I use ATR channels on a weekly chart to define bullish and bearish trends, and the S&P 500 (SPX) turned ‘technically’ bearish on April 22 when it closed below the -1ATR line (highlighted).

Click charts to enlarge

I arrived back from Egypt last night (a beautiful country with amazing people) and fired up my laptop to get a deeper insight into the selloff. I closed out two of the WTF trades while away when they breached their soft protective stops (red triangles) by closing below the weekly -1ATR channel (technically bearish for a stock). Pfizer (PFE) is still open.

I was worried there would be a problem if we had a selloff and I was unable to log in on Friday, May sixth, before the US close, but I managed to get a 4G signal on my iPhone when we were close to shore. We will take a closer look at these trades tomorrow.

Learn more about Ian Murphy at MurphyTrading.com.